Stock (Symbol) |

Walmart (WMT) |

Stock Price |

$119 |

Sector |

| Retail & Travel |

Data is as of |

| March 19, 2020 |

Expected to Report |

| May 19 |

Company Description |

Walmart Inc., formerly Wal-Mart Stores, Inc., is engaged in the operation of retail, wholesale and other units in various formats around the world. The Company offers an assortment of merchandise and services at everyday low prices (EDLP). The Sam’s Club segment includes the warehouse membership clubs in the United States, as well as samsclub.com. The Company operates approximately 11,600 stores under 59 banners in 28 countries and e-commerce Websites in 11 countries.Source: Thomson Financial Walmart Inc., formerly Wal-Mart Stores, Inc., is engaged in the operation of retail, wholesale and other units in various formats around the world. The Company offers an assortment of merchandise and services at everyday low prices (EDLP). The Sam’s Club segment includes the warehouse membership clubs in the United States, as well as samsclub.com. The Company operates approximately 11,600 stores under 59 banners in 28 countries and e-commerce Websites in 11 countries.Source: Thomson Financial |

Sharek’s Take |

Walmart (WMT) has weathered the stock market crash well. But when I analyze the stock, it seems to have low risk/reward. Profits aren’t really growing. But the company will have a catalyst in Walmart+, which is in development. Vox reports the program will be $98 a year for unlimited same-day grocery delivery. My reaction is: how are they gonna make money on that? Walmart (WMT) has weathered the stock market crash well. But when I analyze the stock, it seems to have low risk/reward. Profits aren’t really growing. But the company will have a catalyst in Walmart+, which is in development. Vox reports the program will be $98 a year for unlimited same-day grocery delivery. My reaction is: how are they gonna make money on that?

Here’s an old timeline of Walmart, from the School of Hard Stocks:

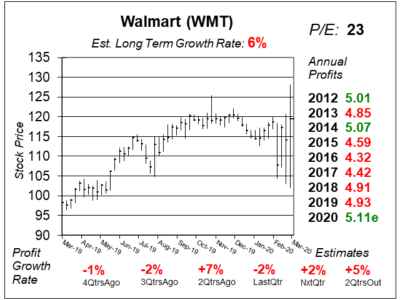

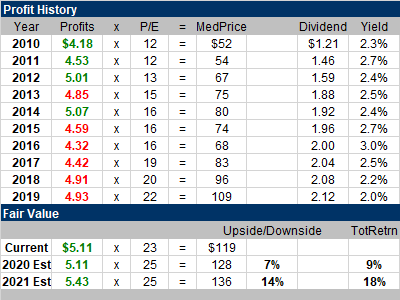

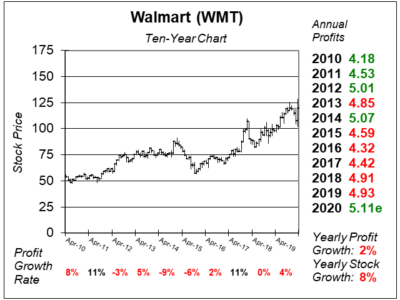

Walmart hasn’t had record profits in years. Here’s WMT’s annual profits since 2014: $5.07, $4.57, $4.32, $4.42, $4.91, and $4.93 last year. Investors have appreciated the company’s strength against Amazon and have rewarded WMT with a higher multiple. The stock used to sell for 16x earnings and now it sells for 23x. My Fair Value is 25x profits which is $128 per share. The stock is now $119. That’s just 7% upside in a stock market that’s dropped 30%. There are tons of deals in the market today — stocks with huge upside. With an Estimated Long-Term Growth rate of 6% and a dividend yield of 2% I’m not excited about this stock. In fact, I think it’s cowardly to go low-risk reward at this time. WMT is close to an All-Time high, thus it will likely lead the new Bull Market higher. But the stock doesn’t have enough juice for the Conservative Growth Portfolio. |

One Year Chart |

Negative two percent profit growth last qtr. Negative profit growth in three of the last four qtrs. Zero percent profit growth in 2019. Stock’s up from $98 to $120 in the last year. Negative two percent profit growth last qtr. Negative profit growth in three of the last four qtrs. Zero percent profit growth in 2019. Stock’s up from $98 to $120 in the last year.

The Est. LTG of 6% isn’t high enough for me. I look for a stock to have an Est. LTG + dividend yield of 10% or greater. This is just 8%. |

Earnings Table |

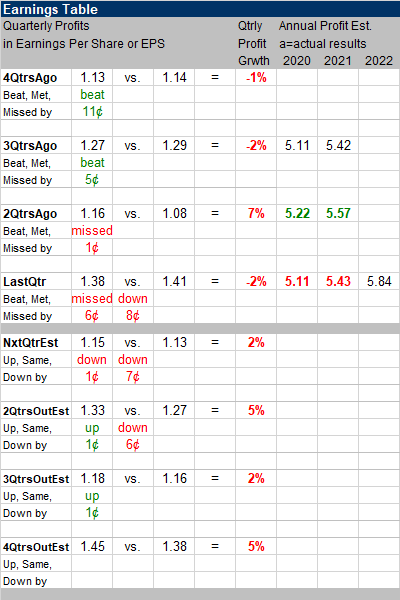

Last qtr, WMT had -2% profit growth and missed estimates of 2%. We were only expecting 2% profit growth, and the company couldn’t deliver. Sales increased 2% on 2% same store sales growth, both weak numbers. eCommerce sales are growing around 30%, but show me the profits. Last qtr, WMT had -2% profit growth and missed estimates of 2%. We were only expecting 2% profit growth, and the company couldn’t deliver. Sales increased 2% on 2% same store sales growth, both weak numbers. eCommerce sales are growing around 30%, but show me the profits.

Annual Profit Estimates declined. Qtrly profit Estimates declined. Now analysts expect just 2%, 5%, 2% and 5% profit growth the next 4 qtrs. I expect the company to beat the street the next couple of quarters as Americans are stuck at home. And I think Walmart+ will be a HUGE success. But will profits grow 10% from all this? Show me the money. |

Fair Value |

Walmart hasn’t had record annual profits since 2014. Notice the stock had a P/E of 16 between 2014 and 2016. Now the company has a 23 P/E. Still no record profits. Walmart hasn’t had record annual profits since 2014. Notice the stock had a P/E of 16 between 2014 and 2016. Now the company has a 23 P/E. Still no record profits.

I do feel management is doing a great job evolving the company into an e-commerce world. But Amazon is doing it so much better. I’m taking my Fair Value P/E from 23 to 25 this qtr because I like the Walmart+ catalyst. This is a nice safe pick for concerned investors. |

Bottom Line |

Walmart (WMT) stock bottomed five years ago and has been in an uptrend since. Most recently the investor community has rewarded the stock with a higher multiple (P/E) even though profits haven’t hit record highs since 2014. Walmart (WMT) stock bottomed five years ago and has been in an uptrend since. Most recently the investor community has rewarded the stock with a higher multiple (P/E) even though profits haven’t hit record highs since 2014.

I do believe Walmart+ will be a catalyst for the stock, but perhaps not profit growth. It seems to me like Walmart isn’t making profits like Amazon is because Amazon has other ventures — like Amazon Web Services — that have higher profit margins. Unlimited food delivery sounds expensive. WMT remains on the radar for the Conservative Growth Portfolio. I think there are other stocks with better risk/reward. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |