DR Horton’s (DHI) Affordable Homes Make the Stock an Attractive Investment

DR Horton (DHI) is in a sweet spot where more people are needing homes. Especially with immigrants crossing over the border.

DR Horton (DHI) is in a sweet spot where more people are needing homes. Especially with immigrants crossing over the border.

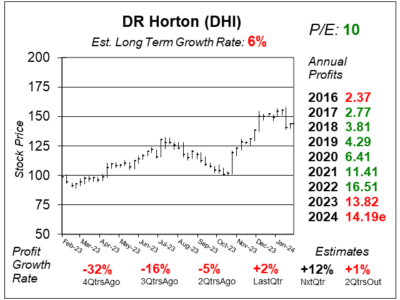

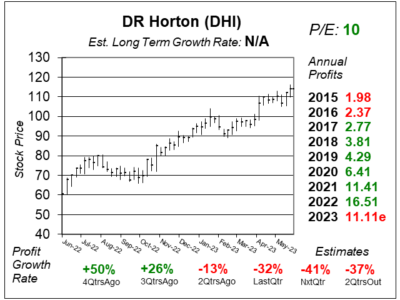

DR Horton (DHI) stock has surged this month as investors anticipate lower interest rates in 2024, which should boost housing sales.

DR Horton (DHI) beat analyst expectations by a bunch last quarter, but profit growth is still falling due to tough comparisons.

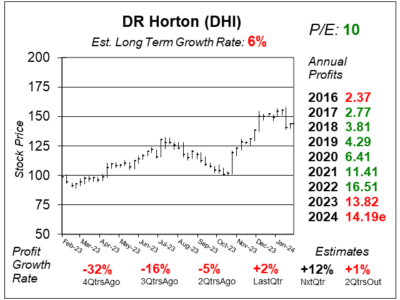

DR Horton (DHI) stock has been climbing higher even as high mortgage rates remain high. Investors must be looking ahead.

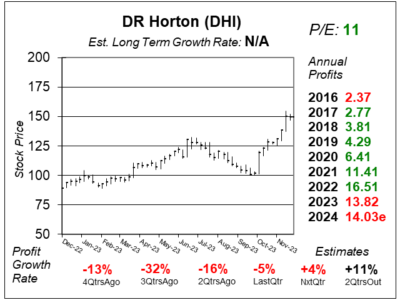

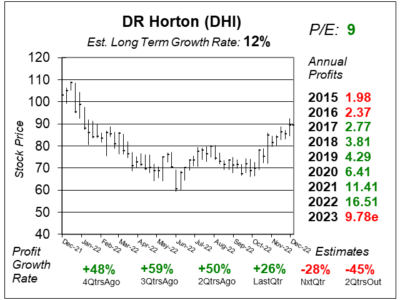

Interest rates are high, and the housing market is weak. Still, homebuilder DR Horton (DHI) is up as profits are et to decline in 2023.

DR Horton (DHI) is starting to feel the of higher mortgage rates. But the stock is a good value here if rates decline in 2023.

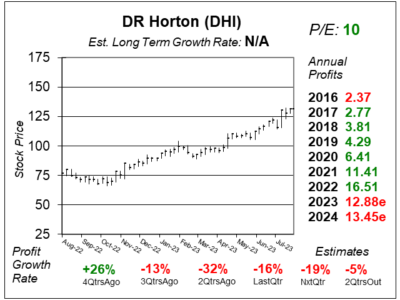

Fears of a housing colapse seem copletely overblown, as leverage is low and demand is still higher than supply at DR Horton (DHI).

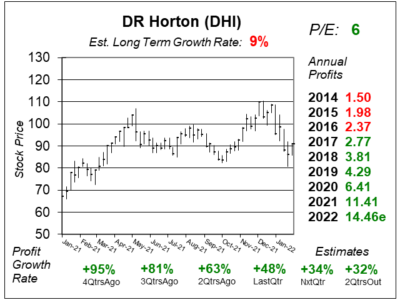

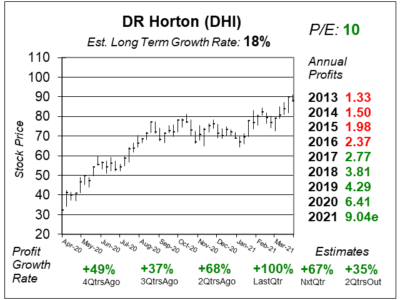

DR Horton (DHI) looks great with a P/E of just 6, but higher interest rates might bring down profit estimates in he coming qtrs.

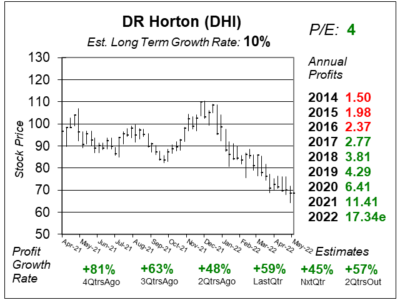

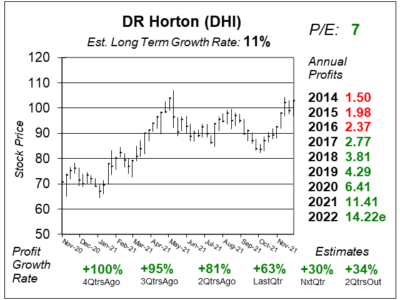

DR Horton (DHI) could be a big winner in 2022 as the stock has a P/E of only 7 as Americans continue to migrate to suburbs.

DR Horton (DHI) looks like one of the best deals in the stock market iwth a P/E of 7. But the company just lowered guidance.

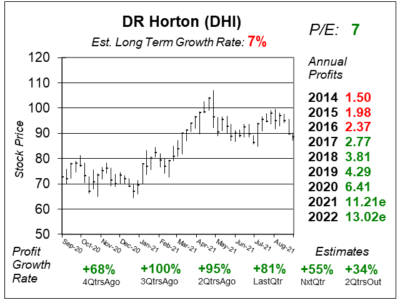

DR Horton (DHI) stock hasn’t moved much since my report last qtr, but the profit picture got better, and the 8 P/E is great.

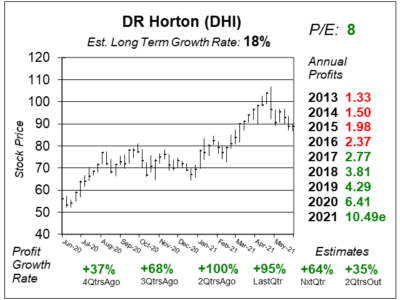

Homebuilder DR Horton (DHI) just delivered 100% qtrly profit growth. Wow! And with a P/E of 10, DHI has good upside.