The stock market gained ground on Thursday after yesterday’s sell-off as the Federal Reserve signaled that a March rate cut is unlikely. Investors now await the January jobs report that will be out on Friday.

The stock market gained ground on Thursday after yesterday’s sell-off as the Federal Reserve signaled that a March rate cut is unlikely. Investors now await the January jobs report that will be out on Friday.

Overall, S&P 500 and NASDAQ both grew 1.3% to 4,906 and 15,362, respectively.

Tweet of the Day

David Sharek’s Top Ten Conservative Stocks for 2024 | @GrowthStockGuy

— SchoolofHardStocks (@SchoolHardStock) February 1, 2024

Chart of the Day

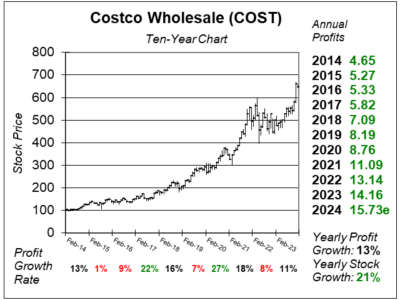

Here is the ten-year chart of Costco (COST) as of January 3, 2024, when the stock was at $645.

Here is the ten-year chart of Costco (COST) as of January 3, 2024, when the stock was at $645.

Costco is paying its investors a special one-time dividend of $15 per share. The payment hits today, January 12, 2024, to shareholders who owned the stock at the close of December 28, 2023. Previous one-time dividends include $7 in fiscal 2012, $7 in 2017, $10 in 2021. The company also pays a quarterly dividend of $1.02 per share. No wonder the stock is so richly valued. The P/E of 41 is high for a company with an Estimated Long-Term Growth Rate of 9% a year.

In terms of retail production, the company did well last quarter and delivered 15% profit growth as revenue increased 6%. The sales of fresh foods were strong, and items like food and sundries did well. Non-food products showed improvement from September to November.

COST is a core holding in the Conservative Growth Portfolio. Looking ahead, management should raise membership fees in the upcoming months, and that will boost revenue.