On Tuesday, S&P 500 fell 0.2% to 5,051, while NASDAQ declined 0.1% to 15,865. This was after Federal Reserve Chair Jerome Powell said interest rate cuts may take longer than expected. He cited “lack of further progress” in bringing inflation down to the central bank’s target of 2%.

Last week, Consumer Price Index rose 0.4% from last month and 3.5% year-over-year. This was against expectations of 0.3% monthly and 3.4% yearly increase.

Tweet of the Day

Morgan Stanley: "Square's $SQ volume growth has been consistently slowing over the past couple years, and is now trending similar to that of the incumbent, Global Payments $GPN, while peers such as Toast $TOST, Shift4 $FOUR, and Fiserv's Clover $FI are growing meaningfully… pic.twitter.com/z9DYWLDvr8

— Jevgenijs Kazanins (@jevgenijs) April 5, 2024

Chart of the Day

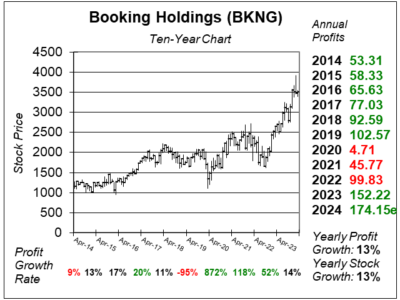

Here is the ten-year chart of Booking Holdings (BKNG) as of March 19, 2024, when the stock was at $3,506.

Here is the ten-year chart of Booking Holdings (BKNG) as of March 19, 2024, when the stock was at $3,506.

Booking Holdings beat the street last quarter as airline bookings soared. The company delivered a profit (in EPS) of $32 a share, and beat expectations of $29 a share. Year-over-year profit growth was 29% versus expectations of 17%. Revenue increased a solid 18%. Booking Holdings saw a nice increase in bookings of 16%. Growth was helped by a big jump in airline bookings, which rose 46%. In 2023, airline bookings jumped 58% driven primarily by the development of flights on Booking.com.

Looking ahead to this year, management sees many people have already planned trips for 2024, especially for the summer. However, it is important to note that many of these planned trips can still be canceled. Management saw early indications of potentially another record Summer travel season.

BKNG is part of our Conservative Growth Portfolio. David Sharek, Founder of School of Hard Stocks, expects momentum to continue into 2024.