The stock market closed lower on Thursday as bond yields continued to rise. The benchmark 10-year rate climbed to 4.7%.

The stock market closed lower on Thursday as bond yields continued to rise. The benchmark 10-year rate climbed to 4.7%.

Meanwhile, the consumer price index for September rose 0.4% from the previous month, and 3.7% from a year ago. This follows a hotter-than-expected produced price index data for September.

Overall, S&P 500 and NASDAQ fell 0.6% to 4,350 and 13.574, respectively.

Tweet of the Day

.. 10-yr yield hits low of 4.544% the lowest level since Sep 29th

@CNBC pic.twitter.com/RpmZI6LFIW

— Carl Quintanilla (@carlquintanilla) October 11, 2023

Chart of the Day

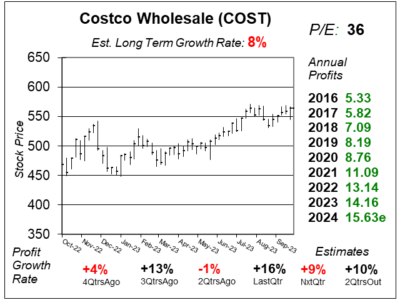

Here is the one-year chart of Costco Wholesale (COST) as of September 27, 2023, when the stock was at $564.

Here is the one-year chart of Costco Wholesale (COST) as of September 27, 2023, when the stock was at $564.

Costco is the second largest global retailer with more than 120 million members. The company opens around 20 to 30 locations annually. The profit Costco makes is mostly made up of the annual membership fees it brings in.

Costco beat the street last quarter and delivered 16% profit growth as revenue grew 9%. There was not much in the earnings call to comment about. Shopper frequency rose 5% during the quarter. E-commerce was doing poorly in the previous two quarters, but was better last quarter. Management stated shrinkage (theft) hasn’t been a big problem for them, but it continues to rise a little due to the rollout of self-checkouts.

Shares also climbed by almost 15% since the company’s late may reported earnings, and initial knee-jerk reactions was to lock in profits. In addition, some are disappointed at Costco’s refraining from increasing membership fees as it refrained from such for over 6 years due to high inflation. Management stated that an increase in membership fees is a matter of when, and that it will happen at some point. Some market participants anticipate that COST will pull the trigger to increasing membership fees due to easing inflation relative to last year, with the CFO stating that raising fees “isn’t a matter of if, but when.” In the meantime, COST continues to be a likely share gainer in the grocery space and is doing pretty well in a difficult climate.

COST is a core holding in the Conservative Growth Portfolio. Looking ahead, management should raise membership fees in the upcoming months, and that will boost revenue.