Stock (Symbol) |

PayPal (PYPL) |

Stock Price |

$297 |

Sector |

| Financial |

Data is as of |

| July 15, 2021 |

Expected to Report |

| July 29 |

Company Description |

PayPal Holdings, Inc. is a technology platform and digital payments company that enables digital and mobile payments on behalf of consumers and merchants. The Company’s combined payment solutions, including its PayPal, PayPal Credit, Braintree, Venmo, Xoom and Paydiant products, compose its Payments Platform. It offers consumers person-to-person payment solutions through its PayPal Website and mobile application, Venmo and Xoom. Source: Thomson Financial PayPal Holdings, Inc. is a technology platform and digital payments company that enables digital and mobile payments on behalf of consumers and merchants. The Company’s combined payment solutions, including its PayPal, PayPal Credit, Braintree, Venmo, Xoom and Paydiant products, compose its Payments Platform. It offers consumers person-to-person payment solutions through its PayPal Website and mobile application, Venmo and Xoom. Source: Thomson Financial |

Sharek’s Take |

PayPal (PYPL) has a next-generation digital wallet that it plans on rolling out this qtr. In last qtr’s earnings call, management mentioned it will be an all-in-one personalized app that will “empower users to make the most of their money and strengthen their financial lives every day”. It will be a combination of shopping, financial services and payment choices for customers. I previously mentioned the company is building a Venmo Checkout experience to mirror the PayPal checkout, and that should lead to a meaningful increase in merchant transactions in 2021 as some of the world’s largest retailers incorporate Venmo at checkout. It seems like this all-in-one app will be a combination of PayPal and Venmo, and Honey as well. I am thinking this new digital wallet might have a 1% kickback to consumers who use the app to make purchases. So Honey might give people the best prices while PayPal gives them another 1%. Game Changer. PayPal (PYPL) has a next-generation digital wallet that it plans on rolling out this qtr. In last qtr’s earnings call, management mentioned it will be an all-in-one personalized app that will “empower users to make the most of their money and strengthen their financial lives every day”. It will be a combination of shopping, financial services and payment choices for customers. I previously mentioned the company is building a Venmo Checkout experience to mirror the PayPal checkout, and that should lead to a meaningful increase in merchant transactions in 2021 as some of the world’s largest retailers incorporate Venmo at checkout. It seems like this all-in-one app will be a combination of PayPal and Venmo, and Honey as well. I am thinking this new digital wallet might have a 1% kickback to consumers who use the app to make purchases. So Honey might give people the best prices while PayPal gives them another 1%. Game Changer.

PayPal looks to be on its way to becoming the world’s top Financial stock as its developing tools to manage people’s financial lives. Tools and services include enhanced direct deposit an check cashing, budget and savings tools, bill pay, investment alternatives including cryptocurrency, subscription management, buy now & pay later, as well as Honey’s shopping tools such as wish lists, price monitoring, deals, coupons and rewards. The company has a catalyst in Venmo. Venmo is a free digital wallet that lets you make and share payments with friends for free (such as splitting dinner). This year, PayPal launched a Venmo credit card (issued by Synchrony and powered by Visa) that gives the user the ability to manage the card right in the Venmo app. PayPal might have a future catalyst in Honey, a free online coupon service (in a browser extension) that applies coupons to items you’re buying. Honey also comes with a mobile app where consumers can throw stuff from different stores into one shopping cart, get coupons applied automatically, and pay for it all at once. PYPL paid $4 Billion in cash for Honey in January 2020. Buy Now, Pay Later is a new catalyst for the company, as its shown a 15% increase in transactions and customer spend, on more than $1 billion in sales in the U.S. alone. Also, PayPal is now available as a payment method on Alibaba’s wholesale marketplace and on AliExpress. Stats from last qtr include:

PayPal is making tons of money and uses its cash to buy back stock and make great acquisitions. Management plans to return 40-50% of cash flow to investors during the next five years. Last qtr it had free cash flow of $1.54 billion, up 27% from the same qtr a year ago. The stock has an Est. LTG of 24% a year and a P/E of 63. I think PayPal should be be the biggest FinTech company in the world in two to three years, and the party might get started this qtr when the new all-in-one payment wallet debuts. PayPal is a top holding in my Growth Portfolio. |

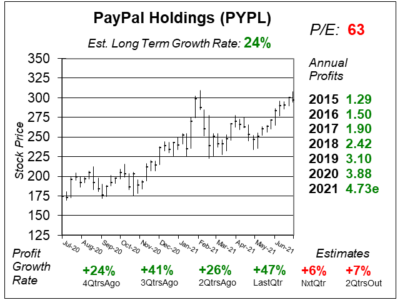

One Year Chart |

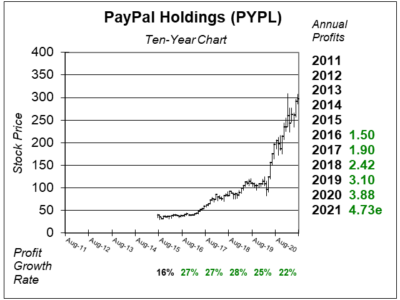

PayPal stock is up from ~$175 to ~$300 during the past year. That’s around 70% growth. Notice profits haven’t grown that fast the past 4 qtrs, so its safe to assume this stock has gotten a higher multiple (P/E). Looking back at my past research reports, the stock had a 42 P/E in 2020 Q2. This stock’s valuation is much higher than it used to be, so investors should temper their expectations going forward. PayPal stock is up from ~$175 to ~$300 during the past year. That’s around 70% growth. Notice profits haven’t grown that fast the past 4 qtrs, so its safe to assume this stock has gotten a higher multiple (P/E). Looking back at my past research reports, the stock had a 42 P/E in 2020 Q2. This stock’s valuation is much higher than it used to be, so investors should temper their expectations going forward.

During the past three qtrs, the P/E has risen from 42 to 2 and now 63. That’s got to zap some of the long-term upside. My Fair Value on this stock is a P/E of 55, so the current P/E is in red, as I think the stock is overvalued. The Est. LTG of 22% slightly lower than the 23 P/E last qtr. I think this is a 30% to 35% grower this qtr. Last qtr I felt it was a 30-40% grower. |

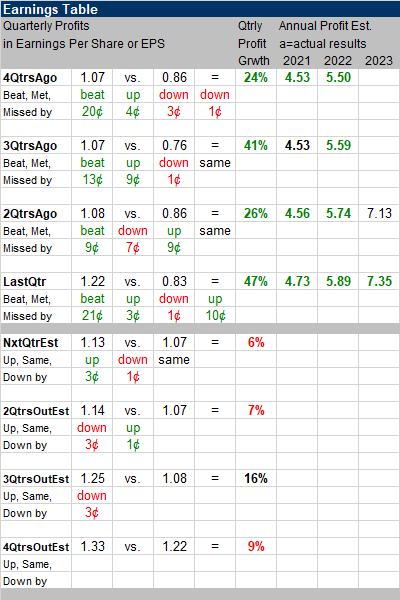

Earnings Table |

Last qtr PayPal delivered 47% profit growth and beat estimates of 22%. Revenue grew 31%, which is a big acceleration from 23% 2QtrsAgo. Profit growth slowed from 41% 2QrtsAgo. Last qtr PayPal delivered 47% profit growth and beat estimates of 22%. Revenue grew 31%, which is a big acceleration from 23% 2QtrsAgo. Profit growth slowed from 41% 2QrtsAgo.

Annual Profit Estimates got a nice jump this qtr. That TPV growth of 50% last qtr is impressive. Qtrly profit Estimates are for 3%, 3%, 9% and 19% profit growth the next 4 qtrs. Profit growth is expected to slow this qtr. PYPL did beat the street by 22 cents last qtr, and if it does that next qtr it will mean 26% profit growth. That’s still good enough for the stock to keep its upward momentum. |

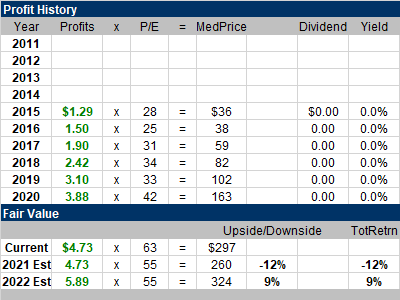

Fair Value |

My Fair Value P/E stays at 55. With this qtr’s P/E at 63, I think the stock is a little overvalued. But I’m leery of selling any shares here. I think this new digital wallet could be a game changer. Long-term, I think this stock is a 30% to 35% grower. My Fair Value P/E stays at 55. With this qtr’s P/E at 63, I think the stock is a little overvalued. But I’m leery of selling any shares here. I think this new digital wallet could be a game changer. Long-term, I think this stock is a 30% to 35% grower. |

Bottom Line |

PayPal’s (PYPL) opened for trading in July 2015 at $38. PYPL stock didn’t start moving until it went from $45 on April 27, 2017. Profits grew 19% that day, and blew away estimates of 11%. Now the stock is in a nice uptrend, but the recent angle is a little high. PayPal’s (PYPL) opened for trading in July 2015 at $38. PYPL stock didn’t start moving until it went from $45 on April 27, 2017. Profits grew 19% that day, and blew away estimates of 11%. Now the stock is in a nice uptrend, but the recent angle is a little high.

PayPal’s new digital wallet should be a game changer. We all know what we want from a payment app. We want interest on our deposits, low transfer fees, the best prices on purchases, and cash back on purchases. This new PayPal app might not check every box when it launches, but I think over time it will. PYPL moves up from 11th to 10th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

10 of 38Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |