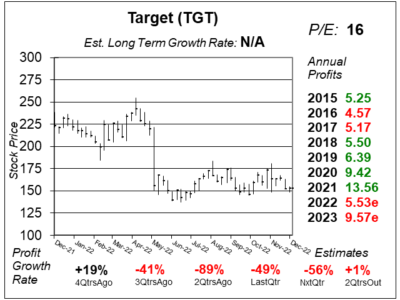

Target (TGT) Continues to Have Serious Issues as Profits Slide

Target (TGT) was having high inventory issues. Now the company has issues with a struggling consumer as well as shoplifters.

Target (TGT) was having high inventory issues. Now the company has issues with a struggling consumer as well as shoplifters.

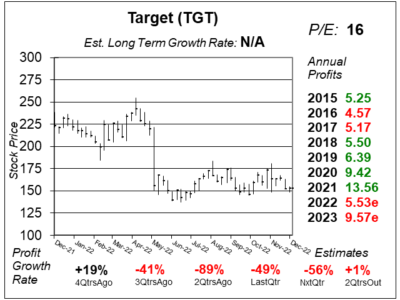

Target (TGT) mismanaged its inventory purchases, and is now lowering prices to clear the shelves. 2023 should be a better year.

Target (TGT) stock got slammed after the company missed profit estimates, as management is clueless about how to stock shelves.

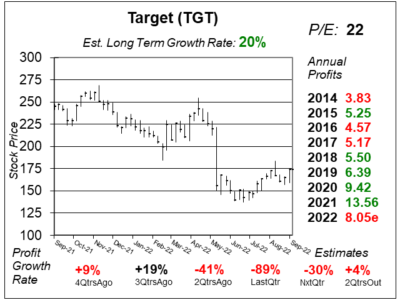

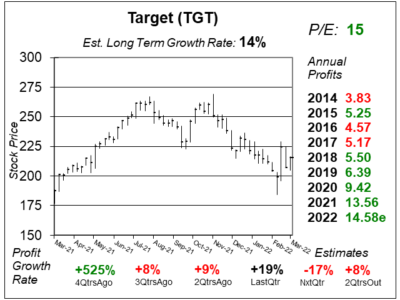

Target (TGT) is driving half of its growth via digital channels, most of which are picked up at stores. With a P/E of 15, TGT is a deal.

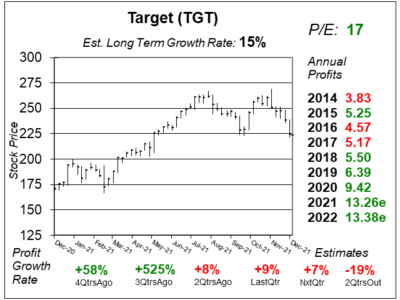

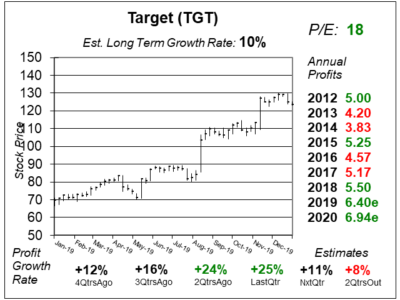

Target (TGT)’s pick-up/delivery options are pupular, as sales grew 60% last qtr. Meanwhile, TGT is a bargain with a P/E of only 17.

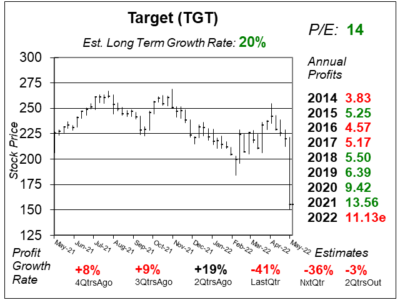

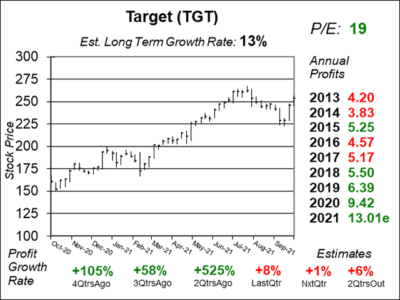

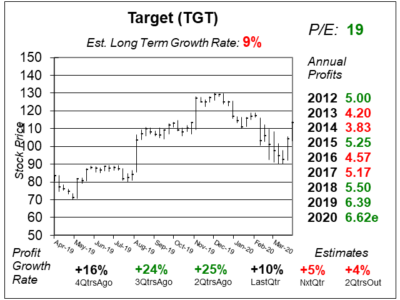

Target’s (TGT) profit growth rate slowed from 525% to 8% last qtr, then the stock fell. Now with a P/E of 19, TGT is a bargain.

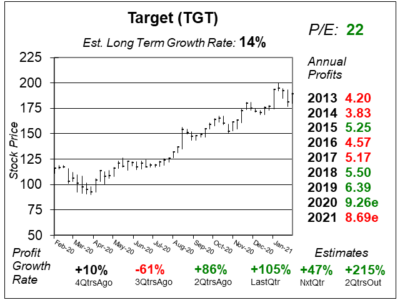

Target (TGT) as kept the momentum going from last year, and what’s leading the sales charge is same day pick up and delivery.

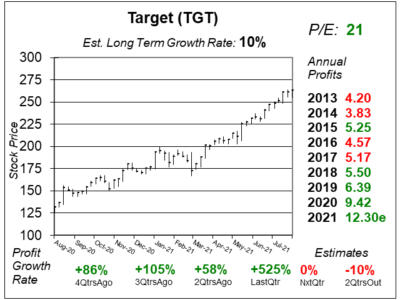

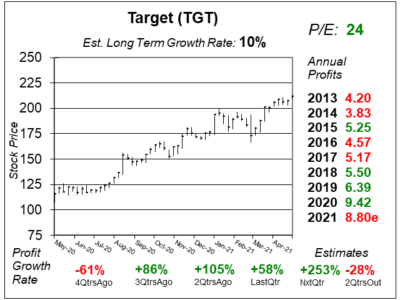

Targer (TGT) hasa great 2020 due to COVID restrictions, and the company keeps the momentum flowing into 2021.

Target (TGT) has been rolling this past year. And what’s been boosting business is same-day pick-up and delivery.

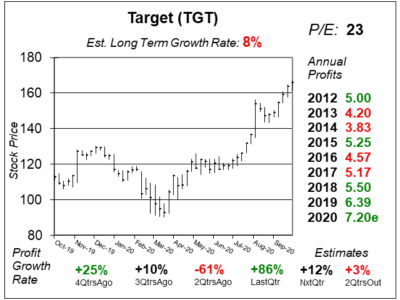

Target (TGT) just delivered a monster qtr with profits up 86% as e-commerce sales increased 195%. TGT is cheap with a 23 P/E.

Target (TGT) is transforming itself to thrive in a Coronavirus world, and the stock might benefit in a big way next year.

Coronavirus shutdowns in competing retail stores have caused traffic at Target (TGT) to surge. What about profits?

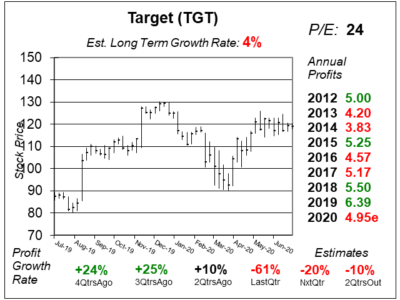

Target (TGT) stock just went through a decade of no-growth. Now, a decade of trending higher might be in store.

Target’s (TGT) up big today. But the stock’s had a pretty boring decade. Could this be the beginning of a new era for the stock?