The stock market was down on Friday as inflation worries broke investors sentiment. In addition, geopolitical tensions in the Middle East continued to rattle financial markets. Oil prices rose amid reports of Israel’s planned attacked on Iran this weekend.

The stock market was down on Friday as inflation worries broke investors sentiment. In addition, geopolitical tensions in the Middle East continued to rattle financial markets. Oil prices rose amid reports of Israel’s planned attacked on Iran this weekend.

Overall, S&P 500 fell 1.5% to 5,123, while NASDAQ declined 1.6% to 16,175.

Tweet of the Day

" $SNOW wasn't doing any AI.

It's just a warehouse company for questions about the past."@databricks CEO is brutal 🤣 pic.twitter.com/55AoH4CNUc

— Arny Trezzi (@arny_trezzi) April 4, 2024

Chart of the Day

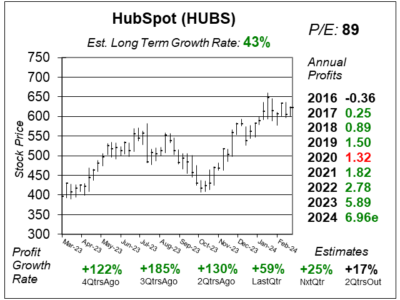

Here is the one-year chart of HubSpot (HUBS) as of March 12, 2024, when the stock was at $621.

Here is the one-year chart of HubSpot (HUBS) as of March 12, 2024, when the stock was at $621.

HubSpot reported a solid performance last quarter. Despite facing macroeconomic challenges, it was able to deliver 59% profit growth on 24% revenue growth. Such was driven by strong customer acquisition, with nearly 11,000 net new customers added last quarter, bringing the total to over 205,000 globally. Customer count increased a robust 23% in 2023.

In the higher-end market, the company closed 18 of the top 25 wins, including Sales Hub. The idea of using multiple hubs were also popular. More businesses are now using multiple hubs, and after INBOUND was relaunched, Sales Hub became even more successful. Customers liked the AI features, such as call summarization and forecasting, which helped them sell more.

HUBS is part of our Aggressive Growth Portfolio. With a P/E of 89, the stock is expensive on a P/E basis, but at 12x revenue, the stock is reasonable on a price-to-revenue basis.