The stock market surged on Friday after a softer-than-expected April jobs report. Employers added 175,000 jobs below the 240,000 estimates, and unemployment rate increased to 3.9% from 3.8% in the previous month. This boosted hopes that the Federal Reserve could cut interest rates sooner than thought.

The stock market surged on Friday after a softer-than-expected April jobs report. Employers added 175,000 jobs below the 240,000 estimates, and unemployment rate increased to 3.9% from 3.8% in the previous month. This boosted hopes that the Federal Reserve could cut interest rates sooner than thought.

Overall, S&P 500 rose 1.3% to 5,128, while NASDAQ jumped 2.0% to 16,156.

Tweet of the Day

Vertiv $VRT continues to be a great story and a core holding. Reported this morning – beat / raise and the stock closed +7% on 60% order growth in Q1 – buyside “bogey” for orders was somewhere ~30%, but as I’ve said, I try not to play the expectations game around quarters.… https://t.co/2EreXeemdJ

— Radnor Capital (@RadnorCapital) April 24, 2024

Chart of the Day

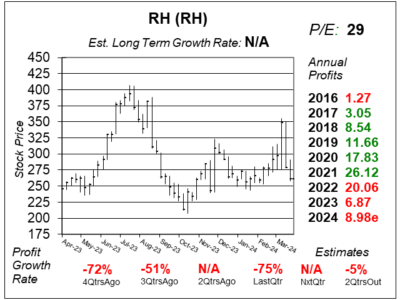

Here is the one-year chart of RH (RH) as of April 10, 2024, when the stock was at $260.

Here is the one-year chart of RH (RH) as of April 10, 2024, when the stock was at $260.

RH has missed profit estimates badly in the past two quarters. Last quarter, results fell short by a significant margin with -75% profit growth on -4% revenue versus estimates of -41% and 1%, respectively. This performance setback can be attributed to adverse weather conditions in January that led to shipping delays (resulting in a $40 million impact last quarter); ongoing conflicts in the Red Sea region further hampered transit times; and most importantly, higher mortgage rates in the US exerted downward pressure on consumer spending in the housing market.

However, management is still thinking long-term as it opens new locations and introduces new products in its Modern and Outdoor collections. Last quarter, the company launched its RH Outdoor Sourcebook, chock-full of high-end outdoor furniture. The RH Modern Sourcebook includes 30 new collections and is set to be mailed out any day now. Expansion efforts include the United Kingdom, Europe, Australia and the Middle East. Management expects demand to return in mid-2024.

The potential here is enormous. If the company makes $35 or so in EPS in the coming years and gets a P/E of 30, this could become a $1000 stock. RH is on the radar for the Growth Portfolio.