HubSpot (HUBS) Stock is One of the Best Values in the Software Space

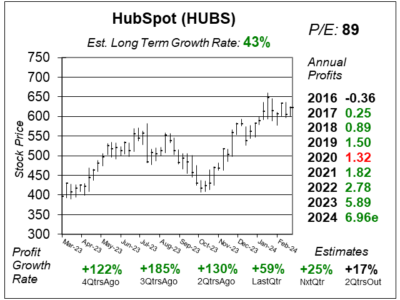

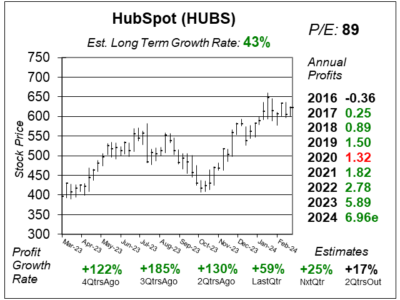

After a big run-up in software stocks this year, HubSpot (HUBS) stock now looks to be one of the best values in software space.

After a big run-up in software stocks this year, HubSpot (HUBS) stock now looks to be one of the best values in software space.

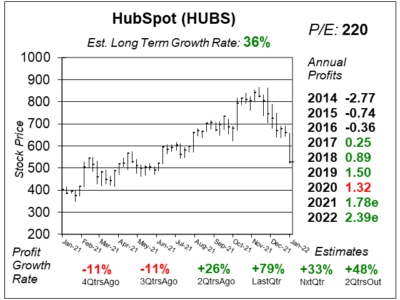

HubSpot (HUBS) has been adding to its AI repertoire while expanding profit margins at the same time. The future is bright here.

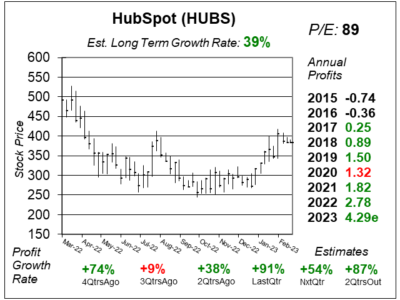

HubSpot (HUBS) is growing profits rapidly as profit margins rise. And AI additions to its software could keep momentum going.

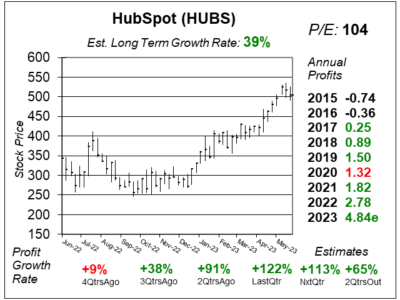

Last quarter HubSpot (HUBS) whipped profit estimates of 54% and delivered 122% growth. Now, the focus is using AI to help sales.

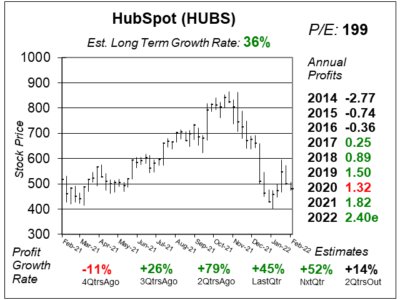

HubSpot (HUBS) came through with one ofthe best earnings reports of this quarter. They beat the street and guided much higher.

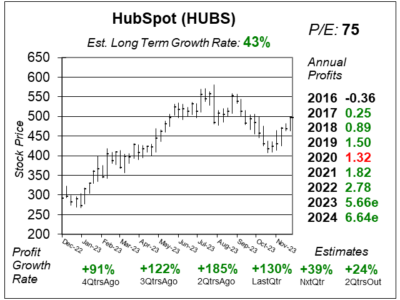

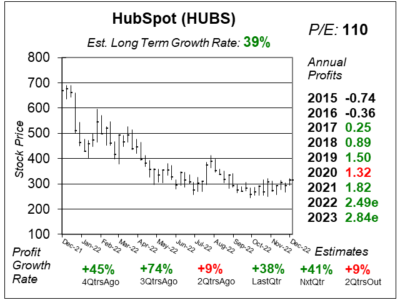

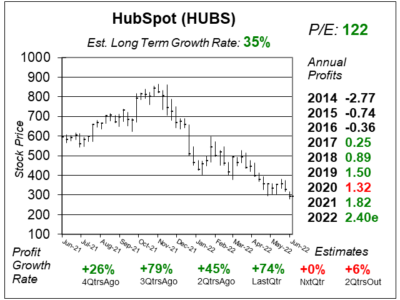

HubSpot (HUBS) could be a software stock that bounces back in a big way in 2023 as the shares sell for less than 10x revenue.

HubSpot (HUBS) is hanging around a 52-week low even though revenue grew 36% last qtr. The reason why is profit margins.

HubSpot (HUBS) grew its customer base 26% last qtr while the price of its CRM software rose 12%. Now let’s look at the stock.

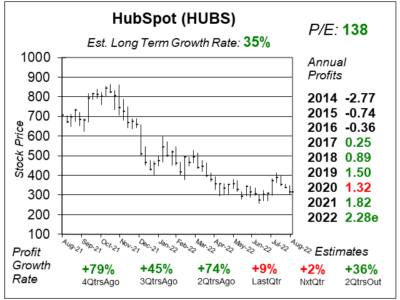

Software company HubSpot (HUBS) stock seems to have bottomed. HUBS has good upside, once we get past this Bear Market.

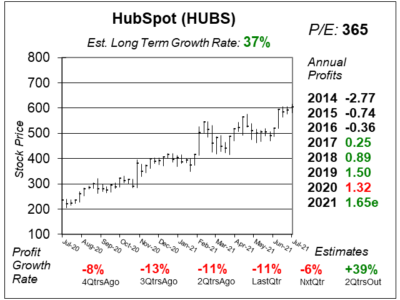

HubSpot (HUBS) fell mightily from its highs as software stocks have gotten crushed. Now, the stock seems fairly valued at $525.

HubSpot broke out in a big way yesterday after the company announced its integrating payment options into its software.

Zoom’s merging with Five9, which makes customer service software. That’s good for HubSpot (HUBS) because it sets a “multiple”.

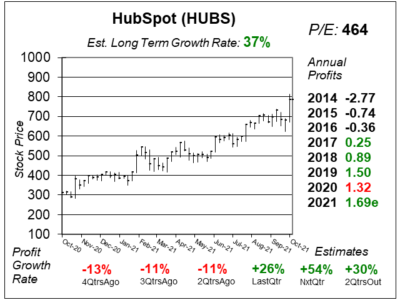

HubSpot (HUBS) is breaking out to a NEW All-Time high today as the stock has >50% upside to my 2021 Fair Value.

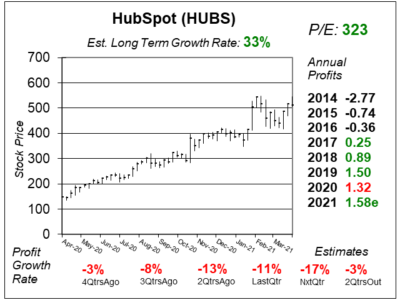

HubSpot (HUBS) stock went on a nice run from $150 to $400 in the last 12-months, and it still seems to have upside.

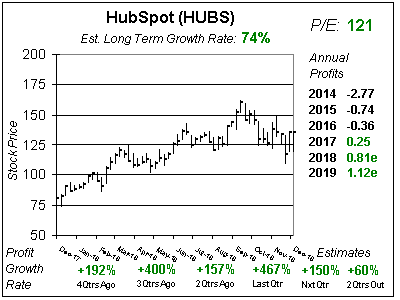

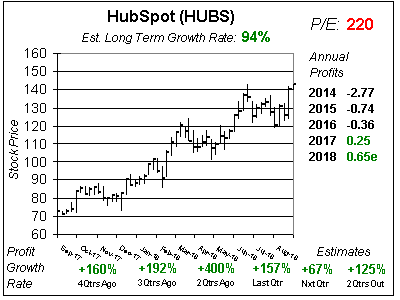

I normally put a fair value on a stock using EPS x P/E = Stock. But HubSpot (HUBS) needs to be priced differently.

HubSpot (HUBS) broke out to a new All-Time high this week as business software is the hot-spot in the stock market.

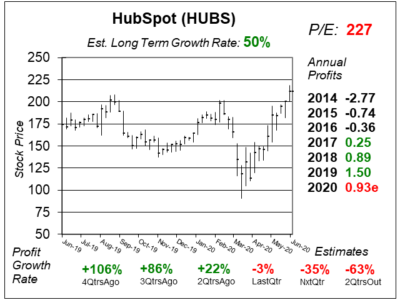

Hubspot (HUBS) has software small businesses need for customer service and online marketing in a stay-at-home world.

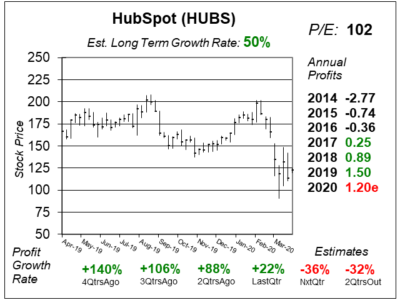

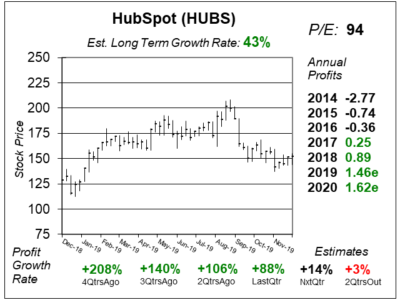

HubSpot (HUBS) stock is down as slowing growth is expected in 2020. But HUBS has been beating the street — handily.

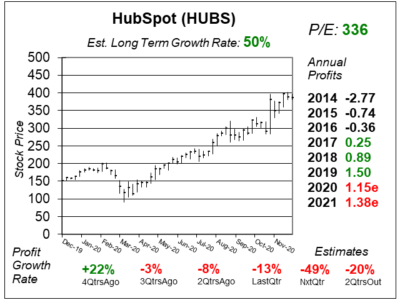

Hubspot (HUBS) delivered another beatdown to analyst earnings estimates, pushing the stock to an All-Time high.

HubSpot (HUBS) is legit. It’s software is comparable to Salesforce’s, but is more reasonably priced to appeal to small businesses.

I heard HubSpot (HUBS) is like a Salesforce for broke people. Yes, Hubspot is cheaper, but HUBS stock is now the premier growth stock between the two.

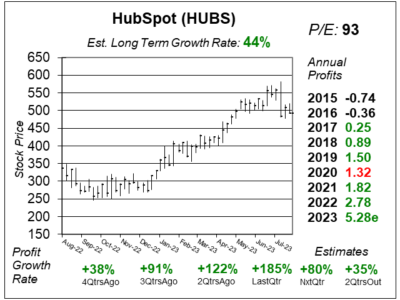

In my book, the faster the profit growth the better, which makes HubSpot (HUBS) a favorite of mine as its delivering triple-digit growth.

Shares of HubSpot (HUBS) have more than doubled in a year. HUBS has a P/E higher than 200. But it could be the next Salesforce.

Cloud software provider HubSpot (HUBS) is the best stock we don’t own — and not it’s so high we can’t. Well we can, but its dangerous.

HubSpot (HUBS) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $1.50 vs. $1.20 = +25%

Revenue Est: +19%