The stock market closed lower on Monday, as chip leader NVIDIA (NVDA) announced that its revenue might be weaker than expected last qtr.

The stock market closed lower on Monday, as chip leader NVIDIA (NVDA) announced that its revenue might be weaker than expected last qtr.

Overall, S&P500 and NASDAQ both fell 0.1% to 4,140 and 12,644, respectively.

Meanwhile, lower lumber should help profits of DR Horton (DHI), and we think mortgage rates will simmer down.

Tweet of the Day

Lumber down 60% from highs. pic.twitter.com/xFzJVjeiNO

— Ophir Gottlieb (@OphirGottlieb) July 26, 2022

Chart of the Day

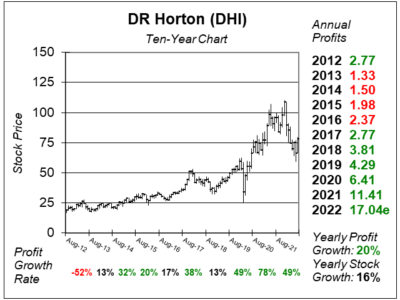

Our chart of the day is the ten-year chart of DHI.

Our chart of the day is the ten-year chart of DHI.

Founded in 1978 in Fort Worth Texas, DHI is the largest home building company in the United States. The company constructs and sells homes in 88 markets across 29 states under the names DR Horton, Emerald Homes, Express Homes, and Freedom Homes. Homes range in size from 1000 square feet to 4000 square feet, and are priced between $150,000 to more than $1 million.

Management says the supply of new homes remains limited and is purposely holding back on building homes. In addition, here is currently a lot of demand for housing, as opposed to 16 years ago when there were millions of homes for sale. In 2006, there were 3.5 million homes for sale, while today there are only 870,000 (Source: Greenlight Capital’s David Eihnhorn 2022 Q1 letter). DHI is experiencing higher demand than supply, and the stock looks like a super buy for long-term investors.

DHI is part of the Conservative Growth Portfolio. David Sharek’s Fair Value P/E stays at 8x this qtr, and that equates to 47% upside for 2022 and 60% for 2023. His Fair Value gives the stock solid upside.