Stock (Symbol) |

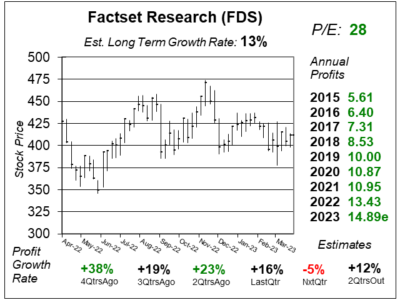

Factset Research (FDS) |

Stock Price |

$412 |

Sector |

| Financial |

Data is as of |

| April 12, 2023 |

Expected to Report |

| June 21 |

Company Description |

FactSet Research Systems Inc. is a provider of integrated financial information, analytical applications and services for the investment and corporate communities. FactSet Research Systems Inc. is a provider of integrated financial information, analytical applications and services for the investment and corporate communities.

The Company delivers information through its four workflow solutions of Research, Analytics and Trading, Content and Technology Solutions (CTS) and Wealth. It serves a range of financial professionals, which includes portfolio managers, investment research professionals, investment bankers, risk and performance analysts, wealth advisors, and corporate clients. The Company provides both insights on global market trends and intelligence on companies and industries, as well as capabilities to monitor portfolio risk and performance and execute trades. It also offers subscription to products and services such as workstations, portfolio analytics, enterprise data and research management. Source: Refinitiv |

Sharek’s Take |

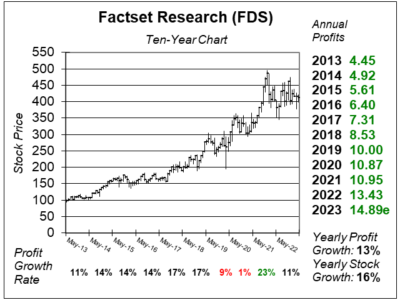

Factset Research (FDS) is a little-known stock that consistently delivers double-digit profit growth. And that makes it safe from Bear Market declines (well, at least so far), Last quarter was “more of the same” from this company, as profits increased 16% on a 20% jump in revenue. Abnormally high sales growth is due in part from a recent acquisition of CUSIP Global Services (CGS), which expands the company into a different direction from its research software. CUSIPs are 9- character numeric identifiers for securities, such as stocks and bonds. CGS was acquired in March 2022 and has helped push up FDS’s sales and profits. Factset Research (FDS) is a little-known stock that consistently delivers double-digit profit growth. And that makes it safe from Bear Market declines (well, at least so far), Last quarter was “more of the same” from this company, as profits increased 16% on a 20% jump in revenue. Abnormally high sales growth is due in part from a recent acquisition of CUSIP Global Services (CGS), which expands the company into a different direction from its research software. CUSIPs are 9- character numeric identifiers for securities, such as stocks and bonds. CGS was acquired in March 2022 and has helped push up FDS’s sales and profits.

Factset Research provides market intelligence on securities, companies, and industries that equips clients with the right research investment tools and ideas so they can personally analyze, monitor, and manage their portfolios. Buy-side clients include portfolio managers, analysts, traders and wealth managers. Sell-side clients include firms that perform mergers and acquisitions, advisory work, capital markets services, and equity research. The big statistics analysts look at when evaluating FDS is the Annual Subscription Value (ASV) of contracts clients sign. During the past 8 qtrs, ASV has been: 5.8%,7.2%, 9.2%, 9.4%, 10.1%, 9.3%, 8.8%, and now 9.1%. ASV was strong last quarter because of increased sales of Content & Technology and Analytics & Trading Solutions. In March 2022, the company completed the acquisition of CUSIP Global Service (CGS) for $2 billion in cash. This acquisition expands market opportunities of the company in the global capital markets. Indices is a good business to be in, with S&P Global being the market leader. Stats from last qtr include:

FDS is a high quality stock with 42 consecutive years of revenue growth. Profits have grown every-single year since the company went public in 1996. The secret to the recipe of growth-every-year is the company sells its software on a subscription basis (which gives it a steady stream of revenues each quarter) and passes along small fee increases each year. Thus, 5% or so user growth combined with 5% price increases and stock buybacks have made 12% profit growth possible in the past. Management buys back lots of stock and makes acquisitions that boost revenues and profits. The company also pays a dividend, which has increased for 23 consecutive years. April 2022’s increase was 8.5% to $0.89 per share, per qtr. FactSet is part of the Conservative Stock Portfolio. This is a fabulous buy-and-hold stock. |

One Year Chart |

FDS stock was very hot last Winter, and now the stock is digesting its gains. The P/E was 33 a year ago, so I like that the valuation is much better now as the P/E is a reasonable 28. FDS stock was very hot last Winter, and now the stock is digesting its gains. The P/E was 33 a year ago, so I like that the valuation is much better now as the P/E is a reasonable 28.

The Est. LTG of 13% is good. I used to think this was a 10-12% grower, but the success of the new additions to the platform is pushing growth up. Alas, the CUSIP acquisition has boosted growth during the past year, and now things will normalize next quarter. Qtrly profit growth has been great the past few qtrs. Growth is expected to simmer down though. Especially when we get NxtQtr. |

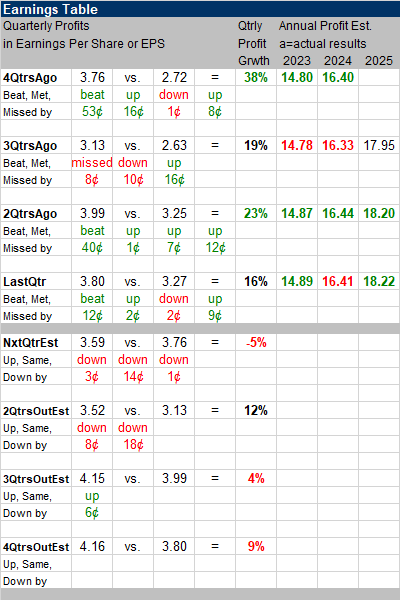

Earnings Table |

Last qtr, FactSet recorded 16% profit growth and beat expectations of 13% growth. Revenue increased 20% while organic revenue growth (minus acquisitions) was 9%. The company benefited by additional revenue from the CUSIP acquisition. ASV plus professional services grew 9% (8% for buy-side companies and 16% for sell-side). Adjusted operating margin was 37.0%, much better than 33.7% a year ago. Margin improvement came from higher revenue, lower wage, and content costs. Last qtr, FactSet recorded 16% profit growth and beat expectations of 13% growth. Revenue increased 20% while organic revenue growth (minus acquisitions) was 9%. The company benefited by additional revenue from the CUSIP acquisition. ASV plus professional services grew 9% (8% for buy-side companies and 16% for sell-side). Adjusted operating margin was 37.0%, much better than 33.7% a year ago. Margin improvement came from higher revenue, lower wage, and content costs.

Regional organic revenue growth rates were:

Growth was strongest with banking, asset owners, and wealth management clients. BMO Wealth Management selected Factset as its primary data provider, and this was a big contributor to the company’s 9% increase in workstations in the past year. Annual Profit Estimates increased this qtr. Management expects organic ASV to grow 8% to 9% in the medium term. Qtrly Profit Estimates are -5%, 12%, 4%, and 9%. Next qtr, analysts’ think that FDS revenue will grow 8%. ASV growth will slow as FDS is now lapping the CUSIP acquisition. Management sees instability in the banking sector and longer sales cycles in addition to budget constraints related to weak macro backdrop. |

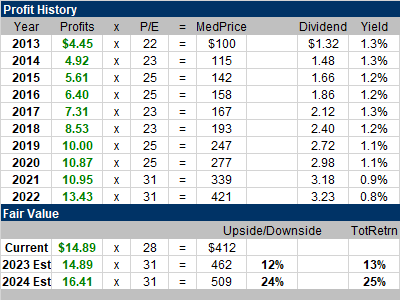

Fair Value |

Fair Value P/E is 31. The stock currently has a P/E of 28. I think the stock has 12% upside to 2023’s Fair Value. Also, the company’s fiscal year end is coming up in two quarters, so I will start looking ahead to 2024’s Fair Value next quarter. So I’m thinking the stock can rise from around $400 to around $500 in the next 18 months. Fair Value P/E is 31. The stock currently has a P/E of 28. I think the stock has 12% upside to 2023’s Fair Value. Also, the company’s fiscal year end is coming up in two quarters, so I will start looking ahead to 2024’s Fair Value next quarter. So I’m thinking the stock can rise from around $400 to around $500 in the next 18 months.

FDS has a Fiscal year-end of August 31, so we are in the company’s Q3 now. |

Bottom Line |

Factset Research (FDS) went public in 1996 at $4 a share. Since then, the stock has been a model of consistency. It has a high degree of safety, a 23-year dividend increase streak, a 42 year history of record-high profits, and a stock buyback program. Factset Research (FDS) went public in 1996 at $4 a share. Since then, the stock has been a model of consistency. It has a high degree of safety, a 23-year dividend increase streak, a 42 year history of record-high profits, and a stock buyback program.

Factset is doing great right now. But the CUSIP acquisition was helping results the past 4 qtrs. Now, year-over-year comparisons will normalize. Management is also seeing slower decision making among clients. So, brace for this growth rate to slow a bit. What I do like is the P/E of 28 is reasonable for new investors to buy in at. FDS pulls back from 7th to 13th in the Conservative Growth Portfolio Power Rankings. The reason for the decline is the CUSIP boost to year-over-year results and there’s good competition at the top of the rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 13 of 31 |