Stock (Symbol) |

DR Horton (DHI) |

Stock Price |

$88 |

Sector |

| Industrials & Energy |

Data is as of |

| March 29, 2021 |

Expected to Report |

| May 3 |

Company Description |

D.R. Horton, Inc. is a homebuilding company. The Company has operations in 88 markets in 29 states across the United States. The Company’s segments include its 44 homebuilding divisions, its financial services operations and its other business activities. In the homebuilding segment, the Company builds and sells single-family detached homes and attached homes, such as town homes, duplexes, triplexes and condominiums. Source: Thomson Financial D.R. Horton, Inc. is a homebuilding company. The Company has operations in 88 markets in 29 states across the United States. The Company’s segments include its 44 homebuilding divisions, its financial services operations and its other business activities. In the homebuilding segment, the Company builds and sells single-family detached homes and attached homes, such as town homes, duplexes, triplexes and condominiums. Source: Thomson Financial |

Sharek’s Take |

DR Horton (DHI) is in a great spot right now as there is spectacular demand for housing. I believe the push is being done by city dwellers who are leaving the cities due to pandemic risks and a deterioration of Democrat run cities. Right now, housing demand is so strong that homes are being bought at above asking price with all cash offers. This environment for DHI could lead to profits coming in WAY above expectations for several quarters. DR Horton (DHI) is in a great spot right now as there is spectacular demand for housing. I believe the push is being done by city dwellers who are leaving the cities due to pandemic risks and a deterioration of Democrat run cities. Right now, housing demand is so strong that homes are being bought at above asking price with all cash offers. This environment for DHI could lead to profits coming in WAY above expectations for several quarters.

Founded in 1978 in Fort Worth Texas, DH Horton is the largest homebuilding company in the United States. The company constructs and sells homes in 88 markets across 29 states under the names DR Horton, Emerald Homes, Express Homes, and Freedom Homes. Homes range in size from 1000 square feet to 4000 square feet, and are priced between $150,000 to more than $1 million. 91% of 2020 home sales revenue came from single family homes, with the remainder via townhouses, duplexes and triplexes. The company also offers mortgages through its DHI Mortgage subsidiary, but still derives 97% of revenue from its core homebuilding business. Substantially all the company’s land development and home construction is performed by subcontractors. DHI employs construction superintendents to coordinate subcontractor activities and interact with homebuyers. Here’s a run-down of DHI’s brands and percentage of 2020 home sales revenue:

I have my expectations low for this stock as the homebuilding industry is cyclical. DHI has an Estimated Long-Term Growth Rate of 18% and the stock yields 1%. That’s an estimated total return of 19% a year, but I’d settle for 12% to 14%. In 2020, management repurchased $360 million in stock and paid cash dividends of $256 million. DR Horton will be added to the Conservative Growth Portfolio today. |

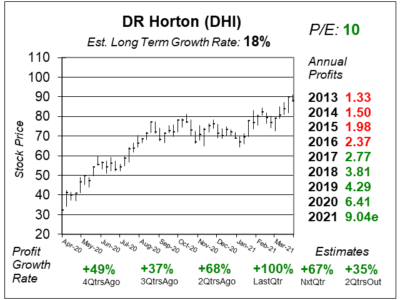

One Year Chart |

What a beautiful one-year chart. There’s a nice long base in the middle, and the stock broke out to fresh highs as the NASDAQ was in a correction. This stock seems to be a safe haven at this time. What a beautiful one-year chart. There’s a nice long base in the middle, and the stock broke out to fresh highs as the NASDAQ was in a correction. This stock seems to be a safe haven at this time.

The P/E of 10 is excellent. Even if the stock gets a 12 P/E that would be a jump of 20%. I think DHI could earn a 14 P/E, but let’s stick with a goal of 12 for now. The Estimates Long-Term Growth Rate of 18% is outstanding, but I think this company will have great growth the next two years before profit growth simmers down to probably less than 18%. |

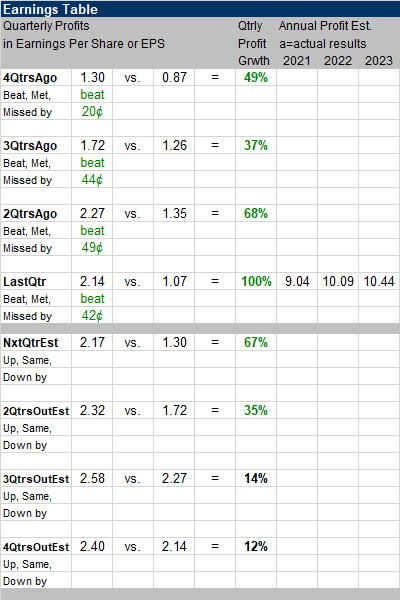

Earnings Table |

Last qtr, DR Horton delivered profit growth of 100% and beat estimates of 61%. Revenue soared 48% year-over-year. Pre-tax income jumped 98% to more than $1 billion. The average selling price increased 4% to $314,200. Pre-tax profit margin jumped to 17.4%, up from 13.0% a year-ago. Higher volumes of homes sold improved SG&A expense as a percentage of revenue to the lowest percentage for the 1st qtr in the company’s history. SG&A was 7.9% in the qtr, down from 9.2% a year-ago. Notice the company has whipped profit estimates the past 4 qtrs. Last qtr, DR Horton delivered profit growth of 100% and beat estimates of 61%. Revenue soared 48% year-over-year. Pre-tax income jumped 98% to more than $1 billion. The average selling price increased 4% to $314,200. Pre-tax profit margin jumped to 17.4%, up from 13.0% a year-ago. Higher volumes of homes sold improved SG&A expense as a percentage of revenue to the lowest percentage for the 1st qtr in the company’s history. SG&A was 7.9% in the qtr, down from 9.2% a year-ago. Notice the company has whipped profit estimates the past 4 qtrs.

This is my first time reviewing DHI so I don’t have a trend on Annual Profit Estimates. Qtrly Estimates call for profit growth to stay strong another two qtrs then simmer down a bit. |

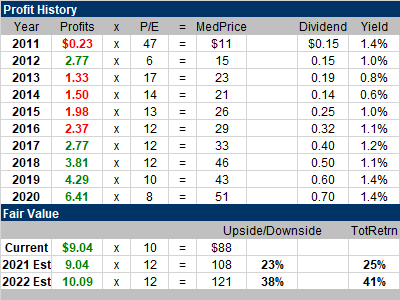

Fair Value |

Even at 12x earnings this stock has nice upside. I imagine annual profit estimates will be increasing too. DHI looks like an excellent investment. Even at 12x earnings this stock has nice upside. I imagine annual profit estimates will be increasing too. DHI looks like an excellent investment. |

Bottom Line |

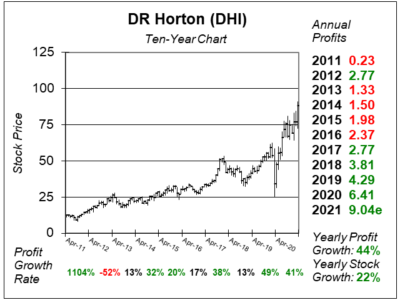

DR Horton (DHI) has a very nice ten-year chart, but it hasn’t always been this good. The stock always hasn’t been this good. What’s not shown here is in mid-2005 the stock peaked around $40 and didn’t hit All-Time highs again until 2017 (which you can see in the middle of this chart). DR Horton (DHI) has a very nice ten-year chart, but it hasn’t always been this good. The stock always hasn’t been this good. What’s not shown here is in mid-2005 the stock peaked around $40 and didn’t hit All-Time highs again until 2017 (which you can see in the middle of this chart).

Right now, there’s blue sky ahead. Profits are growing great and the P/E of 10 is very low. This stock has HUGE upside, but I’m tempering my expectations. Value stocks have had a nice run here, and growth stocks could come back into favor the 2nd half of the year. DHI will be added to the Conservative Growth Portfolio and will rank 8th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 8 of 37 |