The stock market rose on Monday lifted by Artificial Intelligence (AI) developments and as investors awaited Federal Reserve’s new monetary policy guidance.

The stock market rose on Monday lifted by Artificial Intelligence (AI) developments and as investors awaited Federal Reserve’s new monetary policy guidance.

Overall, S&P 500 grew 0.6% to 5,149, while NASDAQ was up 0.8% to 16,103.

Tweet of the Day

Pretty unexpected …

Spoke with the largest Toyota dealer in the United States the other day.

(Longo Toyota in California)

Their President tells me their used car business is the *strongest* they have ever seen.

Ever.

Even better than 2021.

He said they're coming off three…

— Car Dealership Guy (@GuyDealership) March 14, 2024

Chart of the Day

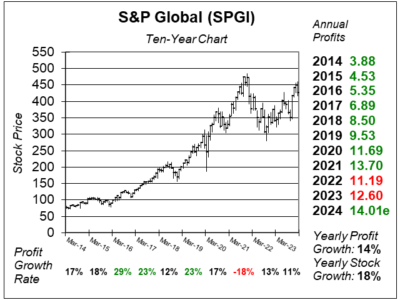

Here is the ten-year chart of S&P Global (SPGI) as of February 20, 2024, when the stock was at $426.

Here is the ten-year chart of S&P Global (SPGI) as of February 20, 2024, when the stock was at $426.

S&P Global stock is trending higher as the company is seeing a resurgence in bond issuance. Last quarter, much of the company’s growth was driven by Ratings Division which delivered 19% revenue growth. Growth was due to a 35% increase in transaction revenue due to heightened refinancing activity increased bank loan and high-yield issuance. Management continues to see issuers returning to the bond market with billed issuance needs. Still, growth isn’t quite back to what we saw years ago, as revenue only increased 7% last quarter.

This is a relatively safe stock that David Sharek, Founder of School of Hard Stocks, thinks can grow 15% a year. Right now, analysts have an Estimated Long-Term Growth Rate of 13% on the stock. The dividend yield is around 1%. SPGI is part of the Conservative Growth Portfolio.