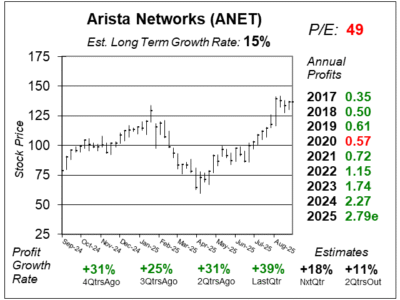

Arista (ANET) Lifts 2025 Outlook as AI Accelerators Drive Networking Demand

Arista Network (ANET) is experiencing greater demand for its high-end networking equipment, as management ups revenue estimates.

Arista Network (ANET) is experiencing greater demand for its high-end networking equipment, as management ups revenue estimates.

Arista Networks (ANET) is growing at a nice rate (revenue up 28% last qtr) as it’s networking gear is used for data centers and more.

Arista Networks (ANET) experienced slower growth from Meta, but ANET management sees steady sales from them moving forward.

Arista Networks (ANET) high-speed Ethernet products are focused on supporting AI, machine learning, and next-gen data centers.

Arista Networks (ANET) is continues to see solid demand as companies that add NVIDIA’s AI need updated networking equipment.

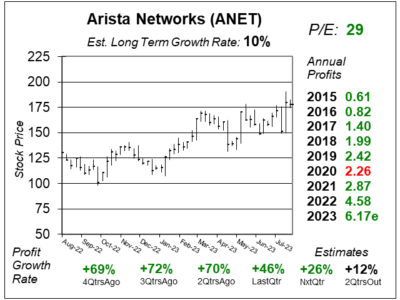

Arista Networks (ANET is seeing strong demand for its AI networking gear, & expects this trend to continue throughout the decade.

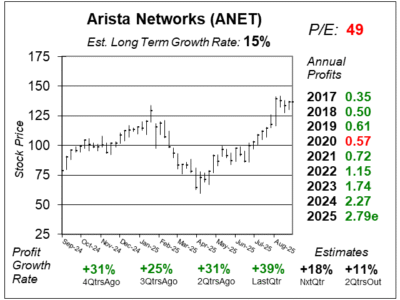

Arista Networks (ANET) has been one of the hottest stocks lately. But there are a couple of things that make me think the run is done.

One of Arista Networks’ (ANET) largest customers (Meta) expects higher infrastructure related costs in 2024. That’s good news for ANET.

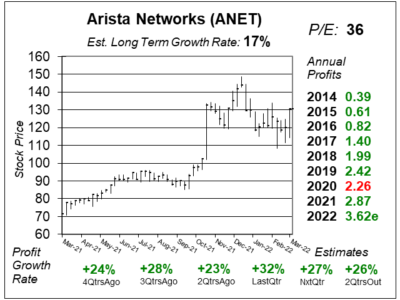

Arista Networks’ (ANET) impressed investors in its latest earnings report, but there is some uncertainty in its upcoming quarters.

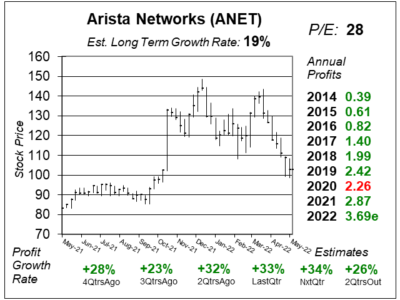

Arista Networks’ (ANET) results weren’t that impressive last quarter. But that could be a seasonality issue, as next qtr could be strong.

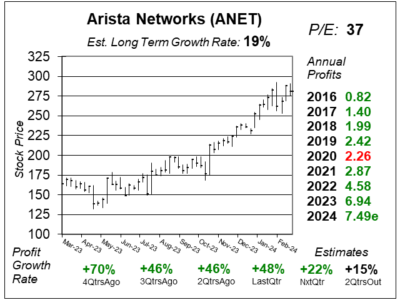

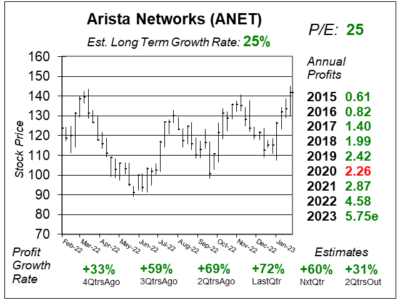

Artificial Intelligence (AI) is all in the news right now. And I think the prime beneficiary of this momentum is Arista Networks (ANET).

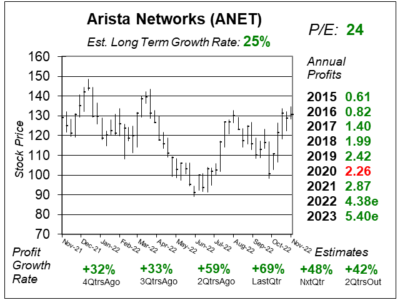

Technology might be in a recession right now, but Arista Networks (ANET) is thriving as Microsoft and Meta keep buying more.

Arista Networks (ANET) isn’t seeing a recession for its cloud networking equipment. In fact, sales and profit growth are accelerating.

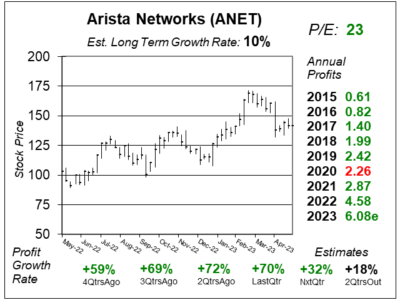

Arista Networks (ANET) continues to see strong demand from enterprise customers — and cloud titans — for its network equipment.

Arista Networks (ANET) is doing big business with Cloud Titans such as Microsoft and Google. ANET stock is breaking out today.

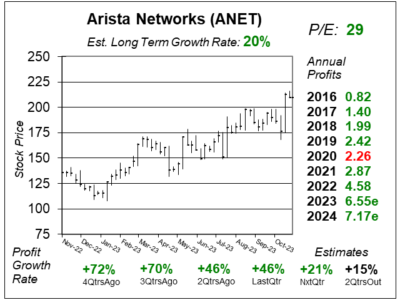

Arista Networks (ANET) makes network switches that help computer servers communicate in datacenters and the metaverse.

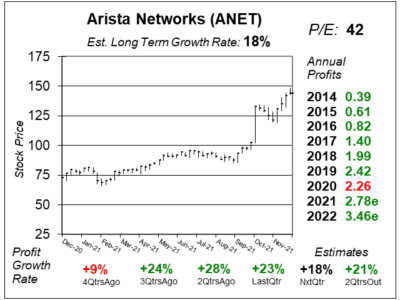

Arista Networks (ANET) lowered profit guidance after it reported earnings, now 2020 profits are expected to decline 5%.

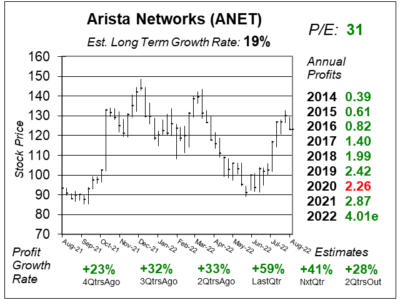

Arista Networks (ANET) beat the street last qtr, but lowered guidance due to slow demand. This might be time to sell.

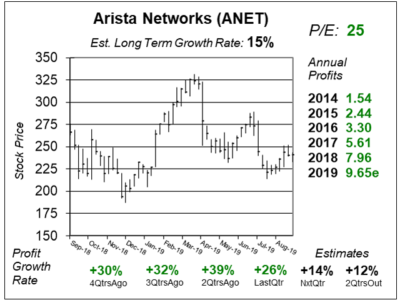

Arista Networks (ANET) is eating Cisco’s lunch in the high speed data center switching market. Here’s our first look at ANET stock.

Arista Networks (ANET) is expected to report qtrly profits (EPS) and revenues:

Arista Networks (ANET) reports qtrly profits (EPS) and revenues:

Arista Networks (ANET) reports qtrly profits (EPS) and revenues:

Arista Networks (ANET) reports qtrly profits (EPS) and revenues:

Arista Networks (ANET) reports qtrly profits (EPS) and revenues:

Arista Networks (ANET) reports qtrly profits (EPS) and revenues:

Arista Networks (ANET) reports qtrly profits (EPS) and revenues:

Arista Networks (ANET) reports qtrly profits (EPS) and revenues:

Arista Networks (ANET) reports qtrly profits (EPS) and revenues:

Arista Networks (ANET) reports qtrly profits (EPS) and revenues: