The stock market climbed on Thursday despite the central bank’s comment on more rate hikes this year. The increase marked the sixth consecutive growth in the market.

The stock market climbed on Thursday despite the central bank’s comment on more rate hikes this year. The increase marked the sixth consecutive growth in the market.

Overall, S&P 500 and NASDAQ both expanded 1.2% to 4,426 and 13,783, respectively.

Tweet of the Day

$CAVA reality: “We sell overpriced salads & pitas”.

Cava’s IPO prospectus: “We meet consumers’ desire to engage with convenient, authentic, purpose-driven brands that view food as a source of self-expression” 🥴

Some of these IPO prospectuses are just pure cringe banker poetry. pic.twitter.com/nmSPZBxrj5

— Wasteland Capital (@ecommerceshares) June 15, 2023

The funny thing is $CAVA bought publicly listed Zoe’s Kitchen for $300m in 2018 at 1x sales (Zoe’s had~ $300m in annual revenue then).

Now, just five years later, they’re flipping it to market at approximately 4.4x sales ($2.5bn on $564m rev last year).

Just incredible. 🥹 pic.twitter.com/dBw2oG1qbT

— Wasteland Capital (@ecommerceshares) June 15, 2023

Chart of the Day

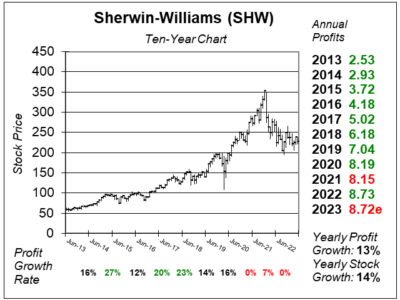

Here is the ten-year chart of Sherwin-Williams (SHW) as of May 31, 2023, when the stock was at $228.

Here is the ten-year chart of Sherwin-Williams (SHW) as of May 31, 2023, when the stock was at $228.

Sherwin-Williams has the #1 brand in paint (Sherwin-Williams), stain (Minwax), spray paint (Krylon), auto paint (Dupli-Color), and water sealer (Thompson’s). This company has a marvelous end-to-end supply chain, with around 100 manufacturing sites and distribution centers, 400 trucks and 1200 trailers to get paint and other goods to home improvement centers and approximately 5000 company-operated stores.

Sherwin-Williams’ management gave a bearish outlook for 2023, despite delivering solid results last quarter. Looking at quarterly profits, the company delivered 27% last quarter. Estimates are for +10%, -12%, -16% and 0% profit growth for the next four quarters. David Sharek, Founder of School of Hard Stocks, thinks these estimates are way off, and believes the company is just setting the bar low to beat the street in the upcoming quarters. Also, inflation has been simmering down. That should lead to lower mortgage rates and perhaps a better housing market later this year.

David Sharek thinks deflation in shipping and raw materials will help the company boost profits this year.

SHW is part of our Conservative Growth Portfolio.