The stock market was mixed on Monday as investors shrugged off rising Treasury yields, as well as Fed Governor’s Michelle Bowman comment on the need of multiple rate hikes to control inflation. The ten-year Treasury yield reached 4.7% during the session – its highest since October 2007.

The stock market was mixed on Monday as investors shrugged off rising Treasury yields, as well as Fed Governor’s Michelle Bowman comment on the need of multiple rate hikes to control inflation. The ten-year Treasury yield reached 4.7% during the session – its highest since October 2007.

Meanwhile, the Senate passed a spending bill over the weekend averting a government shutdown.

Overall, S&P 500 closed flat at 4,288, while NASDAQ was up 0.7% to 13,308.

Tweet of the Day

SPY made lower intraday lows for 9 days in a row, but this ended yesterday.

A sign of a major flush? It might be.

Super small sample size, as only 3 other times (since 1993) did we see streaks like this.

6 mo later? up 18.0%.

12 mo later? up 30.9%.

— Ryan Detrick, CMT (@RyanDetrick) September 29, 2023

Chart of the Day

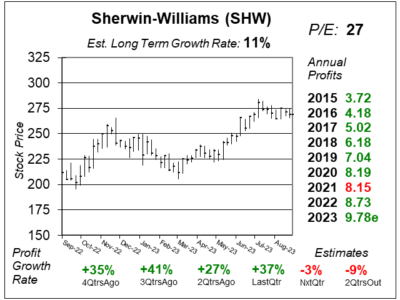

Here is the one-year chart of Sherwin-Williams (SHW) as of September 13, 2023, when the stock was at $268.

Here is the one-year chart of Sherwin-Williams (SHW) as of September 13, 2023, when the stock was at $268.

Sherwin-Williams has the #1 brand in paint (Sherwin-Williams), stain (Minwax), spray paint (Krylon), auto paint (Dupli-Color), and water sealer (Thompson’s). This company has a marvelous end-to-end supply chain, with around 100 manufacturing sites and distribution centers, 400 trucks and 1200 trailers to get paint and other goods to home improvement centers and approximately 5000 company-operated stores.

Sherwin-Williams’ profits jump as paint stores show strength while raw material costs simmer down. Last quarter, its profits rose 37% and blew away estimates of 10%, as revenue increased 6%. Paint Store revenue growth (+10%) was led by commercial and property maintenance, as well as boat paint and protectant. Residential repaint was strong as well. Sales in this segment were up 19% in the year-ago period. Sales exceeded expectations in all three company segments, and profit margins in all segments increased year-over-year. Business is so good that analysts raised 2023 profit estimates from $8.72 to $9.78.

SHW is part of the Conservative Growth Portfolio.