The stock market continued its growth on Wednesday, as investors assessed stronger-than-expected inflation data. US wholesale prices climbed in September, with the producer price index increasing 2.2% from a year ago. This was faster than the 1.6% estimate for the period.

The stock market continued its growth on Wednesday, as investors assessed stronger-than-expected inflation data. US wholesale prices climbed in September, with the producer price index increasing 2.2% from a year ago. This was faster than the 1.6% estimate for the period.

Meanwhile, investors are hoping that the Federal Reserve will not hike interest rates during its November meeting.

Overall, S&P 500 grew 0.4% to 4,377, while NASDAQ rose 0.7% to 13,660.

Tweet of the Day

China reported 43,507 @Tesla sales for September. 🇨🇳

• Best Q3 ever and -12% quarter-over-quarter

• Year-to-date +37% over same period last year

• Year-to-date is 99% of last year's total pic.twitter.com/iNRLCOPZoc— Roland Pircher (@piloly) October 11, 2023

Chart of the Day

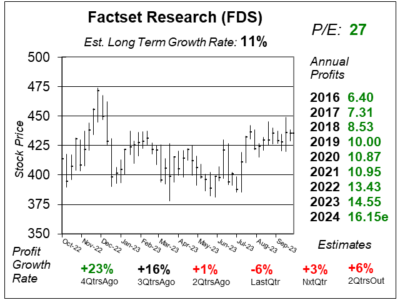

Here is the one-year chart of Factset Research (FDS) as of September 26, 2023, when the stock was at $435.

Here is the one-year chart of Factset Research (FDS) as of September 26, 2023, when the stock was at $435.

Factset Research provides market intelligence on securities, companies, and industries that equips clients with the right research investment tools and ideas so they can personally analyze, monitor, and manage their portfolios. Buy-side clients include portfolio managers, analysts, traders, and wealth managers. Sell-side clients include firms that perform mergers and acquisitions, advisory work, capital markets services, and equity research.

Factset Research’s management expects total revenue to continue growing within the lower range of the guidance they issued last quarter. Note that the company’s Fiscal Year ends on August 31, so Factset Research just entered Fiscal 2024.

In prior years, clients had higher budgets to spend before calendar year-end. Now, management expects continued caution for the rest of calendar year 2023, then for things to pick up after New Years. In turn, analysts lowered quarterly estimates slightly. Management also sees sluggish results for the next two quarters, with quarterly profit estimates of 3% and 6%. Analysts estimate revenue will grow 7% next quarter.

FDS is part of the Conservative Stock Portfolio. This is a fabulous buy-and-hold stock.