On Thursday the stock market saw gains across the board as investor digested good earnings from big tech stocks and and the Federal Reserve saying we aren’t in a recession (but we are).

On Thursday the stock market saw gains across the board as investor digested good earnings from big tech stocks and and the Federal Reserve saying we aren’t in a recession (but we are).

This was the 2nd strong rally day in a row. It’s obvious Jerome Powell’s words on inflation and the economy yesterday have perked up investors.

That’s dispite the recession news. Today it was announced Gross Domestic Product fell 0.9% in the 2nd qr, which followed a 1.6% in the 1st qtr, and officially put the United States in a recession with two consecutive quarters of negative GDP growth.

Also helping boost stocks: Microsoft (MSFT) and Alphabet (GOOGL) reported earnings last night that were impressive. Today, MSFT was up 3% to $276 as Azur and other cloud services revenue was up 40% during the qtr. GOOGL was up 1% on the day to $114 as Google Search revenue (its biggest division) saw revenue climb a very solid 14%.

Chart of the Day

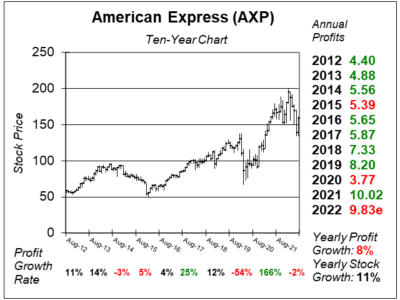

Our Chart of the day is this ten-year chart of American Express (AXP).

Our Chart of the day is this ten-year chart of American Express (AXP).

In my first research report on AXP stock in two years, it seems to be like this is a 10% grower long-term. If that’s good enough for you.

When you look at the ten-year chart (below) you can see the stock grew 11% the past decade, while profits grew 8% a year.

Tack on a 1% dividend yield and this is hypothetically a 10% grower.

AXP is a safe stock, but it does have its downturns. With us officially in a recession, this would be a quality name to pick up on a dip.

Tweet of the Day

Wild that Covid was a bigger volume shock for American Express than the GFC pic.twitter.com/mJpOifG3ft

— Marcelo P. Lima (@MarceloPLima) July 28, 2022