The stock market snapped its losing streak on Thursday ahead of crucial jobs data. Investors await Friday’s jobs report for signals on the path of the interest rate moving forward.

The stock market snapped its losing streak on Thursday ahead of crucial jobs data. Investors await Friday’s jobs report for signals on the path of the interest rate moving forward.

Overall, S&P 500 grew 0.8% to 4,586, while NASDAQ jumped 1.4% to 14,340.

Tweet of the Day

Peter Lynch when asked what it takes to become a great investor:

"In the stock market, the most important organ is the stomach. It’s not the brain. On the way to work, the amount of bad news you could hear is almost infinite now.

So the question is: Can you take that?

1/3

— Investment Wisdom (@InvestingCanons) December 7, 2023

Chart of the Day

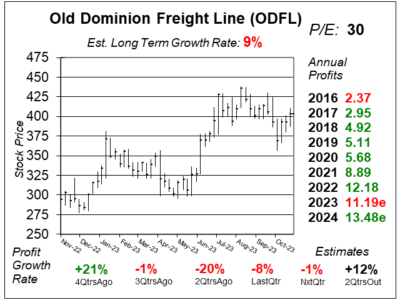

Here is the one-year chart of Old Dominion Freight Line (ODFL) as of November 15, 2023, when the stock was at $403.

Here is the one-year chart of Old Dominion Freight Line (ODFL) as of November 15, 2023, when the stock was at $403.

Old Dominion Freight Line delivered another weak quarter as profits declined 8% on a 6% decreased in revenue. The softness was due to overspending on items during the COVID-19 outbreak.

Last quarter, the company had a 7% decrease in Less Than Truckload (LTL) tons per day, partially offset by a 3% increase in LTL revenue per hundredweight. Shipment levels decreased for the fifth consecutive quarter due to continued softness in the domestic economy. Despite the decrease, there was a positive inflection in volumes during the quarter, with LTL shipments per day averaging 49,670 after averaging 47,077 per day for the first 6 months of the year. The company’s competitor Yellow filed for bankruptcy in July 2023, and that has helped Old Dominion Freight Line gain market share. Yellow was the #3 LTL shipping company in the US, while the company is #1.

This stock has done well this year even though profit growth has been weak in the past three quarters. Note that profit growth is expected to return to normal two quarters from now.

ODFL is on the radar for the Conservative Growth Portfolio. But with a P/E of 30, the stock seems too high to buy.