The stock market sank on Wednesday on increasing worries of a potential default by the US. Lawmakers struggled to reach a deal on the country’s debt ceiling.

The stock market sank on Wednesday on increasing worries of a potential default by the US. Lawmakers struggled to reach a deal on the country’s debt ceiling.

Overall, S&P 500 fell 0.7% to 4,115, while NASDAQ declined 0.6% to 12,484.

Tweet of the Day

$HUBS notes from JPM conference. Dharmesh with a very pragmatic take on AI pic.twitter.com/iHuFjfyI64

— Elliot (@AlphaSeeker84) May 22, 2023

Chart of the Day

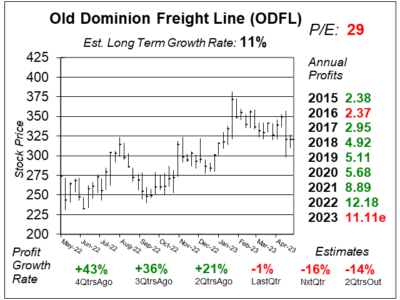

Here is the one-year chart of Old Dominion Freight Line (ODFL) as of May 3, 2023, when the stock was at $321.

Here is the one-year chart of Old Dominion Freight Line (ODFL) as of May 3, 2023, when the stock was at $321.

Old Dominion Freight Line is a national freight leader that provides next-day and second-day shipping of less than full truckloads (LTL) of merchandise. It is known for its modern fleet of trucks and efficient deliveries with 99% on time and a workforce that doesn’t damage the customers shipment.

Old Dominion Freight Line just delivered a weak quarter as profits grew -1% on a -4% revenue gain. That ended the 10th straight qtrs of double-digit profit growth.

Shipments per day decreased 9.6% year-over-year due to a soft economy, while revenue per shipment increased 9.2% as management was more efficient. Salaries, wages and benefits are the company’s biggest cost. With the economy tight, some customers are using cheaper truck lines.

ODFL is on the radar for the Conservative Growth Portfolio. But with a P/E of 29 the stock seems too high to buy.