The stock market declined on Friday following a renewed threat from President Donald Trump to raise tariffs on Chinese imports, reigniting concerns of a potential trade war between the world’s two largest economies.

The stock market declined on Friday following a renewed threat from President Donald Trump to raise tariffs on Chinese imports, reigniting concerns of a potential trade war between the world’s two largest economies.

Overall, S&P 500 dropped 2.7% to 6,553, while NASDAQ slid 3.6% to 22,204.

Chart of the Day

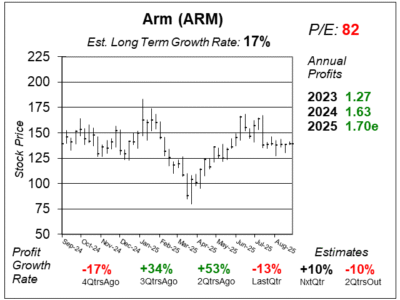

Here is the one-year chart of Arm (ARM) as of September 8, 2025, when the stock was at $139.

Here is the one-year chart of Arm (ARM) as of September 8, 2025, when the stock was at $139.

In last quarter’s earnings call, management stated Arm’s leadership in AI is amplified by its unmatched software developer ecosystem as over 22 million developers — more than 80% of the global base — is building on Arm. More than 70,000 enterprises now run AI workloads on Arm Neoverse datacenter chips, a 40% increase year-over-year and a 14x surge since 2021.

What is Arm Neoverse? It is a powerful computer chip designed to handle big, heavy AI workloads, while using less energy than older chips. Management stated Arm Neoverse CPUs now power the most important AI infrastructure in the world, including NVIDIA Grace, AWS Graviton, Google Axion, and Microsoft Cobalt.

Last quarter, NVIDIA (NVDA) announced Google (GOOGL) & Microsoft (MSFT) are now deploying hundreds of thousands of NVIDIA’s Arm’s Neoverse-based Grace Blackwell superchips across their data centers.

Management expects the market share of Arm’s Neoverse-based chips to top hyperscalers to reach nearly 50% this year. They added that they are seeing AI moving to the edge where the need for local real-time intelligence is enabled by Arm’s efficiency and scale.

ARM is on the radar for our Growth Portfolio.