Today in the stock market, stocks were burried again as Snap (SNAP) dropped like a rock. SNAP stock fell 43% to close at $13 on the day afer management stated it wouldn’t hit analyst estimates. Investors were fearfull that Snap’s results would carry over into other advertising stocks, including Meta (FB), which declined 8% on the day to close at $181.

Today in the stock market, stocks were burried again as Snap (SNAP) dropped like a rock. SNAP stock fell 43% to close at $13 on the day afer management stated it wouldn’t hit analyst estimates. Investors were fearfull that Snap’s results would carry over into other advertising stocks, including Meta (FB), which declined 8% on the day to close at $181.

On the day, Tuesday May 24, 2022, the S&P 500 fell 0.8% to 3941. What’s nice about this is the S&P seems to have suport at 3900. This is now the 3rd straight week of the index trading in the 3900 range. I’m not saying this could be a bottom, as investors are fearful the index could decline to 3500.

Inflation Might Come Down BIG TIME

If we look at inflation data, the year-over-year comparisons are getting easier in the upcoming months. Just like within retail stocks, their same-store sales figures are poor right now due to high revenue numbers a year-ago due to stimulus checks, inflation is set to come up against some tougher year-over-year numbers. Here’s a comparison of monthly Consumer Price Index (CPI) figures for 2021 and 2022:

Jan: 2021 1.4%, 2022 7.5%

Feb: 2021 1.7%, 2022 7.9%

Mar: 2021 2.6%, 2022 8.5%

Apr: 2021 4.2%, 2022 8.3%

May 2021 5.0%

Jun: 2021 5.4%

Jul: 2021 5.4%

Aug: 2021 5.3%

Sep: 2021 5.4%

Oct: 2021 6.2%

Nov: 2021 6.8%

Dec: 2021 7.0%

So as we get further into the year, the year-over-year figures should simmer down some, which could cause a rally in the stock market.

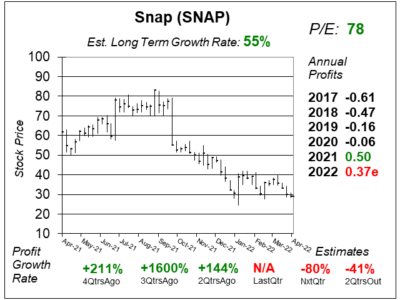

Chart of the Day

SNAP is our chart of the day, and here’s this one-year chart from May 9th. I saw this and sold the stock earlier this month. Although I didn’t suffer through today’s loses, I still took a heavy loss in the shares.

SNAP is our chart of the day, and here’s this one-year chart from May 9th. I saw this and sold the stock earlier this month. Although I didn’t suffer through today’s loses, I still took a heavy loss in the shares.

Note the company didn’t make a profit last qtr, which was the March 31st qtr. And profit Estimates for the next two qtrs were bad as well. With a 78 P/E, the stock was a risky bet at the time.