Factset Research (FDS) Continues to Grow As Expected in a Slow Finance Market

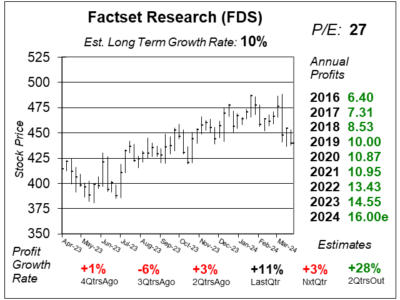

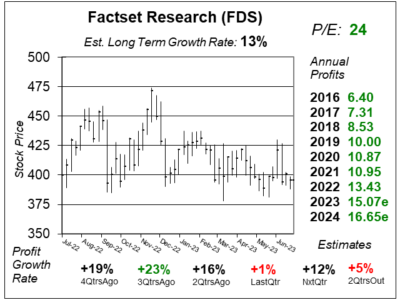

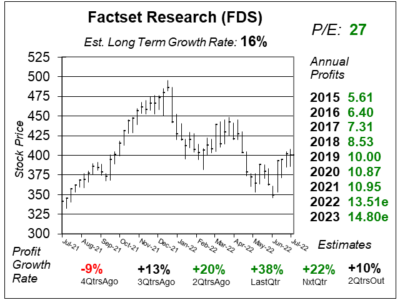

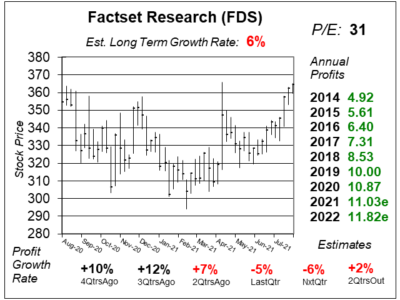

FactSet Research (FDS) is seeing internal cost cutting among its clients. Still, profits grew a solid 11% last quarter as revenue rose 6%.

FactSet Research (FDS) is seeing internal cost cutting among its clients. Still, profits grew a solid 11% last quarter as revenue rose 6%.

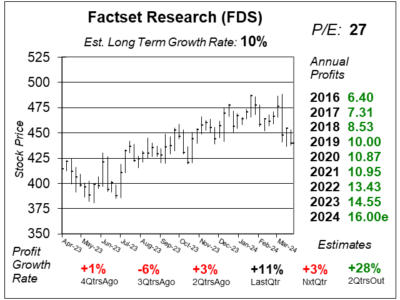

Factset Research (FDS) is seeing slow profit growth right now. But the company has some AI initiatives that can boost revenue.

Factset Research (FDS) management expects cautions clients for the rest of calendar year 2023, then for things to pick up in 2024.

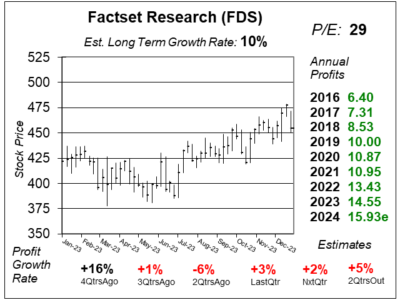

Factset Research (FDS) has the lowest P/E ratio I’ve seen the stock have since 2019. Now the stock seems to have solid upside.

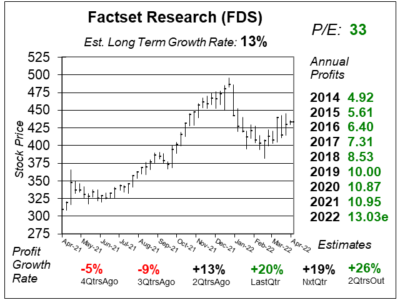

Factset Research (FDS) has been a dependable double-digit grower — both profit-wise and stock-wise — that continues to deliver.

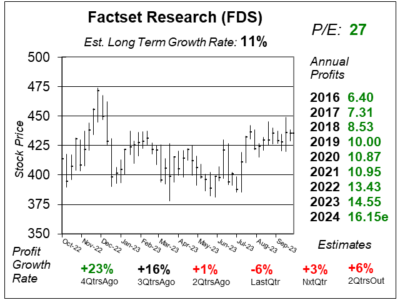

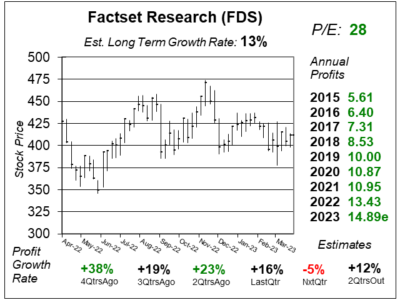

Factset Research (FDS) is getting a boost from a recent acquisition, CUSIP Global Services, which is pushing profits even higher.

Factset Research (FDS) is delivering strong growth with its financial info software. Last qtr, profits grew 19% on 21% sales growth.

Factset Research (FDS) is seeing broad-based acceleration across all markets for its financial software, as the numbers look excellent.

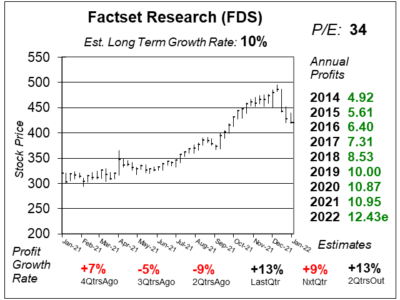

Factset Research (FDS) is getting strong demand for its workstations, and that’s causing profits to rise faster than they normally do.

Factset Research (FDS) new bond trading ability and deep-dive industry data has spurred growth for its financial workstations.

Factset Research (FDS) stock jumped 35% during the past two qtrs as the the financial software’s subscription revenue climbs.

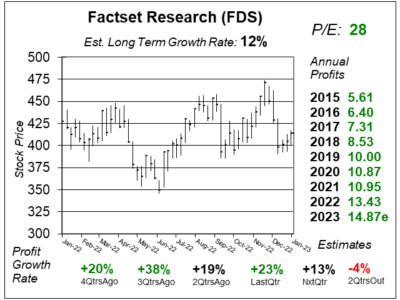

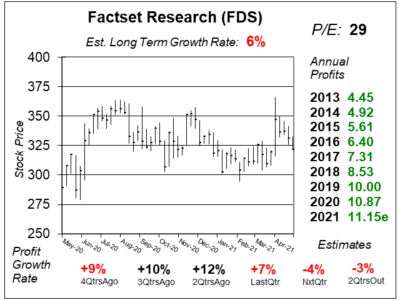

Factset Resarch’s (FDS) profits fell 5% last qtr, yet has risen 13% from $322 to $364 since our report last qtr. Why?

Factset Research (FDS) is expecting some slow growth in the upcoming qtrs, but profits have grown every year since 1996.

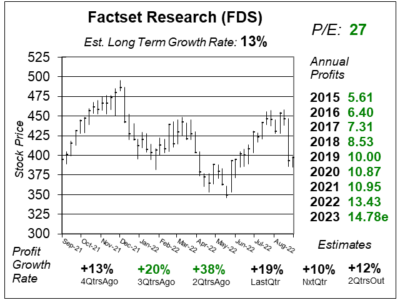

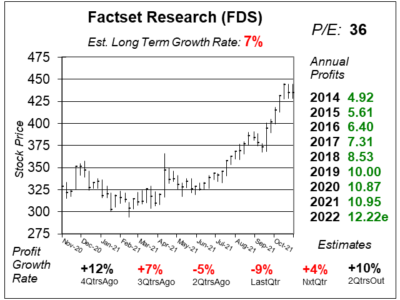

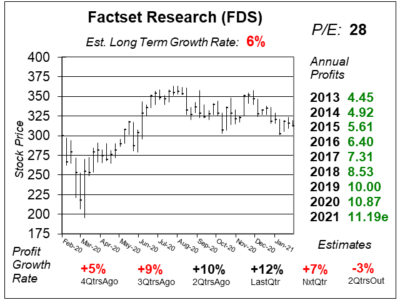

Factset Research (FDS), a provider of financial workstations, is expecting some big deals to come its way in 2021.

Factset Research (FDS), provides a financial workstation, is seeing demand from private equity, venture capital and hedge funds.

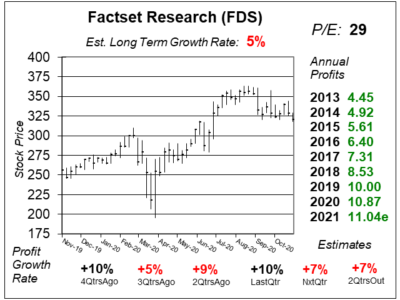

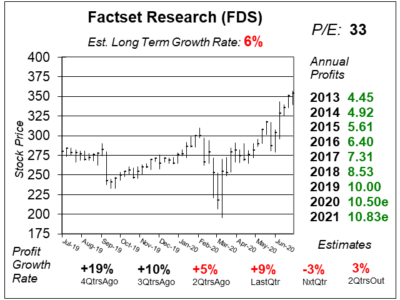

Factset Research (FDS) stock is sky-high with a 33 P/E even though sales grew just 3% last qtr with 9% profit growth.

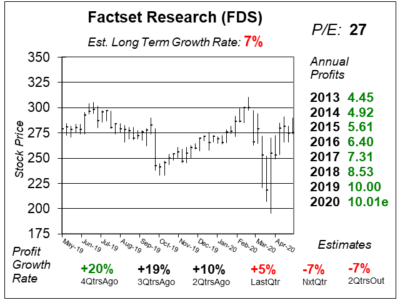

Factset Research (FDS) is spending to improve its financial software this year, thus 2020 profits might not grow.

Factset Research (FDS) claimed it would have 0% profit growth for 2020. But after one qtr the company delivered 10% growth.

Factset Research (FDS) needs to spend more to grow its business. That’s gonna cost ya. One year’s of profit growth.

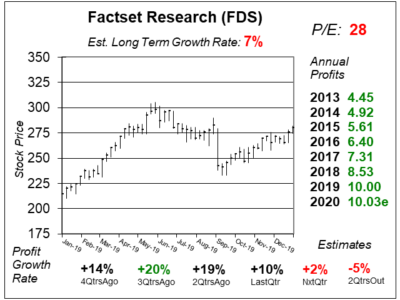

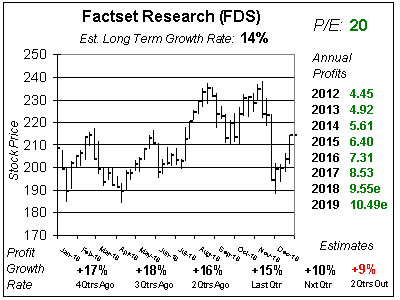

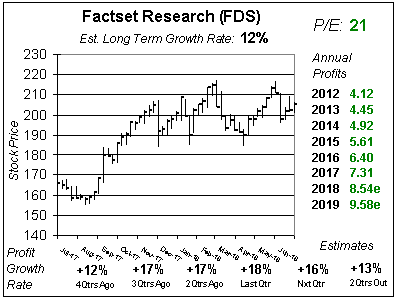

Factset Research (FDS) has delivered record profits every year since it went public. 2019 looks to be another record year.

The S&P 500 was up 18% year-to-date through the first 4 months of 2019. A strong market is good for Factset Research (FDS).

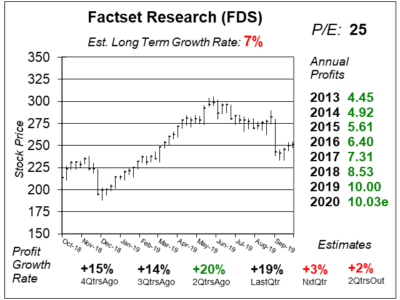

FactSet Research (FDS), a provider of financial data, has delivered profit growth every year since 1996. But will growth slow with the stock market weak?

Factset Research (FDS) provides financial data to investment mangers — whose stocks are faltering while FDS stock stands tall.

Factset Research (FDS) is on track for another record profit year. In fact, FDS has grown profits every year since it went public in 1996.

FactSet Research (FDS) offers content and statistics to asset managers (like me) on a subscription basis, and what’s helping FDS is analytics.

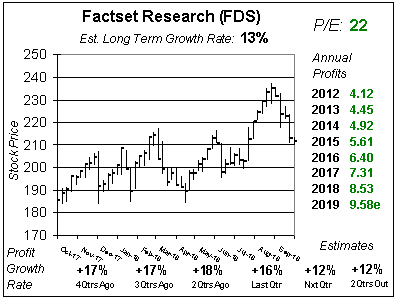

Acquisitions helped boost Factset Research’s (FDS) sales growth from what would have been 6% to 14% last qtr. That helped boost profits 17%.

Factset (FDS) provides tools and data for money managers and analysts to do their work. And with the stock market up big in 2017, the outlook for FDS is good.

Is passive investing — i.e. people putting money into index funds and ETFs — hurting Factset Research (FDS)? Yes. But the pendulum is about to swing the other way.

Factset Research (FDS) provides stock and bond data for guys like me. FDS has been a good stock for a while, so why did it fall after another good qtr?

Dow 20,000 is great news for Factset Research (FDS), as Factset provides financial software and data many money managers utilize to research stocks.

Factset Research (FDS) delivers company data on a subscription basis to people in the Finance industry. FDS has also grown profits every year since it went public in 1996.

Factset Research (FDS) continues down the slow and steady road of mid teens profit growth, which has been the case for more than a decade now.

Factset Research (FDS) provides financial data and analytics to finance companies who depend on its research to manage portfolios and do deals.

Factset (FDS) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $3.90 vs. $3.79 = +3%

Revenue Est: +4%