Stock (Symbol) |

InMode (INMD) |

Stock Price |

$45 |

Sector |

| Healthcare |

Data is as of |

| July 12, 2023 |

Expected to Report |

| July 27 |

Company Description |

Inmode Ltd is an Israel-based global provider of energy-based, minimally-invasive surgical medical treatment solutions. Inmode Ltd is an Israel-based global provider of energy-based, minimally-invasive surgical medical treatment solutions.

Company products and solutions are primarily designed to address three energy-based treatment categories comprised of: face and body contouring; medical aesthetics; and women’s health. The Company have developed and commercialized products utilizing medically-accepted RF energy technology, which can penetrate deep into the subdermal fat, allowing adipose tissue remodeling. It’s RF energy-based proprietary technologies – Radio Frequency Assisted Lipolysis (RFAL), Deep Subdermal Fractional RF, Simultaneous Fat Destruction and Skin Tightening and Deep Heating Collagen Remodeling for skin and human natural openings- represent a paradigm shift in the minimally-invasive aesthetic solutions market. These technologies are used by physicians to remodel subdermal adipose, or fatty tissue in a variety of procedures. Source: Refinitiv |

Sharek’s Take |

Medical device maker InMode (INMD) broke out big time when it pre-announced earnings would come in better than analyst expectations. INMD jumped from $41 to $45 on the news. Still, the company hasn’t actually reported profits, which are expected to come out tomorrow morning before trading begins. Even with the preannouncement of “good results” profit growth is only expected to be 8% this quarter. So I’m curious as to why investors sent the stock higher with such low profit growth expected? I guess it could be two reasons. First, the stock has a low P/E. Currently trading around $45, the stock’s P/E is just 17. Second, maybe the company will end up beating the 8% profit growth that’s expected tomorrow? Founded in Israel in 2008, InMode is a developer of minimally invasive surgical medical equipment, focusing on three areas: (1) face and body contouring, (2) medical aesthetics, and (3) women’s health. It operates in 92 countries with 7 patented technologies across 10 product families. Its products utilize the company’s proprietary Radio Frequency (RF) energy technologies, which can penetrate deep into fat and allow tissue remodeling. Doctors utilize InMode equipment for liposuction and skin tightening, permanent hair reduction, face and body contouring, ablative skin treatments, and treatments for vaginal issues for women in menopause. Each product consists of a small platform that incorporates energy sources, a hand piece, proprietary software, and a touch screen. The company derives revenue from InMode devices, as well as consumables. These are like razor blades to a razor. Here’s a breakdown of revenue by category last quarter:

INMD stock looks to be a deal. I’ve been watching the stock for years, waiting for a good opportunity to buy in. This seems to be one of them. Analysts give the stock an Estimated Long-Term Growth Rate of 13% while the P/E is only 17. INMD will be purchased today in the Growth Portfolio. The company has an ocular care device Envision coming to the US, and a new and improved Evoke device for skin tightening. These could boost revenue past current estimates. |

One Year Chart |

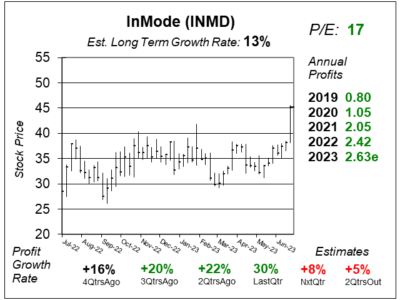

INMD broke out of a year-long base when the stock rose from $41 to $45 on July 12. Volume was high, that that’s a bullish signal. Note these charts are from 7/12, today is 7/26. I’ve been watching the stock’s action. The P/E is just 17 which is very reasonable. I think the P/E should be 25. Note the Est. LTG of 13%. That’s pretty good. But last qtr this figure was 33%. What’s not great is qtrly profit growth is expected to be just 8% and 5% the next two qtrs. |

Earnings Table |

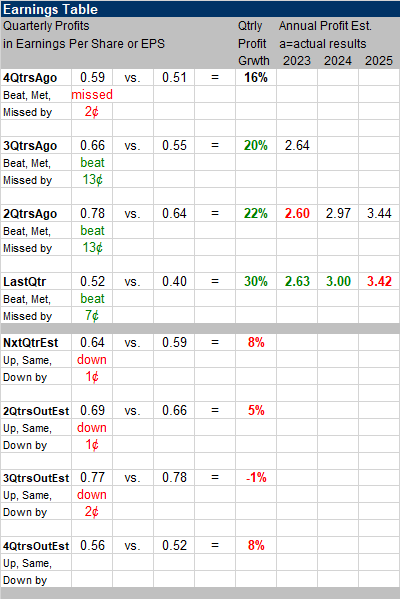

Last qtr, INMD delivered 30% profit growth and beat estimates of 13%. Revenue grew 24% against expectations of 17%.

Minimally invasive and under-the-skin treatments were 83% of revenue. Hands-free was 8% of sales. Non-invasive treatments was 9% of sales. Growth was driven by strong demand but management said last qtr is always the slowest qtr in terms of seasonality. Annual Profit Estimates for 202 are slightly up this qtr. Management maintains its guidance for fiscal 2023 with profits between $2.58 and $2.60 per share. 2023 profits are expected to climb just 9%%. That’s not much. I like my growth stocks to grow profits 15% to 20% a year or more. Quarterly profit estimates are for 8%, 5%, -1%, and 8% profit growth the next four quarters. Analysts expect revenue climbing 15% this quarter. |

Fair Value |

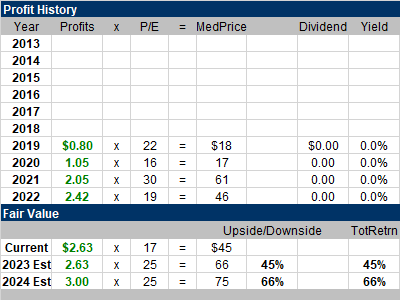

INMD has a P/E of only 17, which I think is a bargain. The stock’s had a wild history where the P/E was just 16 in 2020, shot up to 48 at the stock’s height in 2021 (the $99 stock was going to make $2.05 in profits), then fell to 19 last year. COVID-19 hurt this company as they could not do in-person demonstrations. My Fair Value is a P/E of 25, or $65 a share, which is around 45% upside from here. |

Bottom Line |

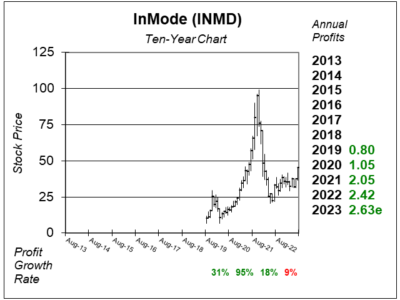

InMode (INMD) had its IPO in August 2019 and opened at $7 a share. The stock was a market leader in 2021 and went on a parabolic run and peaked at $99 in November 2021. The stock then went into a 6-month selloff and fell all the way to $21. I went back and looked at the news at the time, and the company continued to do well, but had some supply chain shortage that had a small impact on profit margins. InMode (INMD) had its IPO in August 2019 and opened at $7 a share. The stock was a market leader in 2021 and went on a parabolic run and peaked at $99 in November 2021. The stock then went into a 6-month selloff and fell all the way to $21. I went back and looked at the news at the time, and the company continued to do well, but had some supply chain shortage that had a small impact on profit margins.

INMD seems like a bargain of a stock, with very good upside even after the recent jump. That huge volume breakout the stock just made makes me bullish. INMD will be added to the Growth Portfolio. The stock will rank 17th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

17 of 28Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |