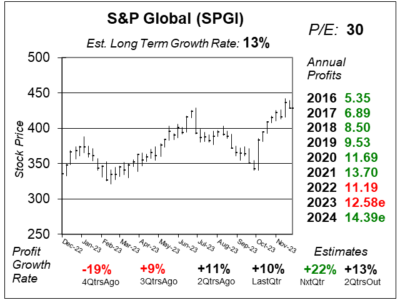

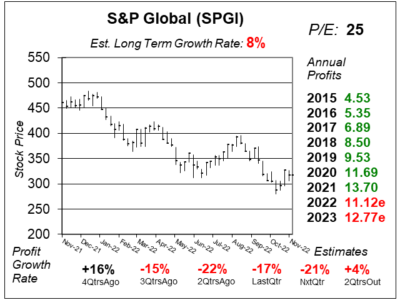

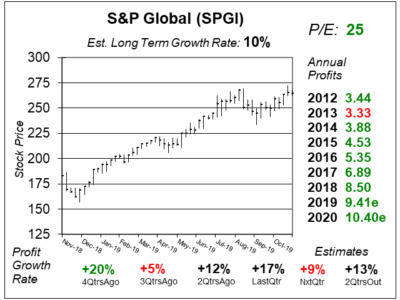

S&P Global (SPGI) Profits Climb as Bond Issuance Successfully Rebounded

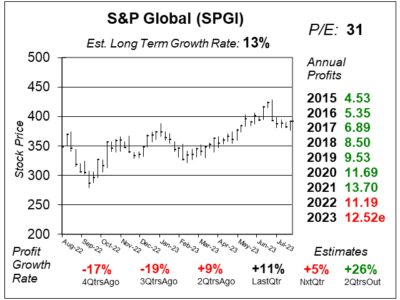

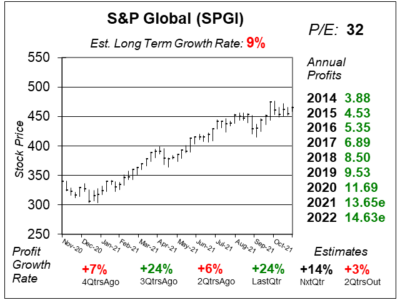

S&P Global (SPGI) is seeing a pick up in bind issuance, which helped its Ratings division grow revenue a solid 19% last quarter.

S&P Global (SPGI) is seeing a pick up in bind issuance, which helped its Ratings division grow revenue a solid 19% last quarter.

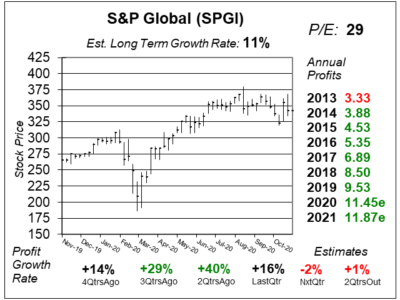

S&P Global (SPGI) had accelerated revenue growth across all divisions last quarter. And analysts see better things in store in 2024.

S&P Global’s (SPGI) is seeing global bond issuance improve, which helped boost SPGI’s quarterly profits back to double-digit growth.

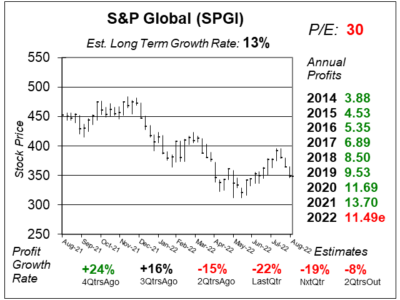

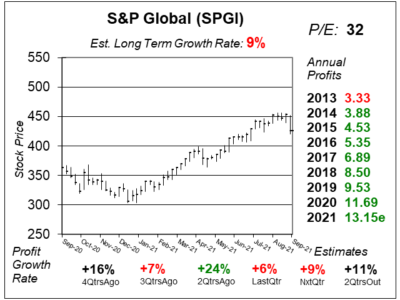

S&P Global (SPGI) has seen weakness in its Ratings division for the past year. Now, bond issuance is coming back. Profits may follow.

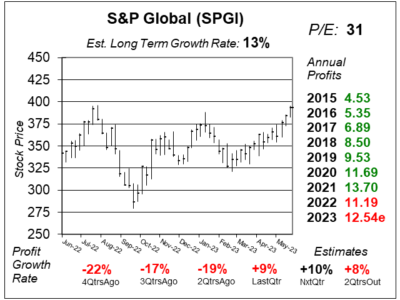

S&P Global’s (SPGI) profits have been down as global bond issuance was -20% in 2022. But issuance is expected to rise 3% in 2023.

S&P Global’s (SPGI) profits are down because credit ratings down. But qtrly profit growth is set to return to the mid-teens in 2023.

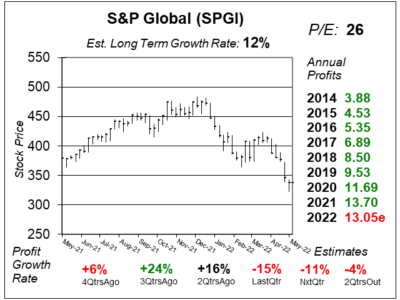

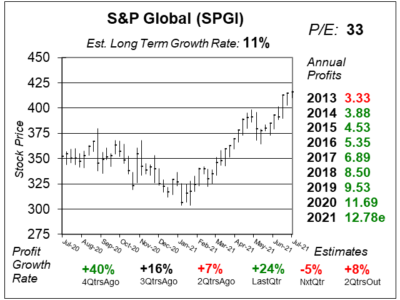

5 of 6 segments at S&P Global (SPGI) delivered revenue growth last qtr, but Ratings revenue was -26% and that hurt results a lot.

A hangover from last year’s strong bond issuance, and higher inflation this year, and hurting S&P Global’s (SPGI) Ratings division.

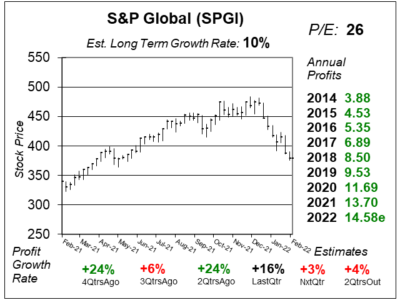

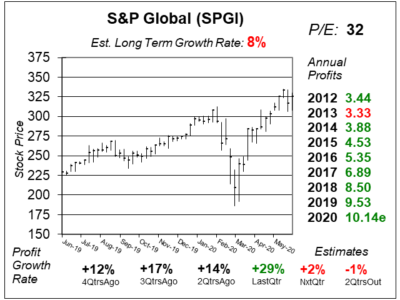

S&P Global (SPGI) acquired London’s IHS Markit, a financial information and analytics company, which is set to boost SPGI’s profits.

S&P Global’s (SPGI) Indicies division (S&P 500, DJIA) grew revenue 27% last qtr as assets under management (AUM) jumped 43%.

S&P Global (SPGI) management is optimistic as economies around the word recover while employment and GDP rise.

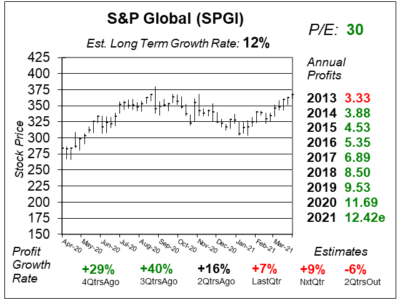

S&P Global (SPGI) had great results in its bond rating division as high-yield and China bonds were in high demand.

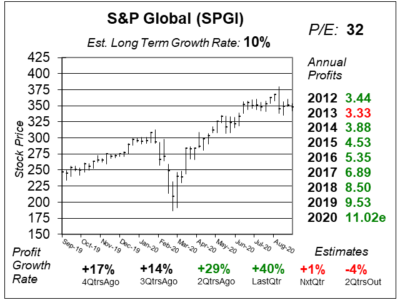

S&P Global (SPGI) had a grand 2020 with 23% profit growth. Now, growth has slowed. What does that mean for the stock?

S&P Global’s (SPGI) bond rating division continues to shine, as U.S. high yield bond issuance jumped 94% last qtr.

A surge in companies gathering cash during the COVID-19 pandemic helped S&P Global (SPGI) deliver an exceptional qtr,

S&P Global’s (SPGI) largest division, Global Ratings, got a boost when COVID-19 caused companies to issue new bonds.

S&P Global (SPGI) is known for its S&P 500 index. But half of company revenue comes from bond ratings.

S&P Global (SPGI) has thrived the stock market rising, and now stronger bond issuance in the U.S is helping to boost results.

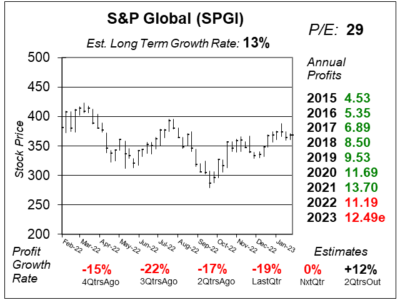

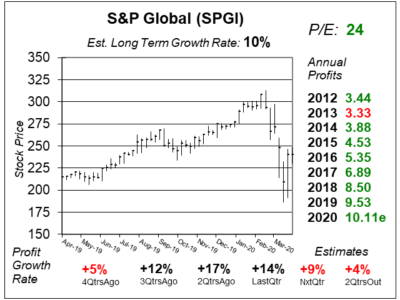

S&P Global’s (SPGI) bond rating division just went from -7% sales growth to +3%. But is the good news already priced in?

S&P Global’s Market Intelligence — a subscription platform for financial data — is leading the company (and its shares) higher.

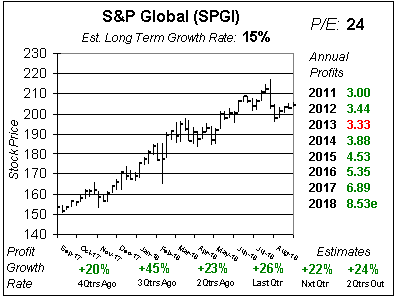

Large corporations aren’t issuing as many bonds due to U.S. Tax reform, which has hurt S&P Global’s (SPGI) ratings division.

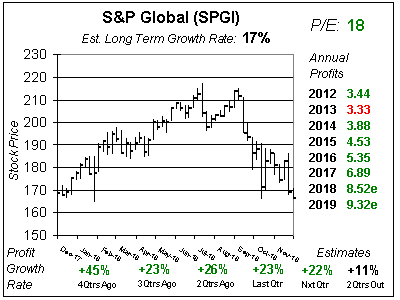

Blue Chip stock S&P Global (SPGI) faces and uncertain 2019 as the stock is a Financial, and Financials are getting buried right now.

The S&P 500 is up 9% year-to-date as investors continue to pour money into S&P ETFs, which is good for S&P Global (SPGI).

A strong stock market and increased volatility sparked 25% revenue growth at S&P Global’s (SPGI) Dow Jones Indices division last qtr.

S&P Global (SPGI) keeps beating the street as SPGI’s CFO said the “trend of assets moving into passive investments shows no signs of letting up.”

S&P 500 assets soared 38% during the last year, and that’s helped boost shares of S&P Global (SPGI), which makes licensing fees off these investments.

Higher stock and bond markets mean good business for S&P Global (SPGI), which had profits surge past expectations last qtr on solid demand for its research.

S&P Global’s (SPGI) data is used to by managers who follow the S&P 500 and Dow Jones Industrial Average. The stock is also solid, and pays a dividend.

S&P Global (SPGI) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $3.52 vs. $3.15 = +12%

Revenue Est: +5%