The stock market was mixed on Wednesday, as the Federal Reserve announced a quarter-point rate hike. Currently, the rates are at their highest level in more than 22 years.

The stock market was mixed on Wednesday, as the Federal Reserve announced a quarter-point rate hike. Currently, the rates are at their highest level in more than 22 years.

Overall, S&P 500 closed flat at 4,567, while NASDAQ declined 0.1% to 14,127.

Tweet of the Day

$NKE UBS believes that Nike could double from here:

"If Nike were to reach these targets by FY26, EPS could reach at least $6.50. This is more than 2x the $3.23 Nike earned in FY23. If the stock holds its P/E, then the stock could double."

UBS has a PT of $150 compared to the… pic.twitter.com/df2Bc1bRYm

— Hedge Vision (@HedgeVision) July 25, 2023

Chart of the Day

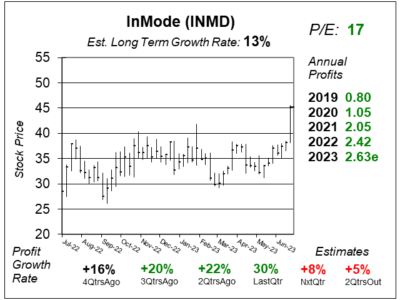

Here is the one-year chart of InMode (INMD) as of July 12, 2023, when the stock was at $45.

Here is the one-year chart of InMode (INMD) as of July 12, 2023, when the stock was at $45.

InMode is a developer of minimally invasive surgical medical equipment, focusing on three areas: (1) face and body contouring, (2) medical aesthetics, and (3) women’s health. It operates in 92 countries with 7 patented technologies across 10 product families. Its products utilize the company’s proprietary Radio Frequency energy technologies, which can penetrate deep into fat and allow tissue remodeling. Doctors utilize InMode equipment for liposuction and skin tightening, permanent hair reduction, face and body contouring, ablative skin treatments, and treatments for vaginal issues for women in menopause.

Medical device maker InMode (INMD) broke out big time when it pre-announced earnings would come in better than analyst expectations. INMD jumped from $41 to $45 on the news. Still, the company hasn’t actually reported profits, which are expected to come out tomorrow morning before trading begins. Even with the preannouncement of “good results” profit growth is only expected to be 8% this quarter.

David Sharek, Founder of School of Hard Stocks, was curious as to why investors sent the stock higher with such low profit growth expected. It could be two reasons. First, the stock has a low P/E. Currently trading around $45, the stock’s P/E is only 17. Second, the company might end up beating the 8% profit growth that is expected tomorrow.

INMD was bought today for the Growth Portfolio.