Stock (Symbol) |

PayPal (PYPL) |

Stock Price |

$196 |

Sector |

| Financial |

Data is as of |

| August 10, 2020 |

Expected to Report |

| October 21 |

Company Description |

PayPal Holdings, Inc. is a technology platform and digital payments company that enables digital and mobile payments on behalf of consumers and merchants. The Company’s combined payment solutions, including its PayPal, PayPal Credit, Braintree, Venmo, Xoom and Paydiant products, compose its Payments Platform. It offers consumers person-to-person payment solutions through its PayPal Website and mobile application, Venmo and Xoom. Source: Thomson Financial PayPal Holdings, Inc. is a technology platform and digital payments company that enables digital and mobile payments on behalf of consumers and merchants. The Company’s combined payment solutions, including its PayPal, PayPal Credit, Braintree, Venmo, Xoom and Paydiant products, compose its Payments Platform. It offers consumers person-to-person payment solutions through its PayPal Website and mobile application, Venmo and Xoom. Source: Thomson Financial |

Sharek’s Take |

PayPal (PYPL) is rolling as Management said during the first half of 2020, e-commerce sales as a percentage of retail sales outpaced forecasts by 3 to 5 years. So PayPal is pushing to accelerate in-store contactless payments, as consumers no longer want forms of payments that require physical touch. Its QR Code Payments for a touch-free to buy and sell in person is available for small merchants in 28 countries. Venmo has 60 million customers, but most of the transfers have been person-to-person, which are free. QR functionality will accelerate Venmo monetization efforts. PayPal also working with CVS Pharmacy to enable PayPal or Venmo as payment options. PayPal seems to be taking market share in the credit/debit payment space. My guess is its Visa, which is the largest FinTech stock with a stock market value double PayPal’s. PayPal (PYPL) is rolling as Management said during the first half of 2020, e-commerce sales as a percentage of retail sales outpaced forecasts by 3 to 5 years. So PayPal is pushing to accelerate in-store contactless payments, as consumers no longer want forms of payments that require physical touch. Its QR Code Payments for a touch-free to buy and sell in person is available for small merchants in 28 countries. Venmo has 60 million customers, but most of the transfers have been person-to-person, which are free. QR functionality will accelerate Venmo monetization efforts. PayPal also working with CVS Pharmacy to enable PayPal or Venmo as payment options. PayPal seems to be taking market share in the credit/debit payment space. My guess is its Visa, which is the largest FinTech stock with a stock market value double PayPal’s.

Positives from last qtr include:

The company has a slew of catalysts that give it immense growth opportunity:

PayPal is a well-run organization that’s in the hot financial technology (FinTech) sector. It’s making tons of money — $2.2 billion in free cash flow last qtr — and uses its cash to buy back stock and make great acquisitions. Management plans to return 40-50% of cash flow to investors during the next five years, last qtr it bought back $220 million in stock. The stock has an Est. LTG of 23% a year and a P/E of 52. The P/E is higher than it used to be, but this company has made tremendous advances during the past six months that it’s worthy of a higher multiple. This should be be the biggest FinTech company in the world in 2-3 years. PayPal is part of my Growth Portfolio and Aggressive Growth Portfolio. |

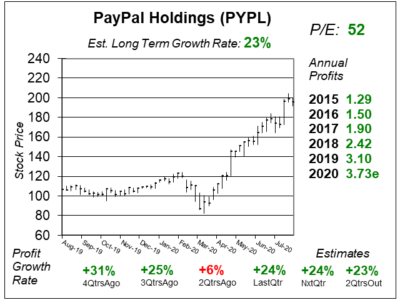

One Year Chart |

PayPal broke out in a HUGE way when it reported profits 2 qtrs ago. It was the highest volume week EVER. PayPal broke out in a HUGE way when it reported profits 2 qtrs ago. It was the highest volume week EVER.

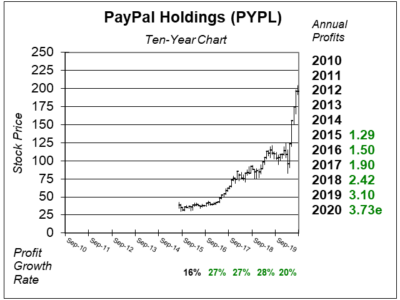

PayPal recently made two acquisitions — Honey and GoPay — and these cut profits the past two qtrs. PYPL just beat the street in a big way last qtr, and that might mean +40% profit growth could be headed our way in the coming qtrs. The Est. LTG of 19% is the same as it was last qtr. PYPL was a 25-30% grower before this qtr, now I think its a 30-40% grower. During the last 4 qtrs, PYPL’s P/E went from 29 to 35 to 42 and now 52. My Fair Value is a P/E of 60. |

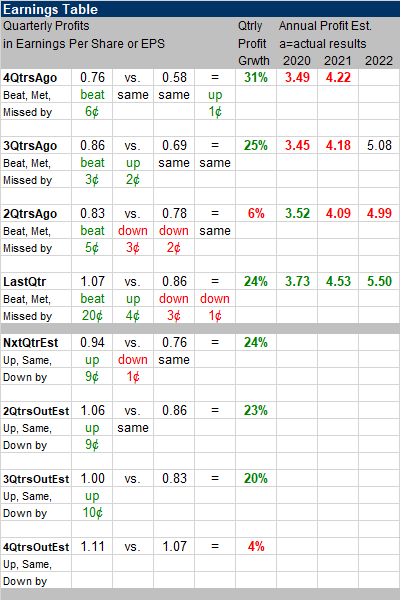

Earnings Table |

Last qtr PayPal delivered 24% profit growth and crushed estimates of 1%, with 22% revenue growth. Contrast that to Visa which had -22% profit growth on -19% revenue growth and you can understand why I’m so bullish on this stock. Last qtr PayPal delivered 24% profit growth and crushed estimates of 1%, with 22% revenue growth. Contrast that to Visa which had -22% profit growth on -19% revenue growth and you can understand why I’m so bullish on this stock.

Annual Profit Estimates jumped higher. I honestly think $6 is a good estimate for 2021. But 2021 doesn’t end for another 6 qtrs. Maybe PYPL will make more? We need to start thinking about when this company might earn $10 per share in profits. Qtrly profit Estimates are for 24%, 23%, 20% and 4% profit growth the next 4 qtrs. The 4QtrsOut estimate is low because PYPL just beat the street and analysts are slow to increase this estimate. Venmo started the first 3 weeks of this qtr with growth rates greater than 60%. |

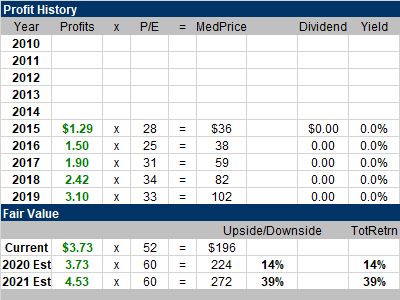

Fair Value |

My Fair Value P/E jumps from 45 to 60. It was 35 two qtrs ago. Times are changing as this company is evolving. My Fair Value P/E jumps from 45 to 60. It was 35 two qtrs ago. Times are changing as this company is evolving.

I think this stock can continue into the $200s. Accounts are opening so quickly that its tough to figure out what profits might be in the coming qtrs. A boost in business from China could push profits higher than these estimates indicate. |

Bottom Line |

Last qtr marked PayPal’s (PYPL) 5th year as a publicly traded company. The stock opened for trading in July 2015 at $38. PYPL stock didn’t start moving until it went from $45 on April 27, 2017. Profits grew 19% that day, and blew away estimates of 11%. Last qtr marked PayPal’s (PYPL) 5th year as a publicly traded company. The stock opened for trading in July 2015 at $38. PYPL stock didn’t start moving until it went from $45 on April 27, 2017. Profits grew 19% that day, and blew away estimates of 11%.

Right now, the stock looks extended, but it’s hard to take profits when there are so many good things going the company’s way. PayPal is taking major market share in merchant services while also becoming the preferred banking/debit card company to millions of consumers. PYPL moves up from 9th to 8th in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. I would like to put it higher but there are so many great growth stocks right now. |

Power Rankings |

Growth Stock Portfolio

8 of 47Aggressive Growth Portfolio 8 of 22Conservative Stock Portfolio N/A |