The stock market tumbled on Friday, as the benchmark 10-year Treasury yield crossed 5% for first time since 2007. This could impact rates on mortgages, credit cards and auto loans, among others.

The stock market tumbled on Friday, as the benchmark 10-year Treasury yield crossed 5% for first time since 2007. This could impact rates on mortgages, credit cards and auto loans, among others.

Overall, S&P 500 dropped 1.3% to 4,224, while NASDAQ fell 1.5% to 12,984.

Tweet of the Day

BREAKING: The United States has just restricted sales of Nvidia, $NVDA, chips to China.

The Commerce Department said exports of AI chips would be "significantly" restricted.

The goal is to limit China's "access to advanced semiconductors that could fuel breakthroughs in AI."… pic.twitter.com/mocZJSzgVv

— The Kobeissi Letter (@KobeissiLetter) October 17, 2023

Chart of the Day

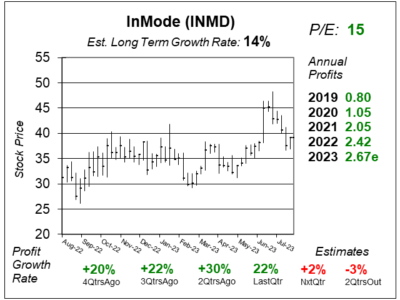

Here is the one-year chart of InMode (INMD) as of August 23, 2023, when the stock was at $39.

InMode is a developer of minimally invasive surgical medical equipment, focusing on three areas: (1) face and body contouring, (2) medical aesthetics, and (3) women’s health. It operates in 92 countries with a sales team of 264 sales reps utilizing 7 patented technologies across 10 product families. Its products utilize the company’s proprietary Radio Frequency (RF) energy technologies, which can penetrate deep into fat and allow tissue remodeling.

On October 12, 2023, InMode announced it will miss next quarter’s earnings estimates and forecasts a profit of $0.59 to $0.60 per share. Estimates were for $0.67. When we look at year-over-year growth, that implies $0.60 vs. $0.66 = -9% profit growth. Management blames the economic slowdown and constraints in financing due to higher interest rates on the shortfall.

INMD stock fell from $28 to $21 on October 13. Meanwhile the stock was $40 back in August and the stock was in free-fall during September, thus David Sharek, Founder of School of Hard Stocks, feels some investors might have been aware of the shortcoming prior to the public knowing. In addition, InMode is based in Israel, which declared war on Palestine this past week. He sold our shares of INMD from the Growth Portfolio. Cost basis in client accounts is ~$45 per share.