The stock market continues to show extreme weakness as inflation wreaks havoc on investor portfolios. But there was some hope today as a late day rally erased serious losses made during the day.

The stock market continues to show extreme weakness as inflation wreaks havoc on investor portfolios. But there was some hope today as a late day rally erased serious losses made during the day.

Today, Friday May 20, 2022, the S&P 500 was flat on the day (+0.0%) while the NASDAQ declined slightly (-0.3%).

Shares of Palo Alto Networks (PANW) were the bright spot on the day, as the cybersecurity company beat earnings estimates when it reported earnings the evening prior. PANW was up 10% on the day.

- Palo Alto Networks reports earnings:

- Reported: $1.79 vs. $1.38 = +30%

- Estimate: $1.68 vs. $1.38 = +22%

- Revenue: +29%

Chart of the Day

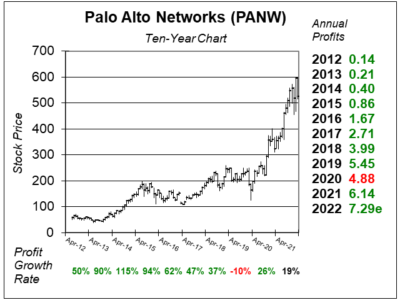

Here’s a ten-year chart of PANW as of March 14, 2022 when the stock was $525. Now the stock is $479. I’ve sold this stock in the past and have gone on to regret it. This time, I’m sticking with Palo Alto. Cybersecurity is one of the strongest areas of the economy right now.

Here’s a ten-year chart of PANW as of March 14, 2022 when the stock was $525. Now the stock is $479. I’ve sold this stock in the past and have gone on to regret it. This time, I’m sticking with Palo Alto. Cybersecurity is one of the strongest areas of the economy right now.

Since this chart was done, PANW’s 2022 profit estimates have increased from $7.29 to $7.43. So the stock’s prospects have gotten better while the share price has declined.

PANW is expected to close its Fiscal Year next qtr (July 31). Analyst estimates for this year are $7.43 while next year’s are for $9.26. Since we are in Q4, when I update my PANW charts I will calculate my P/E based on next year’s estimates. Right now that P/E — calculated on 2023 estimates — is 52, not bad for a stock that just grew profits 30% with an Estimated Long-Term Growth Rate of 25% per year. My Fair Value is a P/E of 75, but that may come down with equity valuations sliding.