Stock (Symbol) |

Cloudfare (NET) |

Stock Price |

$98 |

Sector |

| Technology |

Data is as of |

| February 20, 2024 |

Expected to Report |

| April 25 |

Company Description |

Cloudflare is a global cloud services provider that delivers a range of services to businesses of all sizes and in all geographies. Cloudflare is a global cloud services provider that delivers a range of services to businesses of all sizes and in all geographies.

The Company’s network serves as a scalable, unified control plane to deliver security, performance, and reliability across on-premise, hybrid, cloud, and software-as-a-service (SaaS) applications. The Company’s integrated suite of products consists of solutions for an organization’s external-facing infrastructure, such as Websites, applications, and application programming interfaces (APIs) to deliver security, performance, and reliability; solutions to serve an organization’s internal resources, such as Internal networks and devices; developer-based solutions, and consumer offerings. Its security products include Cloud Firewall, Bot Management, Unmetered Mitigation, Cloudflare Orbit, SSL for SaaS, Dedicated & Custom Certs and others. Its performance products include Content Delivery, Intelligent Routing, Content Optimization and others. Source: Refinitiv |

Sharek’s Take |

Cloudflare (NET) closed out 2023 with what management says was “robust momentum with large customers” as both close rates and average deal size improved markedly (source: Earnings Call). Wow, those are big statements. And the company made significant progress in the public sector, which is where ServiceNow hit it big a few years ago. Government contracts can be very large. The CEO stated the company is firing on all cylinders. Investors agreed as the stock jumped after earnings were released. The company ended 2023 with 346 customers that spent more than $500,000 last year, a 56% increase from a year ago. Stats from last quarter include: Cloudflare (NET) closed out 2023 with what management says was “robust momentum with large customers” as both close rates and average deal size improved markedly (source: Earnings Call). Wow, those are big statements. And the company made significant progress in the public sector, which is where ServiceNow hit it big a few years ago. Government contracts can be very large. The CEO stated the company is firing on all cylinders. Investors agreed as the stock jumped after earnings were released. The company ended 2023 with 346 customers that spent more than $500,000 last year, a 56% increase from a year ago. Stats from last quarter include:

Cloudflare speeds up data across your website/network and has cybersecurity functions as well. The company utilizes edge computing, which entails placing edge servers all-around the world. The decrease in distance between the user and the server becomes decreased time, making it quicker for data storage and computations. NET’s servers shift customers and traffic across its network efficiently so product developers and customers do not need to worry about the underlying servers. It load balances to different cities, then to locations, then to servers, etc. to get the best speed. I believe edge computing is the next-big thing in technology, as it makes computing so much faster because of the shorter travel distance. And Cloudflare has an “edge” in that it also offers cybersecurity on these networks. In terms of product uniqueness, Cloudflare’s product portfolio is a unified platform that works seamlessly during any circumstance like a cyberattack and it can show customers what is happening on their website and mitigate it. Cloudflare has three main drivers of revenue: a computing platform, data storage, and cybersecurity.

Cloudflare is focused on growing revenue, thus doesn’t put much effort into making big profits. So the stock has a high P/E. Years ago, the company didn’t even make profits, but it grew revenue 50% a year for five years. Now NET is delivering profits at triple-digit rates each quarter. NET is part of the Growth Portfolio. |

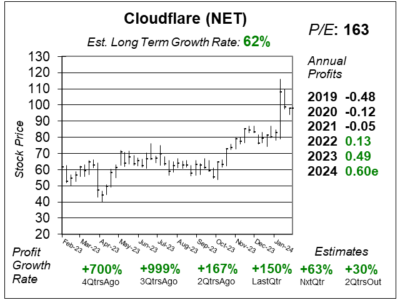

One Year Chart |

NET jumped from $90 to $108 the day after earnings were announced. Volume was extremely high. In the end, NET settled back to what I believe is its Fair Value of $98. NET jumped from $90 to $108 the day after earnings were announced. Volume was extremely high. In the end, NET settled back to what I believe is its Fair Value of $98.

Quarterly profit growth has been excellent, and I also think that it will continue to grow profits at triple-digit rates. The P/E is super high at 163. The Est. LTG. is an amazing 62%. Note that’s a long-term profit growth estimate from analysts, not stock growth. |

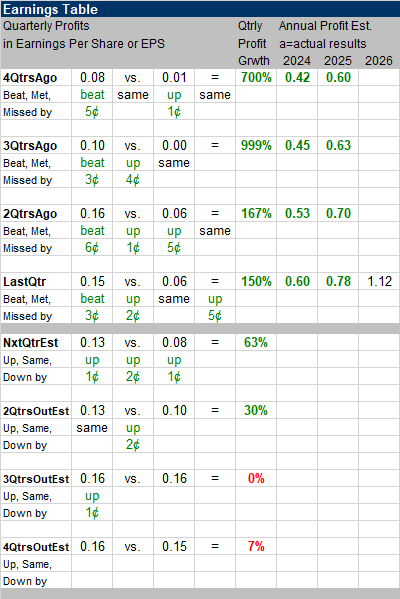

Earnings Table |

Last qtr, Cloudflare delivered 150% profit growth versus analyst estimates of 100%. Revenue increased 32%, year-on-year, versus analyst estimates of 28%. In the earnings call, management stated it was an exceptionally strong quarter. Gross margin was 78.9%, up from 77.4% a year-ago. Last qtr, Cloudflare delivered 150% profit growth versus analyst estimates of 100%. Revenue increased 32%, year-on-year, versus analyst estimates of 28%. In the earnings call, management stated it was an exceptionally strong quarter. Gross margin was 78.9%, up from 77.4% a year-ago.

New Average Contract Value grew nearly 40% year-over-year, the fastest growth since 2021. Management noted that the pipeline generated by the cohort under the new program was 2.1x higher than the year ago cohort and account engagement increased by 3.5x than year ago. Additionally, NET secured it’s largest new customer to date, with the US Department of Commerce for 3 years, $33 million. Annual Profit Estimates decreased this qtr. For 2024, management expects revenue to grow 27%. Qtrly profit Estimates are 63%, 30%, 0% and 7%. But I feel the company will continue to beat the street (that was just a great quarter it delivered). For next qtr, analysts expect revenue to grow 29%. |

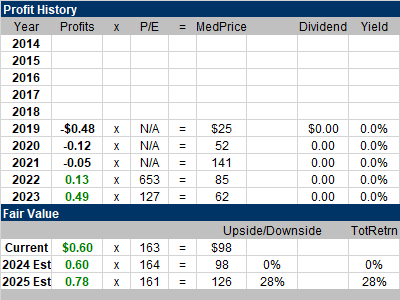

Fair Value |

What’s NET worth? I don’t value the stock on a P/E basis as the company is spending to grow, thus the P/E is super high. Instead, its often priced on a price-to-sales level, like a few other young software stocks. I think this stock is worth 20x annual revenue. The stock did get down to around 13x revenue estimates at its lows in 2022. NET currently sells for 20x 2024 revenue estimates. I think the stock is fairly valued here: What’s NET worth? I don’t value the stock on a P/E basis as the company is spending to grow, thus the P/E is super high. Instead, its often priced on a price-to-sales level, like a few other young software stocks. I think this stock is worth 20x annual revenue. The stock did get down to around 13x revenue estimates at its lows in 2022. NET currently sells for 20x 2024 revenue estimates. I think the stock is fairly valued here:

Current: 2024 Fair Value: 2025 Fair Value: |

Bottom Line |

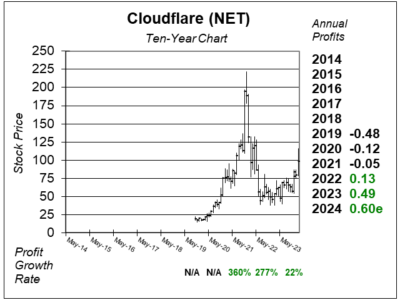

Cloudflare (NET) stock went on a fantastic run higher during 2020/2021 as the shares rose ten-fold. But at the top, the stock was too expensive, and then came crashing down. NET broke out from $32 to $35 on June 17, 2020. I added the stock to the Growth Portfolio on July 6, 2020 at $37 and Aggressive Growth Portfolio on August 13, 2020 at $39. I took profits many times, most recently on 12/1/21 at ~$165. On January 5, 2021 I sold NET totally from the Growth Portfolio around $98. I moved the stock from the Aggressive Growth Portfolio to the Growth Portfolio on 12/8/23 at $78. Cloudflare (NET) stock went on a fantastic run higher during 2020/2021 as the shares rose ten-fold. But at the top, the stock was too expensive, and then came crashing down. NET broke out from $32 to $35 on June 17, 2020. I added the stock to the Growth Portfolio on July 6, 2020 at $37 and Aggressive Growth Portfolio on August 13, 2020 at $39. I took profits many times, most recently on 12/1/21 at ~$165. On January 5, 2021 I sold NET totally from the Growth Portfolio around $98. I moved the stock from the Aggressive Growth Portfolio to the Growth Portfolio on 12/8/23 at $78.

NET is rolling right now, and momentum is strong. Unfortunately, the stock isn’t undervalued at this time. NET jumps from 26th to 17th the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

17 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |