Stock (Symbol) |

Target (TGT) |

Stock Price |

$123 |

Sector |

| Retail & Travel |

Data is as of |

| April 17, 2020 |

Expected to Report |

| May 20 |

Company Description |

Target Corporation (TGT) offers high-quality, on-trend merchandise at discounted prices in clean, spacious, guest-friendly stores and through its digital channels. Source: company website Target Corporation (TGT) offers high-quality, on-trend merchandise at discounted prices in clean, spacious, guest-friendly stores and through its digital channels. Source: company website |

Sharek’s Take |

Target (TGT) has seen a huge increase in traffic and sales with the Coronavirus shutting down non-essential businesses across America. But will the added boost turn into higher profits? It doesn’t look like it. Target’s qtr began on February 1st and during February had an increase in traffic and same store sales. Beginning in mid-March Target experienced an even stronger surge in traffic and sales, especially in Essentials, Food & Beverage, and Home office and Entertainment, Apparel & Accessories have been weak. For much of March TGT’s same store sales were an astounding 20%. Unfortunately, higher labor and cleaning costs are expected to hamper profits. Overall, analysts expect profit growth of just 5% this qtr, which is less than the 10% the company did last qtr. But there’s a good change the company beats the street. Target (TGT) has seen a huge increase in traffic and sales with the Coronavirus shutting down non-essential businesses across America. But will the added boost turn into higher profits? It doesn’t look like it. Target’s qtr began on February 1st and during February had an increase in traffic and same store sales. Beginning in mid-March Target experienced an even stronger surge in traffic and sales, especially in Essentials, Food & Beverage, and Home office and Entertainment, Apparel & Accessories have been weak. For much of March TGT’s same store sales were an astounding 20%. Unfortunately, higher labor and cleaning costs are expected to hamper profits. Overall, analysts expect profit growth of just 5% this qtr, which is less than the 10% the company did last qtr. But there’s a good change the company beats the street.

Target is the second largest general merchandise retailer in America, with 1,871 stores. 75% of the U.S. population lives within 10 miles of a Target location. Guests have a median age of 40 with an approximate household income of $64,000 a year. Around 43% of guests have a child at home, and around 57% have completed college.

TGT has an Estimated Long Term Growth Rate of 9% per year, and a healthy yield of almost 2.5%. Management’s long-term expectations are for mid-single-digit sales growth and high-single-digit profit growth or better, and its surpassing these goals. Also, management has increased the dividend every year since 1971 and buys back stock as well. The company returned $940 million to shareholders last qtr via dividends and share buybacks. This stock was red-hot before the Coronavirus Bear Market in February-March. Now that we are in April the stock has sprung back to life. TGT is one of the top holdings in the Conservative Growth Portfolio. |

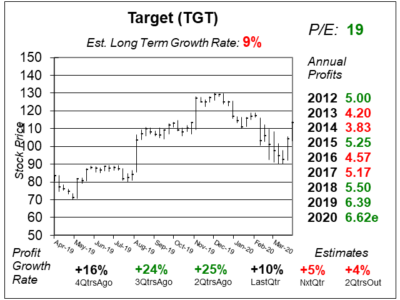

One Year Chart |

TGT feel with the rest of the Retail stocks as Coronavirus fears pulled the stock market lower in February and March. The stock has rebounded nicely this month (April). This stock has broken out three times in the past 13 months (March 2019, August 2019 and November 2019). That’s a great sign! TGT feel with the rest of the Retail stocks as Coronavirus fears pulled the stock market lower in February and March. The stock has rebounded nicely this month (April). This stock has broken out three times in the past 13 months (March 2019, August 2019 and November 2019). That’s a great sign!

The Est. LTG of 9% is down from 10% last qtr but up from 8% the qtr before. Note profit growth is expected to be just5% and 4% the next 2 qtrs. The P/E of 19 give is slightly above the 28 P/E the stock had last qtr. I think the P/E should be 25, more on this later. |

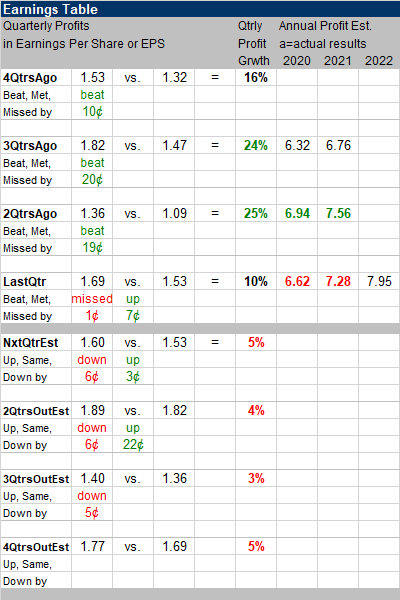

Earnings Table |

Last qtr Target delivered profit growth of 10% on a 2% rise in sales. Same store sales increased a modest 2%. The numbers weren’t great last qtr, which was the qtr ending January 31st, before the COVID-19 crisis hit the U.S. Last qtr Target delivered profit growth of 10% on a 2% rise in sales. Same store sales increased a modest 2%. The numbers weren’t great last qtr, which was the qtr ending January 31st, before the COVID-19 crisis hit the U.S.

Annual Profit Estimates declined this qtr. The company increased the wages of store and distribution center hourly employees by $2 an hr until at least May 2. Team members 65 and over, those that are pregnant and those with underlying medical conditions also have access to paid leave. Profit growth Estimates for the next 4 qtrs are 5%, 4%, 3% and 5%. Qtrly estimates were reduced, but I won’t be surprised if TGT beats the street like it did last year. |

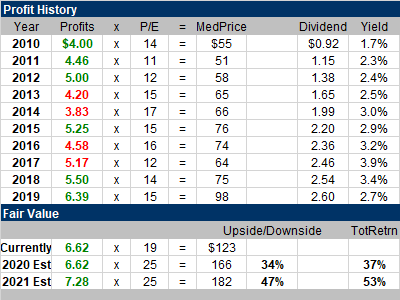

Fair Value |

This stock has been a good value for much of the past decade. Now the company is seen as being more dynamic, and that has earned it a higher multiple. This stock has been a good value for much of the past decade. Now the company is seen as being more dynamic, and that has earned it a higher multiple.

Right now the P/E is 19, but I think it should be 25. This stock has a robust 34% upside to my 2020 Fair Value, and 47% upside to 2021’s. For comparison purposes, Walmart’s P/E was 23 when I did my WMT 2020 Q1 Research Report. Walmart hasn’t had annual record profits since 2014. I think Target is a better stock. |

Bottom Line |

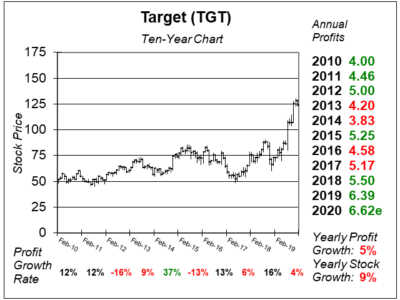

Target (TGT) has been “dead money” this past decade, but that’s a good thing as the stock has become a sneaky value. TGT was a HUGE winner from 1995 to 2007 as the stock went from around $6 to around $60. Fast forward to early 2019 and the stock was still in the $60-$80 range. Then in August the stock had a massive breakout that took it to the $100s. Target (TGT) has been “dead money” this past decade, but that’s a good thing as the stock has become a sneaky value. TGT was a HUGE winner from 1995 to 2007 as the stock went from around $6 to around $60. Fast forward to early 2019 and the stock was still in the $60-$80 range. Then in August the stock had a massive breakout that took it to the $100s.

Target’s move into groceries has given the company a fresh look amongst both customers and investors. The government’s shut-down of non-essential businesses will lead to higher market share for the company long-term. I found shopping for groceries in Manhattan easier at Target than at Trader Joes or Fairway. Especially since Target has a quick self-checkout. TGT moves up from 2nd to 1st in the Conservative Growth Portfolio Power Rankings. The stock has a low P/E, solid upside, and good momentum. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 1 of 33 |