Stock (Symbol) |

Cloudfare (NET) |

Stock Price |

$65 |

Sector |

| Technology |

Data is as of |

| August 31, 2023 |

Expected to Report |

| November 1 |

Company Description |

Cloudflare is a global cloud services provider that delivers a range of services to businesses of all sizes and in all geographies. Cloudflare is a global cloud services provider that delivers a range of services to businesses of all sizes and in all geographies.

The Company’s network serves as a scalable, unified control plane to deliver security, performance, and reliability across on-premise, hybrid, cloud, and software-as-a-service (SaaS) applications. The Company’s integrated suite of products consists of solutions for an organization’s external-facing infrastructure, such as Websites, applications, and application programming interfaces (APIs) to deliver security, performance, and reliability; solutions to serve an organization’s internal resources, such as Internal networks and devices; developer-based solutions, and consumer offerings. Its security products include Cloud Firewall, Bot Management, Unmetered Mitigation, Cloudflare Orbit, SSL for SaaS, Dedicated & Custom Certs and others. Its performance products include Content Delivery, Intelligent Routing, Content Optimization and others. Source: Refinitiv |

Sharek’s Take |

Cloudflare Workers (NET) could be a catalyst for Cloudflare in terms of AI development. Workers is a serverless computer platform that allows developers deploy new applications anywhere in the world. Most serverless platforms are located at centralized data centers, but that may be far away from the developer. With Cloudflare, the code is deployed in more than 200 locations, making the program super fast. Cloudflare Workers now has 10 million active workers applications as of the last qtr, an increase of 490% from a year ago. Management claims Workers the preeminent developer platform for AI companies. Stats from last quarter include:

Cloudflare speeds up data across your website/network and has cybersecurity functions as well. The company utilizes edge computing, which entails placing edge servers all-around the world. The decrease in distance between the server and the user becomes decrease time, making it quicker for data storage and computations. NET’s servers allow shift customers and traffic across its network efficiently so product developers and customers do not need to worry about the underlying servers. It load balances to different cities, then to locations, then to servers, etc. to get the best speed. I believe edge computing is the next-big thing in technology, as it makes computing so much faster because of the shorter travel distance. And Cloudflare has an “edge” in that it also offers cybersecurity on these networks. In terms of product uniqueness, Cloudflare’s product portfolio is a unified platform that works seamlessly during any circumstance like a cyberattack and it can show customers what is happening on their website and mitigate it. Here’s some of the company’s key products:

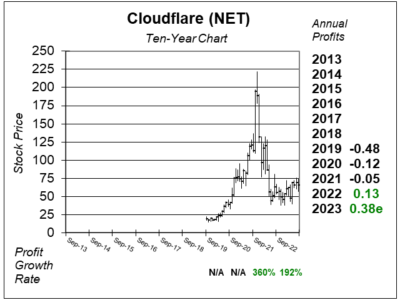

Cloudflare is focused on growing revenue, thus doesn’t put much effort into making big profits. I agree this is the right strategy. NET stock went on a fantastic run higher during 2020/2021 as the shares rose ten-fold. But at the top, the stock was too expensive, and then came crashing down. NET is part of the Aggressive Growth Portfolio. The stock is on the radar for the Growth Portfolio. Management said the macro environment is now stabilizing (despite continuing to be a challenge) while sales cycles have also improved. |

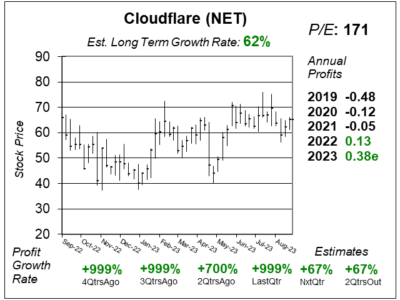

One Year Chart |

This stock has been back-and-forth this year. It seems quite boring actually. During 2020/2021 the shares rose ten-fold. But at the top, the stock was too expensive, and then came crashing down. After that much drama, the stock needed to settle down and build a base. The stock has been in this range for around a year and a half. Quarterly profit growth has been excellent, but the profits aren’t much so is easier to compound. The P/E is super high do to little profitability. The Est. LTG. is 62%, an exceptional figure. |

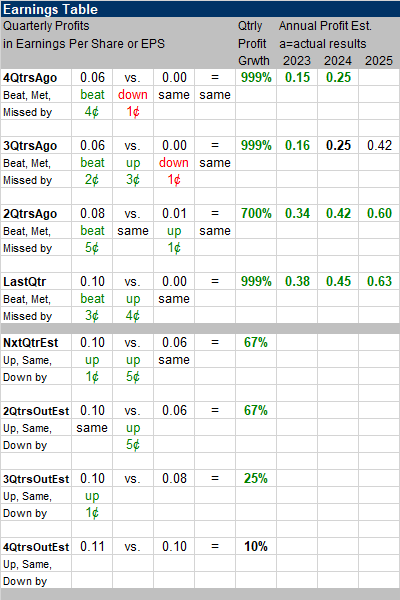

Earnings Table |

Last qtr, Cloudflare delivered 999% profit growth. But this is due to easy comparisons as earnings were $0.10 per share versus $0.00 a year ago. Revenue increased 32%, year-on-year, versus analyst estimates of 30%. Management said that while the macro environment has stabilized despite continuing to be a challenge. IT buyers do not appear to be getting worse for the first time in several qtrs. Management also noted that they do not see any new competitive pressure throughout the qtr. Sales cycles have also shortened due to operational efficiencies, although they remain relatively elevated. Revenue by geography was:

Annual Profit Estimates increased this qtr. For 2023, management expects revenue to grow 32%. In terms of qtrly profit Estimates, management isn’t trying to make a profit. These percentages look big due to little-to-no profits in the year-ago periods. For next qtr, Analysts expect revenue to grow 30%. |

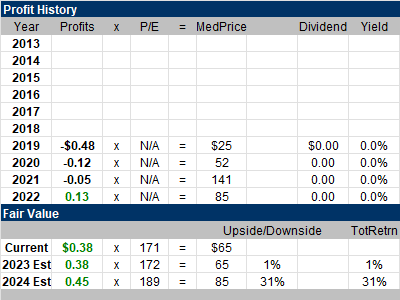

Fair Value |

|

Current: 2023 Fair Value: 2024 Fair Value: |

Bottom Line |

Cloudflare (NET) was a superstar in the stock market. It went on a parabolic run higher, then crashed. NET broke out from $32 to $35 on June 17, 2020 (not earnings related) and the stock hasn’t looked back since. I added the stock to the Growth Portfolio on July 6, 2020 at $37 and Aggressive Growth Portfolio on August 13, 2020 at $39. I took profits many times, most recently on 12/1/21 at ~$165. On January 5, 2021 I sold sell NET totally from the Growth Portfolio around $98. Cloudflare (NET) was a superstar in the stock market. It went on a parabolic run higher, then crashed. NET broke out from $32 to $35 on June 17, 2020 (not earnings related) and the stock hasn’t looked back since. I added the stock to the Growth Portfolio on July 6, 2020 at $37 and Aggressive Growth Portfolio on August 13, 2020 at $39. I took profits many times, most recently on 12/1/21 at ~$165. On January 5, 2021 I sold sell NET totally from the Growth Portfolio around $98.

Cloudflare has a catalyst in Cloudflare Workers. But with revenue growth slowing a bit every quarter, the stock hasn’t had the fuel to break out and run higher. I think the next move is coming, but maybe not until 2024. NET ranks 18th in the Aggressive Growth Portfolio Power Rankings. I will try to add the stock to the Growth Portfolio next quarter (around the end of the year). |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio 18 of 18Conservative Stock Portfolio N/A |

What’s NET worth? I don’t value the stock on a P/E basis as the company is spending to grow, thus the P/E is super high. Instead, its often priced on a price-to-sales level, like a few other young software stocks. I think its worth perhaps between 15x and 20x annual revenue. The stock did get down to around 13x revenue estimates at its lows in 2022. This quarter my Fair Value is 17x sales, or $65 a share. That’s the stock’s price this quarter:

What’s NET worth? I don’t value the stock on a P/E basis as the company is spending to grow, thus the P/E is super high. Instead, its often priced on a price-to-sales level, like a few other young software stocks. I think its worth perhaps between 15x and 20x annual revenue. The stock did get down to around 13x revenue estimates at its lows in 2022. This quarter my Fair Value is 17x sales, or $65 a share. That’s the stock’s price this quarter: