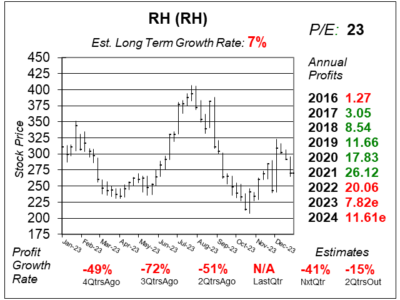

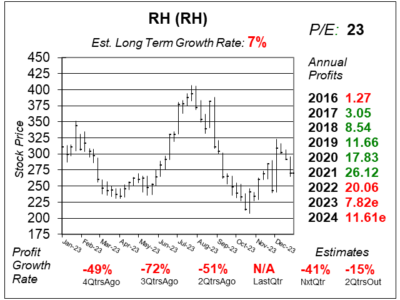

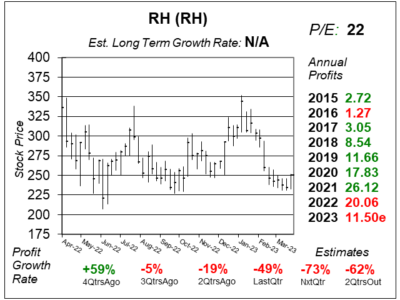

RH (RH) Loses Money as Expansion and Light Demand Hurt Profits

RH (RH) posted a loss last quarter as th company dissapointed investors once again. But the stock does have long-term potential.

RH (RH) posted a loss last quarter as th company dissapointed investors once again. But the stock does have long-term potential.

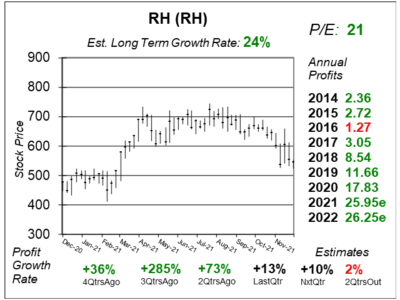

RH (RH) is having trouble growing sales and profits right now as high mortgage rates and a sluggish economy dampen demand.

RH (RH) will increase markdown activities to clear old inventory and spur demand. Meanwhile, the stock’s been rising as profits fall.

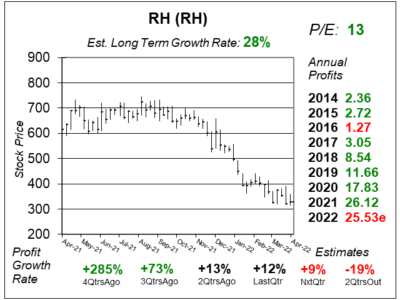

RH (RH) stock lost all its recent momentum as luxury home sales declined 45% in 2022 Q4, which hurt sales of luxury furniture.

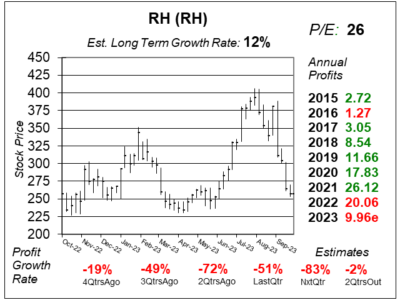

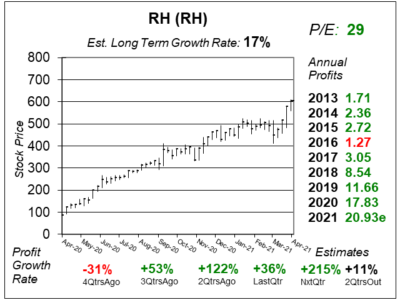

RH (RH) has had a rough 2022, and 2023 looks tough too. Long-term, the stock could compound in price if profits and the P/E rise.

At around $250 a share, RH (RH) is expected to earn $20 to $27 in profits annually, making it one of the stock market’s best values.

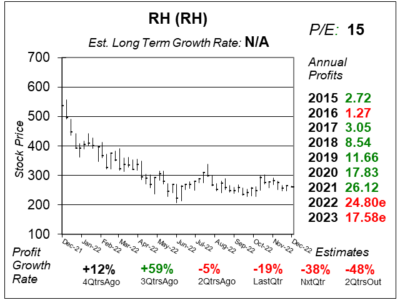

RH (RH) lowered estimates 2x in the last 2 qtrs as furniture sales are weak now because as people bought during COVID lockdowns.

RH (RH) stock is down-and-out as the company was expecting 2022 to be “The Year of the New”. Now, its a year of transition.

2022 for RH (RH) is the Year of the New, as it launches its Contemporary brand, two private charter jets, and a luxury yacht.

RH (RH) has grand plans to become a global powerhouse in luxury products (furniture), places (residences), and services (travel).

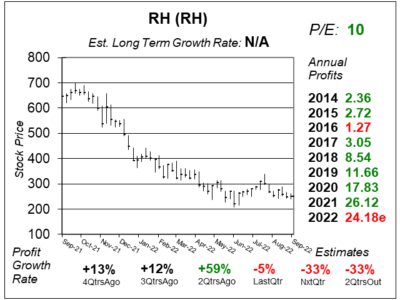

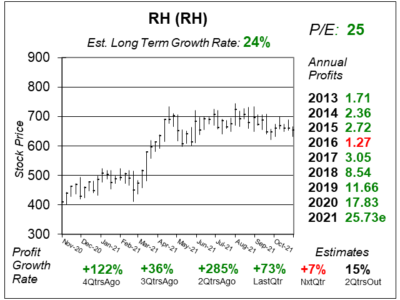

RH (RH) strives to become a premier luxury brands. It’s stock is already better than Amazon, Google, Facebook, LVMH and Hermes.

RH is making a killing in the luxury home furnishings market. Next, the company will build condos, homes and hotels.

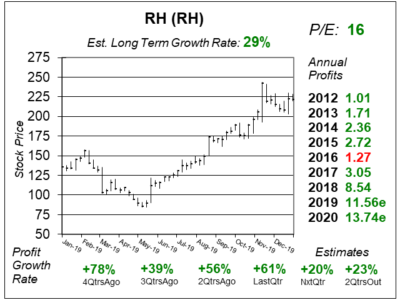

Berkshire Hathaway has invested in RH (RH), which helps furniture store’s reputation while profits are soaring.

RH (RH) is rolling in the profits, but this stock has a shady history with big declines in the stock price before bad news is announced.

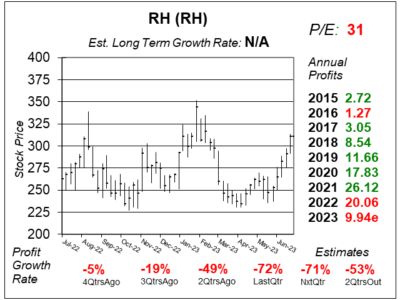

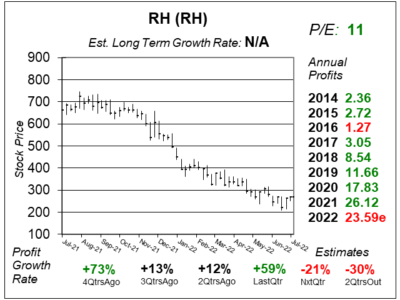

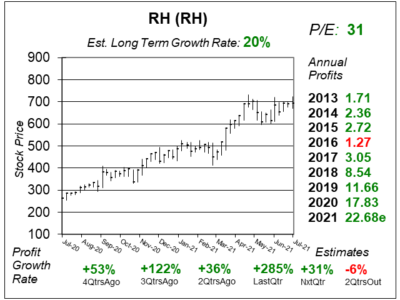

Restoration Hardware (HD) beat the street last qtr (yeah) but then disappointed investors once again by lowering next qtr’s guidance (boo).

Restoration Hardware (RH) is dealing with production issues, but as its CEO points out product at this quality has never been made in these quantities.

Restoration Hardware’s (RH) stock was falling like a knife last Winter, and RH didn’t tell us why. Until it was too late. Still, someone knew.

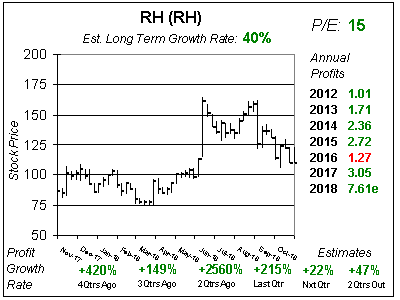

Restoration Hardware (RH) sells for just 20x earnings even though profits are growing around 35%. I don’t know why its down, but I see a big rebound ahead.

Restoration Hardware (RH) is debuting its new RH Modern line, which should be a catalyst for future growth.

This retailer is going through a renaissance and will be added to the Growth Portfolio and Aggressive Growth Portfolio today.

RH (RH) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: -$0.17 vs. $2.21 = N/A

Revenue Est: -2%