The stock market closed lower on Monday as Treasury yields continued to climb on worries that the Federal Reserve may not cut rates as much as expected. The 10-year Treasury yield rose to 4.16% from 4.09% late Friday, its biggest two-day climb since June.

The stock market closed lower on Monday as Treasury yields continued to climb on worries that the Federal Reserve may not cut rates as much as expected. The 10-year Treasury yield rose to 4.16% from 4.09% late Friday, its biggest two-day climb since June.

Overall, S&P 500 declined 0.3% to 4,943, while NASDAQ fell 0.2% to 15,598.

Tweet of the Day

Are we still bullish overall, we sure are.

But be aware that February has been quite weak historically, especially in an election year.

Not to mention the past two times the S&P 500 gained >20% for the year, the following Feb was quite weak (-3.1% in '22 and -8.4% in '20). pic.twitter.com/jrczvyfg11

— Ryan Detrick, CMT (@RyanDetrick) February 4, 2024

Chart of the Day

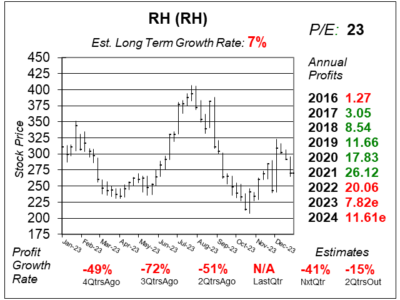

Here is the one-year chart of RH (RH) as of January 3, 2024, when the stock was at $270.

Here is the one-year chart of RH (RH) as of January 3, 2024, when the stock was at $270.

RH lost money last quarter as profit margins plunged. Last quarter, the luxury home furnishings retailer delivered -$0.42 per share versus a juicy profit of $5.67 a year-ago as revenue declined 14%. RH did have high expenses in opening International stores and pending acquisition of its New York Guesthouse property. Management blamed its performance on (1) high mortgage rates which peaked above 8% during the quarter; (2) war in the Middle East; and (3) higher promotions in the furniture segment. RH also pointed out that 82% of homeowners have mortgages below 5% and 62% are below 4%, making the housing market “frozen” until rates or home prices fall.

RH is on the radar for the Growth Portfolio.