Sweetgreen Leads Our List of Stocks of the Day

Sweetgreen (SG) stock was a notable looser on the day, as the stock declined 6% on the day to close at $28. Last month, SG had been preparing to break out and perhaps go on a run higher as the shares were hanging around $32-$36. But the stock has come under selling pressure during April, and is now well below recent support at $31.

Sweetgreen (SG) stock was a notable looser on the day, as the stock declined 6% on the day to close at $28. Last month, SG had been preparing to break out and perhaps go on a run higher as the shares were hanging around $32-$36. But the stock has come under selling pressure during April, and is now well below recent support at $31.

SG is a recent IPO. The company is expected to loose $1.38 per share this year, and this this is a speculative investment — at a time when safe investments are the place to be.

Shares of Atlassian (TEAM) declined 7% to $272 on the day. Yesterday, the company held its Investor Day. TEAM is a software stock with a high P/E of 173. Although Atlassian is a quality company, software stocks with high P/Es have been out of favor since November.

In other news, shares of Shopify (SHOP) declined 6% and NVIDIA (NVDA) fell 4%.

EPAM Jumps 10% as it Plans to Exit Russia

Shares of Epam Systems (EPAM) jumped 10% on the day on updated news of its planned exit of the Russian market. The web development consultant had more than half its staff in Ukraine, Belarus, and Russia. The company is working to relocate its staff to lower risk locations in Ukraine and surrounding countries, and has suspended work with customers in Russia.

Of EPAM’s long-term assets, 33% were in Ukraine, 32% in Belarus, and 7% in Russia. In terms of regions, U.S. was 57% of EPAM’s 2021 revenue, with the U.K. at 13%, followed by Swizerland at 7%.

Target Breaks Out

In terms of gainers Target (TGT) continues to show strength, as the shares broke out of a 2-3 month base. The shares jumped from $211 to $233 this week.

Target is one of our favorite stocks. Our 2022 Fair Value on TGT is $350.

Chart of the Day

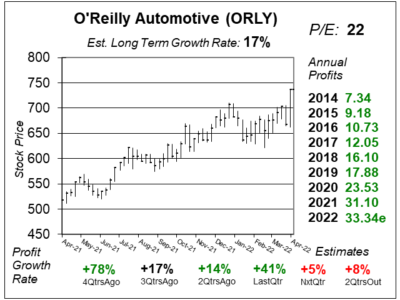

Our chart of the day, today, is this one-year beauty of O’Reilly Automotive (ORLY). With inflation running high, rents and food prices are up around 10% from a year ago. That is taking a bite out of the wallets of Americans, who may delay big purchases like new cars.

Our chart of the day, today, is this one-year beauty of O’Reilly Automotive (ORLY). With inflation running high, rents and food prices are up around 10% from a year ago. That is taking a bite out of the wallets of Americans, who may delay big purchases like new cars.

Fellow auto parts store Autozone (AZO) also broke out to an All-Time high this week. And since the trend is your friend, my friend, the shares could be new market leaders — expecially if the economy goes into a recession.