The stock market closed mixed on Wednesday, as investors went through the minutes from the Federal Reserve’s most recent meeting for signals of the central bank’s next move against inflation.

The stock market closed mixed on Wednesday, as investors went through the minutes from the Federal Reserve’s most recent meeting for signals of the central bank’s next move against inflation.

Today, St. Louis Fed President James Bullard warned that the Fed’s fight against inflation is far from over. The minutes showed that inflation is still above the Fed’s target of 2%.

Overall, S&P 500 fell 0.2% to 3,991, while NASDAQ grew 0.1% to 11,507.

Tweet of the Day

Dumb money has reached extreme highs in this market rally

Confidence can stay overextended during bull markets

But marks significant tops during bear markets pic.twitter.com/1f88hzSoIJ

— Game of Trades (@GameofTrades_) February 22, 2023

Chart of the Day

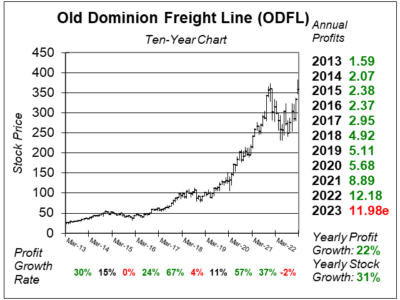

Here is the ten-year chart of Old Dominion Freight Line (ODFL) as of February 15, 2023, when the stock was at $357.

Here is the ten-year chart of Old Dominion Freight Line (ODFL) as of February 15, 2023, when the stock was at $357.

Old Dominion Freight Line is a national freight leader that provides next-day and second-day shipping of less than full truckloads of merchandise.

ODFL is defying gravity. Here we are in what feels like a recession and this trucking company continues to deliver solid results as the stock just rose to an all-time high. ODFL delivered another solid quarter as profits jumped 21% on a 6% revenue gain. That was the 10th straight qtr of double-digit profit growth. The primary reason for the bump up in revenue was a 17% increase in revenue per hundredweight which more than offset a 9% decrease in tons shipped.

ODFL is an excellent organization with a clean fleet of trucks and nice service centers. The stock has been a big winner this past decade. This stock has risen way above David Sharek’s expectations. He will continue to wait and hope he can buy in on a dip if the P/E gets to the mid-20s.

ODFL is on the radar for the Conservative Portfolio. With a P/E of 30 the stock seems too high to buy.