Stock (Symbol) |

HubSpot (HUBS) |

Stock Price |

$784 |

Sector |

| Technology |

Data is as of |

| October 13, 2021 |

Expected to Report |

| November 3 |

Company Description |

HubSpot, Inc. (HubSpot) provides a cloud-based marketing and sales software platform. The Company’s software platform features integrated applications to help businesses attract visitors to their Websites, convert visitors into leads, close leads into customers and delight customers so that they become promoters of those businesses. Source: Thomson Financial HubSpot, Inc. (HubSpot) provides a cloud-based marketing and sales software platform. The Company’s software platform features integrated applications to help businesses attract visitors to their Websites, convert visitors into leads, close leads into customers and delight customers so that they become promoters of those businesses. Source: Thomson Financial |

Sharek’s Take |

HubSpot (HUBS) stock broke out yesterday after the company announced some new features on its business management software platform. At yesterday’s Analyst Day, named INBOUND 2021, management debuted HubSpot’s payments feature, where the company can embed payment links to websites, emails, quotes, ot live chats. Small business owners want to have HubSpot control most if not all of their online business. So having an integrated payment option is a catalyst. Investors agreed as the stock jumped from $683 to $758 yesterday, then had a followthrough rally today that took the stock to $786. Hubspot’s payments feature is currently available in beta version and only in the U.S. Also in the Analyst Day, the company introduced customer portals, where customers can view support tickets, as well as customer feedback surveys. The other big announcement was a new enterprise tier of its Operations Hub. HubSpot (HUBS) stock broke out yesterday after the company announced some new features on its business management software platform. At yesterday’s Analyst Day, named INBOUND 2021, management debuted HubSpot’s payments feature, where the company can embed payment links to websites, emails, quotes, ot live chats. Small business owners want to have HubSpot control most if not all of their online business. So having an integrated payment option is a catalyst. Investors agreed as the stock jumped from $683 to $758 yesterday, then had a followthrough rally today that took the stock to $786. Hubspot’s payments feature is currently available in beta version and only in the U.S. Also in the Analyst Day, the company introduced customer portals, where customers can view support tickets, as well as customer feedback surveys. The other big announcement was a new enterprise tier of its Operations Hub.

HubSpot offers online software that can keep track your business’s customers, potential customers, do online marketing campaigns, track if people are opening your emails, and even automate customer service team. What’s more, is this software is reasonably priced — cheaper than Salesforce. You can get free plans, upgrade for $200 a month, or get a complete suite to run your company. The company ended 2020 with 104,000 total customers, up 42% year-over-year. Customers spend around $10,000 a year with HubSpot historically. When it comes to sales force/customer service/online marketing software, Salesforce is for the big companies and Hubspot is for the small ones. But HubSpot is seeing strong growth its Enterprise tier, which launched in 2020. Big Enterprise customers could provide a catalyst for revenue, and puts it closer to Salesforce in terms of having big-boy software. The company’s offerings include:

Here are some important stats from last qtr:

HubSpot has tremendous opportunity to grow its market cap. The company’s market cap is roughly $35 billion, which is tiny when compared to Salesforce’s $273 billion. This company might be 10x the size in 5-10 years. Analysts give HUBS an Estimated Long-Term Growth Rate of 37% per year. But that’s a profit growth estimate, and the stock is currently selling on a price-to-sales estimate of 29x 2021 revenue estimates. HUBS is part of my Growth Portfolio and Aggressive Growth Portfolio. Earlier this year, HubSpot was named the #2 Best Global Software Seller according to users reviews on G2Crowd. HUBS was between Microsoft and Zoom in the ranking. At the analyst day yesterday, management said it sees huge growth opportunity Internationally. Last qtr, Domestic revenue rose 42% and accounted for 54% of total sales. International revenue up 68% and accounted for 46% of total sales. So overseas business could become a bigger piece of the pie than the American business very shortly. |

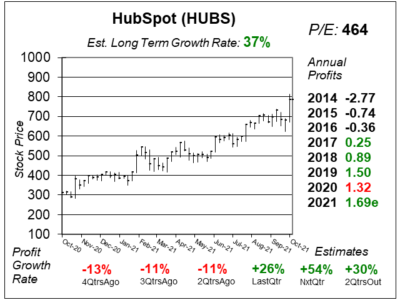

One Year Chart |

HUBS stock has been excellent the past year, doing it while profit growth was mostly negative. I think the reason is investors (including myself) started pricing the stock on a price-to-sales basis instead of price-to-earnings (P/E). Notice the P/E of 384 would be absurdly high with a regular stock that was being valued by a P/E. But on a price-to-sales basis the stock is undervalued in my opinion. More on this later. HUBS stock has been excellent the past year, doing it while profit growth was mostly negative. I think the reason is investors (including myself) started pricing the stock on a price-to-sales basis instead of price-to-earnings (P/E). Notice the P/E of 384 would be absurdly high with a regular stock that was being valued by a P/E. But on a price-to-sales basis the stock is undervalued in my opinion. More on this later.

The Est. LTG of 37% per year is great. There was no change in this figure since last qtr. |

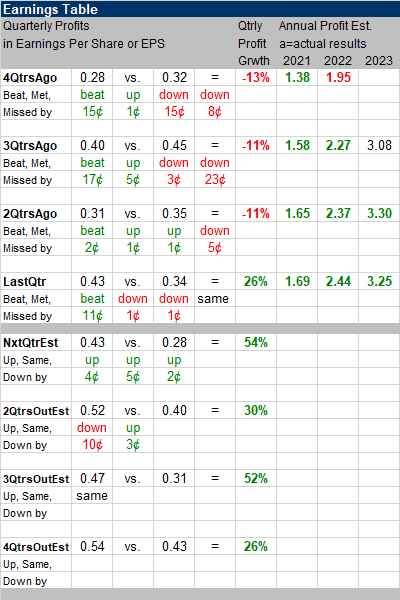

Earnings Table |

Last qtr, HUBS delivered 26% profit growth and beat estimates of -6%. Revenue grew 53% while total customers increased 40% and average subscription revenue per customer advanced 8% to $10,198. Payments might boost the annual subscription rate customers have been paying. That figure has been around $10,000 for years. Domestic revenue was up 42% and accounted for 54% of total sales. International revenue rose 68% and accounted for 46% of total sales. Last qtr, HUBS delivered 26% profit growth and beat estimates of -6%. Revenue grew 53% while total customers increased 40% and average subscription revenue per customer advanced 8% to $10,198. Payments might boost the annual subscription rate customers have been paying. That figure has been around $10,000 for years. Domestic revenue was up 42% and accounted for 54% of total sales. International revenue rose 68% and accounted for 46% of total sales.

The revenue growth was fueled by increased demand for Professional and Enterprise products. According to management, the key driver of their growth is digital transformation, as a majority of customers indicated the advantage of managing their office website with one platform — powered by HubSpot — that is very easy to use. Annual Profit Estimates increased a bit. Management estimated that for the next qtr and full year 2021, total revenue will grow 43% and 44%, respectively. Qtrly Profit Estimates are for 57%, 30%, 58%, and 30% profit growth the next 4 qtrs. |

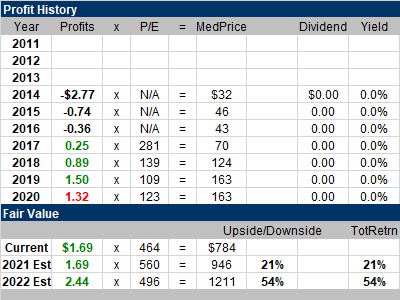

Fair Value |

My Fair Value rises from 25x revenue estimates to 35x. I had it at 30x revenue three qtrs ago, then lowered it to 25x. Here’s my new Fair Values: My Fair Value rises from 25x revenue estimates to 35x. I had it at 30x revenue three qtrs ago, then lowered it to 25x. Here’s my new Fair Values:

Currently: 2021 Fair Value: 2022 Fair Value: |

Bottom Line |

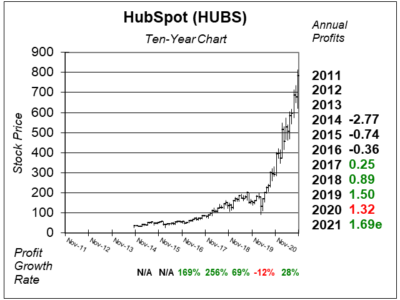

HubSpot (HUBS) has been a stellar investment since it went public. But in August 2020 the stock broke out in big way and started a steeper trend higher. With yesterday’s breakout on HUGE volume, my guess is the stock continues higher. I originally purchased the stock for clients on 9/11/18 at $159 per share. HubSpot (HUBS) has been a stellar investment since it went public. But in August 2020 the stock broke out in big way and started a steeper trend higher. With yesterday’s breakout on HUGE volume, my guess is the stock continues higher. I originally purchased the stock for clients on 9/11/18 at $159 per share.

I really like the HubSpot software, and want it to run my business. It has a great blend of being a place to store all my contacts — subscribers to the website as well as money management clients — and the ability to link it to social media sites to measure advertising metrics is a plus. Then the sales hub can organize conversations with potential clients. When my business grows, I can utilize the customer service part. I like this software better than Salesforce, personally. HUBS moves up from 11th to 6th in the Growth Portfolio Power Rankings. The stock moves from 10th to 7th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

12 of 34Aggressive Growth Portfolio 7 of 37Conservative Stock Portfolio N/A |