The stock market ended Wednesday lower after December retail sales indicated slower consumer spending activity. This raised concerns about a recession.

The stock market ended Wednesday lower after December retail sales indicated slower consumer spending activity. This raised concerns about a recession.

Overall, S&P 500 declined 1.6% to 3,929, while NASDAQ fell 1.2% to 10,957.

Tweet of the Day

$snow data sharing broken down a bit simplistically. This is pretty game changing and you have to be a snowflake customer to send data. Companies have so much data, what a great biz to create a market place for monetizing info or simply using it to share with partners. Sticky. pic.twitter.com/S1OsMX9jnH

— Frank Slootman’s Abandoned Son (@davey_juice) January 18, 2023

Chart of the Day

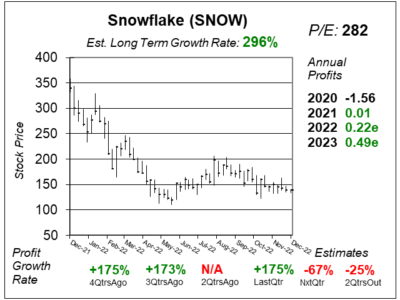

Our chart of the day is the one-year chart of Snowflake (SNOW) as of December 28, 2022, when the stock was at $138.

Our chart of the day is the one-year chart of Snowflake (SNOW) as of December 28, 2022, when the stock was at $138.

Snowflake provides organizations a platform for all their data, then gives managed secure access of the data to company users (or other organizations) without the need for the client to control the database infrastructure.

The company is delivering some impressive growth figures. But while revenue and profits jump higher, SNOW stock is down from around $350 to less than $150 during the past year. The reason for the stock’s decline has been the valuation. A year-ago, SNOW sold for 39x 2022 revenue estimates. This quarter it sells for 15x 2023 revenue estimates, which David Sharek thinks is fair. His Fair Value for 2023 is 15x revenue.

So although the stock isn’t “on sale” after this decline, it might be at a point where the stock climbs as much as the revenue does, which could be 40% a year.

SNOW might be the fastest growing enterprise in the world. The stock is part of the Aggressive Growth Portfolio.