Stock (Symbol) |

HubSpot (HUBS) |

Stock Price |

$497 |

Sector |

| Technology |

Data is as of |

| November 29, 2023 |

Expected to Report |

| February 14 |

Company Description |

HubSpot, Inc. provides a cloud-based customer relationship management (CRM) platform that enables companies to attract and engage users. HubSpot, Inc. provides a cloud-based customer relationship management (CRM) platform that enables companies to attract and engage users.

Its CRM Platform is a single code-based software-as-a-service delivered through web browsers or mobile applications. The Company’s CRM platform provides Marketing Hub, Sales Hub, Service Hub, Content Management system (CMS) Hub, and Operations as well as other tools and integrations that enable companies to attract and engage customers throughout the customer experience. Its CRM Platform features include search engine, blogging, Website content management, messaging, chatbots, social media, marketing automation, email, predictive lead scoring, sales productivity, ticketing and helpdesk tools, customer NPS surveys, analytics, and reporting. Source: Refinitiv |

Sharek’s Take |

HubSpot (HUBS) is growing profits rapidly while investing in AI!Last quarter profits soared to 130% against estimates of 80% while revenue grew 26%. A big reason for the surge in profits was non-GAAP operating margin has also improved to 16% from 9% last year as management has focused on profitability. HubSpot is building AI features across its platform, including AI Assistants, AI Agents, and Chatspot. ChatSpot combines ChatGPT with the HubSpot CRM to become an AI assistant. Users can communicate with ChatSpot to perform CRM tasks. The company also launched content assistant which can generate social media text, create blog content, and prepare prospecting emails without leaving HubSpot. HubSpot with AI can make sales teams more efficient, and help reduce labor. 40% of Enterprise customers are already using HubSpot AI features. And 2/3rds of AI users are using AI assistance to write marketing emails and blogs. HubSpot (HUBS) is growing profits rapidly while investing in AI!Last quarter profits soared to 130% against estimates of 80% while revenue grew 26%. A big reason for the surge in profits was non-GAAP operating margin has also improved to 16% from 9% last year as management has focused on profitability. HubSpot is building AI features across its platform, including AI Assistants, AI Agents, and Chatspot. ChatSpot combines ChatGPT with the HubSpot CRM to become an AI assistant. Users can communicate with ChatSpot to perform CRM tasks. The company also launched content assistant which can generate social media text, create blog content, and prepare prospecting emails without leaving HubSpot. HubSpot with AI can make sales teams more efficient, and help reduce labor. 40% of Enterprise customers are already using HubSpot AI features. And 2/3rds of AI users are using AI assistance to write marketing emails and blogs.

HubSpot offers online software that can keep track of your business’ customers and potential customers, do online marketing campaigns, trace if people are opening your emails, and even automate customer service teams. You can get free plans, upgrade for a small monthly fee, or get a complete suite to run your company. HUBS has more than 1,000 apps in its marketplace that can be integrated into the platform. HubSpot is acquiring Clearbit, a company data provider. Clearbit has public and provide data sources on 20 million companies and 500 million decision makers. Clearbit has been on the HubSpot marketplace since 2019. The company’s offerings include:

HubSpot software is similar to Salesforce’s, but for a lot less money. I like the Salesforce comparison as that was one of the best stocks of the 2010’s decade. Analysts give HUBS an Estimated Long-Term Growth Rate of 44% per year, a very solid number. HUBS is part of my Aggressive Growth Portfolio. With a P/E of 93, the stock is expensive on a P/E basis, but at 12x revenue, the stock is reasonable on a price-to-revenue basis. |

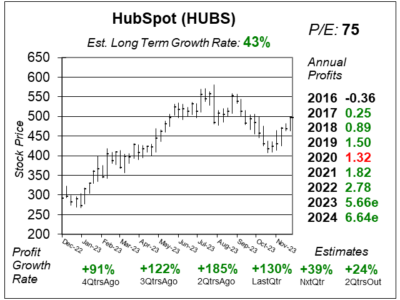

One Year Chart |

This stock has just corrected after a nice move higher. But I don’t have much feel for the stock’s direction right now. This stock has just corrected after a nice move higher. But I don’t have much feel for the stock’s direction right now.

The P/E of 75 is high, but I’m pricing the stock on a price-to-sales basis. Using that metric, the stock has 22% upside to my 2024 Fair Value of $608. The Est. LTG of 43% per year is great. Qtrly profit growth is excellent, and Estimates for the next two quarters are good. |

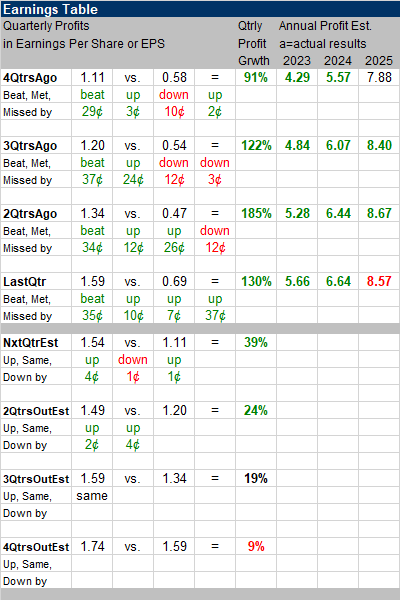

Earnings Table |

Last qtr, HubSpot delivered 130% profit growth and beat estimates of 80% growth. Revenue increased 26%, year-over-year, and beat estimates of 20%. Operating margin jumped to 16.2% from 9.2% a year ago. Customer count grew 22% to 194,000. International revenue grew 30% and is now 47% of total revenue. Last qtr, HubSpot delivered 130% profit growth and beat estimates of 80% growth. Revenue increased 26%, year-over-year, and beat estimates of 20%. Operating margin jumped to 16.2% from 9.2% a year ago. Customer count grew 22% to 194,000. International revenue grew 30% and is now 47% of total revenue.

Growth was driven by multi-hub adoption from Professional and Enterprise customers offset by a large number of low-end Starter customers HUBS added the past few quarters. Billings grew 24%. Budgets are still under scrutiny and deals are taking longer to close, Annual Profit Estimates grew nicely this qtr. Notice 2023 profit estimates jumped from $5.28 to $5.66 since last quarter. Qtrly Profit Estimates are for 39%, 24%, 19%, and 9% profit growth the next 4 qtrs. ut the company has been blowing away estimates lately. Analysts think that HUBS revenue will grow 20% next quarter. |

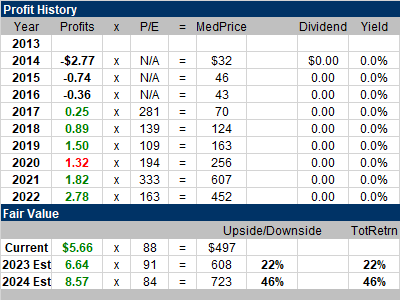

Fair Value |

HUBS stock sold for 8x revenue at the end of 2022, 19x revenue in 2021, 20x revenue in 2020, 10x in 2019, and 9x in 2018. HUBS stock sold for 8x revenue at the end of 2022, 19x revenue in 2021, 20x revenue in 2020, 10x in 2019, and 9x in 2018.

This qtr with HUBS at $497 it sells for 12x 2023 revenue estimates. My Fair Value is 12x revenue, giving us a Fair Value of $608 for 2024 and $723 for 2025: Currently: 2024 Fair Value: 2025 Fair Value: |

Bottom Line |

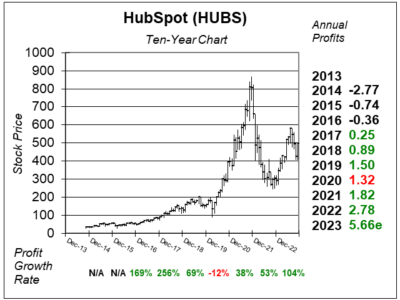

HubSpot (HUBS) was a stellar investment after its IPO. Then in 2020 and 2021 the stock went on a parabolic run higher. The stock then fell in 2022 and rebounded in 2023. HubSpot (HUBS) was a stellar investment after its IPO. Then in 2020 and 2021 the stock went on a parabolic run higher. The stock then fell in 2022 and rebounded in 2023.

Now HubSpot is cranking up profit margins while adding AI to its offerings. I imagine the stock might continue to grow at the rate revenue does, which is ~25% a year. I am adding HUBS to the Growth Portfolio and will rank 22nd of 33 stocks in that portfolio. would like to add it back if it becomes a better value. HUBS will be sold from the Aggressive Growth Portfolio as I’m trying to focus this portfolio on a smaller number of positions (it will have 16 now). |

Power Rankings |

Growth Stock Portfolio

22 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |