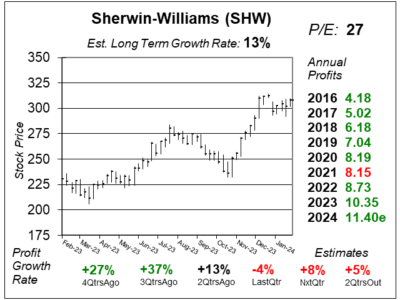

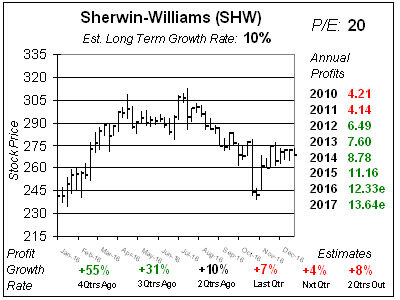

Sherwin Williams (SHW) is Going Through a Slow Growth Period

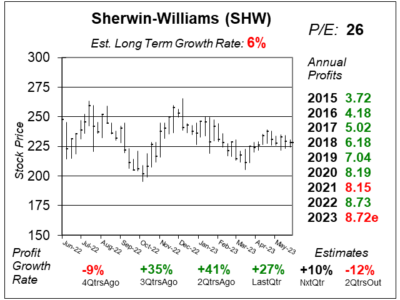

Sherwin Williams (SHW) is in a slow-growth period in terms of sales and profit growth. Lower morgage rates could boost demand.

Sherwin Williams (SHW) is in a slow-growth period in terms of sales and profit growth. Lower morgage rates could boost demand.

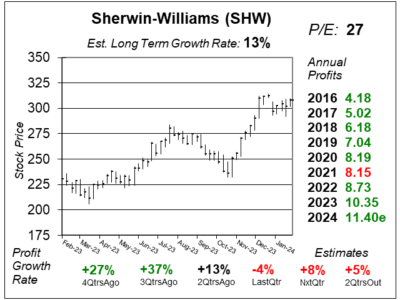

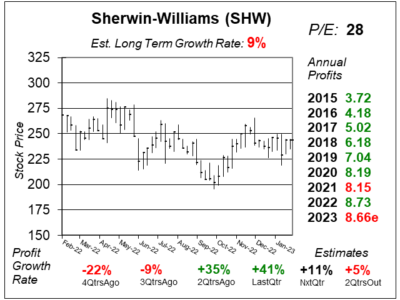

Sherwin-Williams (SHW) is having sluggish sales growth (just 1% last qtr) as DIYers are under economic pressure in North America.

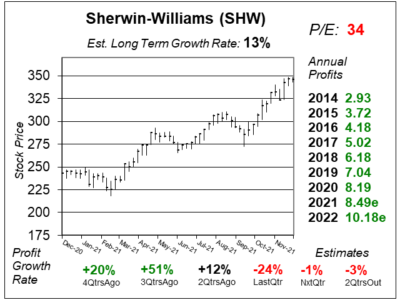

Sherwin Williams (SHW) delivered profits well above expectations last qtr as Paint Stores had strong sales and raw material costs fell.

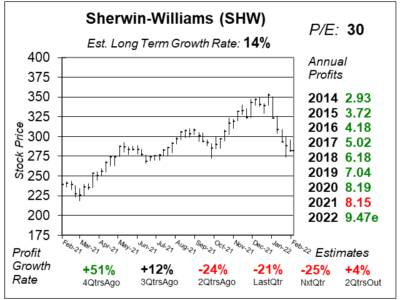

Sherwin-Williams (SHW) delivered an earnings report that is better than expected. But management is talking too cautiously.

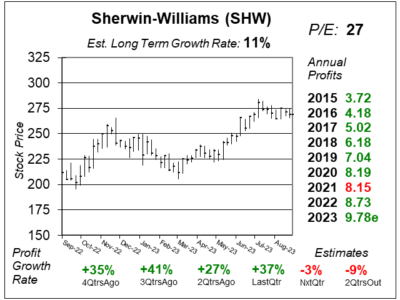

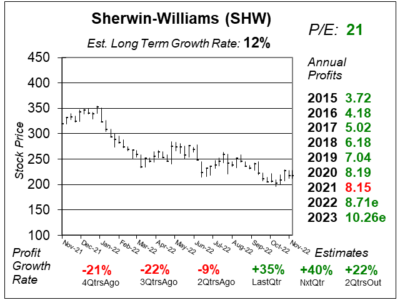

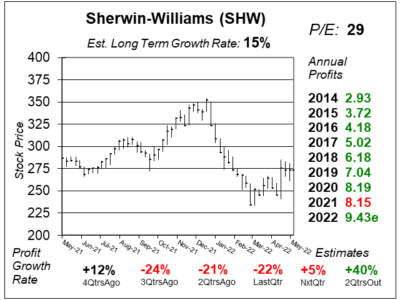

Sherwin-Williams (SHW) delivered a surprisingly negative outlook for 2023 as the US housing market is under significant pressure.

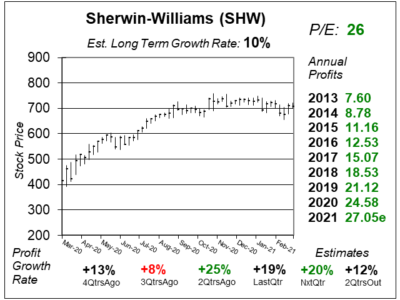

Sherwin-Williams (SHW) looks to already be out of its recession, as last qtr’s profits jumped 35% while the chart is looking up.

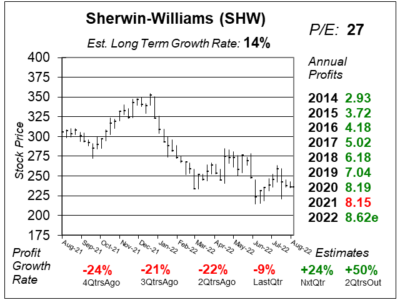

Sherwin-Williams (SHW) is seeing strong demand from professional architects, weak demand from DIY, and high raw material costs.

Sherwin-Williams (SHW) was having trouble getting raw materials. Management says those concerns have eased, so SHW could rise.

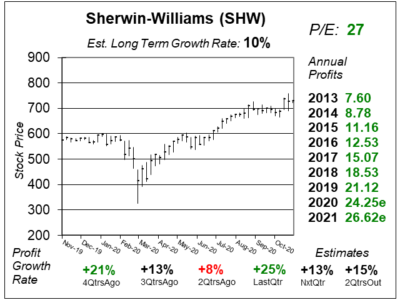

Sherwin-Williams (SHW) has great demand for paint, but it also has unprecedented raw material inflation and supply shortages.

Sherwin-Williams (SHW) is struggling with supply disruptions. But demand continues to be strong — thus so does the stock.

Sherwin-Williams (SHW) is having to pay more for raw materials, so it raised paint prices, which could result in higher profits.

Shwewin-Williams (SHW) is seeing strong demand for residential paint. But higher commodity costs could cut into profits.

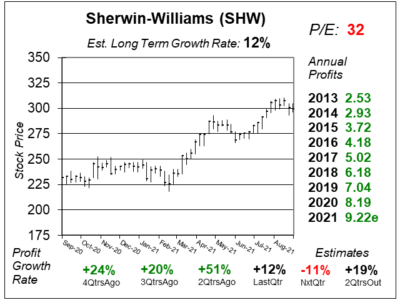

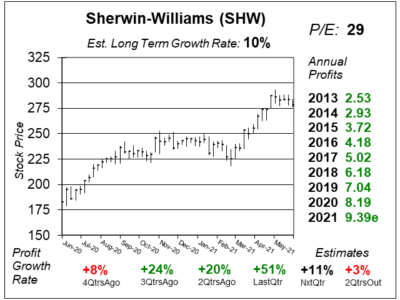

Sherwin-Williams (SHW) delivered record profits in 2020 due to do-it-yourselfers. Now in 2021, industrial sales look to lead.

Sherwin-Williams (SHW) continues to see unprecedented demand in DIY, which helped push profits up 25% last qtr.

Sherwin-Williams (SHW) is getting a boost from do-it-yourselfers who are using their stay-at-home time to paint the house.

Shwewin-Williams (SHW) is getting more business from DIY folks who are using stay-at-home to paint-the-home.

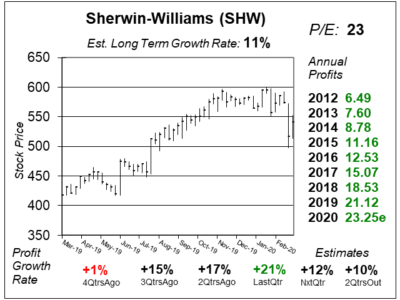

Yesterday’s half percent cut in interest rates by the Fed will help housing & paint maker Sherwin-Williams (SHW).

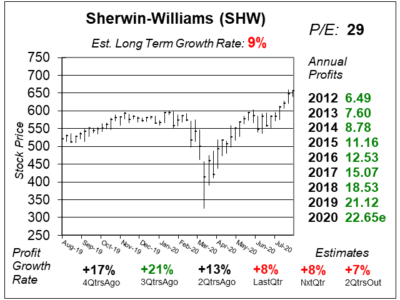

Sherwin-Williams (SHW) stores in America and Canada achieved solid sales growth last qtr, and helped push profits higher.

Sherwin-Williams (SHW) only had sales growth of 2% last qtr. But profits increased a robust 15%. Let’s talk about why.

With mortgage rates dipping below 4%, the housing market should be healthy, and that’s good for Sherwin-Williams (SHW)

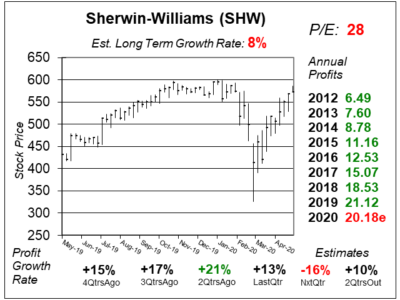

Sherwin-Williams (SHW) said demand reflected upward in December and continues to accelerate in January. But SHW’s profit estimates declined.

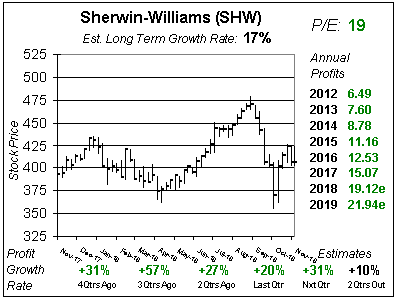

Sherwin-Williams (SHW) is holding up well as the housing and remodeling market weakens. Analysts expect SHW to deliver 15% profit growth in 2019, which is strong.

Sherwin-Williams (SHW) was down after lowering profit guidance last qtr. This qtr the stock rebounded to new highs as estimates rose.

Sherwin-Williams (SHW) had profits climb 57% last qtr with the help of 2017’s acquisition of Valspar. Here’s my take on the paint maker.

Sherwin-Williams (SHW) just went on a run from $100 to $400 over a span of six years. Even after that amazing run, the stock still looks amazing.

Hurricanes and earthquakes across Texas, Florida, Georgia, the Caribbean and Mexico hurt Sherwin-Williams’ (SHW) profits last qtr. But these areas need rebuilding — and that means paint.

Sherwin-Williams (SHW) just acquired Valspar, the 5th largest North American manufacturer of paints and coatings. Let’s look at how Valspar can boosts SHW’s profits.

Prime painting season is upon us, and Sherwin Williams (SHW) has the #1 brand in paint, stain, spray paint, and water sealer to fill all your painting needs.

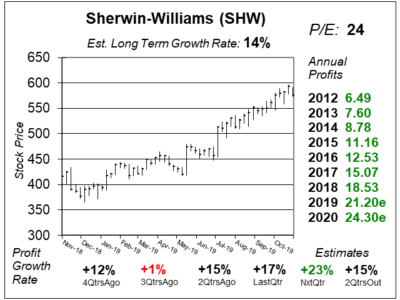

Sherwin-Williams (SHW) just whipped profit estimates with 14% growth last qtr as strong paint sales at its Sherwin-Williams stores pushed sales higher.

Sherwin-Williams (SHW) is acquiring Valspar, the fifth largest North American manufacturer of paints and coatings, and this should give SHW profits boost.

Sherwin-Williams (SHW) has been hot as people spent on improving their homes. But now SHW could be in for a slower growth period.

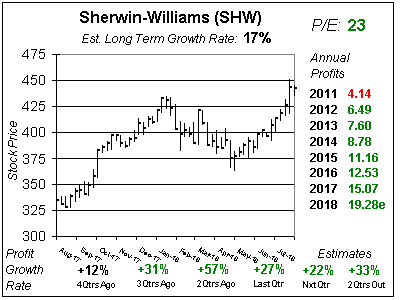

Strong remodeling spending is helping to boost the bottom line for Sherwin-Williams (SHW), which just had 31% profit growth.

Sherwin Williams (SHW) is nearing All-Time highs due to housing market strength, low commodity prices, and a nice stock buyback program.

Sherwin-Williams (SHW) runs a smooth operation, and I will add the stock to the Conservative Growth Portfolio.