The stock market plunged on Wednesday after rating agency Fitch downgraded the U.S. government’s credit rating, from the highest possible rating AAA to AA+.

The stock market plunged on Wednesday after rating agency Fitch downgraded the U.S. government’s credit rating, from the highest possible rating AAA to AA+.

According to Fitch Rating, “[t]he rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance” relative to peers.

Overall, S&P 500 fell 1.4% to 4,513, while NASDAQ declined 2.2% to 13,973.

Tweet of the Day

Theme in software: "outlook isn't getting worse."

Of the 15 cloud software companies to report so far (who also guide full year):

87% (13 of 15) increased full year guidance from in Q2 vs Q1

7% (1 of 15) held full year guide constant

7% (1 of 15) decreased full year guide

— Jamin Ball (@jaminball) August 2, 2023

Chart of the Day

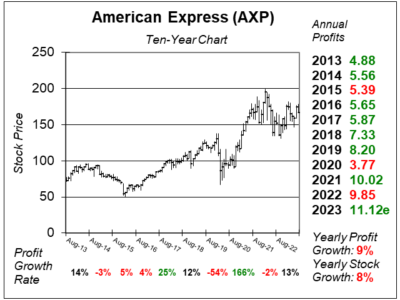

Here is the ten-year chart of American Express (AXP) as of July 25, 2023, when the stock was at $167.

Here is the ten-year chart of American Express (AXP) as of July 25, 2023, when the stock was at $167.

American Express is a globally integrated payments company in providing credit and charge cards to individuals and businesses with high credit scores. The company is both a card issuer (like Chase and Citi) and a card network (like MasterCard and Visa). American Express’ integrated payments platform has direct relationships with Merchants and Card Members, creating a closed loop so it has direct access to information. The company can analyze info on spending to underwrite risk, reduce fraud and do targeted marketing.

American Express continued to rake in excellent revenues, achieving yet again record revenues for the fifth straight quarter. Revenue grew 12% year-over-year (y.o.y) driven by all-time high card member spending and higher average loan volumes, which both grew 8%. This helped offset the unfavorable softness from U.S. small businesses. Do note that revenue was less than expectations of 16%.

Meanwhile, profits grew 12% and beat estimates of 10%. Millennials and Gen Zs are the company’s fastest growing segments, accounting for more than 60% of new customers during the quarter.

AXP is part of the Conservative Portfolio. Strong travel trends and momentum from younger customers are positives. And recession fears are lower than they have been for months. With a P/E of just 15%, this stock has the ability to go a lot higher.