The stock market fell on Tuesday as the Federal Reserve’s two-day meeting started. Investors now await the central bank’s decision on it interest rate policy, which is not expected to raise rates.

The stock market fell on Tuesday as the Federal Reserve’s two-day meeting started. Investors now await the central bank’s decision on it interest rate policy, which is not expected to raise rates.

Overall, S&P 500 and NASDAQ declined 0.2% to 4,444 and 13,678, respectively.

Tweet of the Day

$SNOW might be losing market share to Databricks. While the # of companies mentioning $SNOW in a job opening dropped 8% YoY, it increased 8% for Databricks. Databricks continues to hire at a steady rate while job openings for $SNOW are down 64% YoY pic.twitter.com/MdFn6oHVVp

— Weng (@AznWeng) September 19, 2023

Chart of the Day

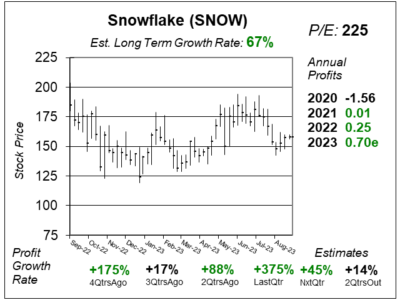

Here is the one-year chart of Snowflake (SNOW) as of September 6, 2023, when the stock was at $157.

Here is the one-year chart of Snowflake (SNOW) as of September 6, 2023, when the stock was at $157.

Snowflake provides organizations a platform for all their data, then gives managed secure access of the data to company users without the need for the client to control the database infrastructure. It is a global data-sharing network. Snowflakes separates storage and computing. Storage is where the data sits, while computing does the work on your data. The data then can be shared with other organizations securely.

Snowflake seems to be losing its customers to competitor Databricks. There’s a couple reasons why Snowflake might be in trouble. First, one of Snowflake’s biggest clients Instacart filed for its IPO, and in the prospectus, it showed payments to Snowflake declined from $51 million in 2022 to $11 million during the first half of 2023. This would imply around $22 million for 2023, a huge decline from a year ago. Second, NVIDIA (NVDA) and Capital One have invested in Databricks. Capital One is Snowflake’s biggest customer, and this could mean its business flows from Snowflake to Databricks. Since David Sharek, Founder of School of Hard Stocks, started following SNOW year-over-year revenue growth has slowed from 101% to 85%, 83%, 67%, 53%, 48%, and most recently 36%. Management has been saying slowing growth was due to the macroeconomy.