Stock (Symbol) |

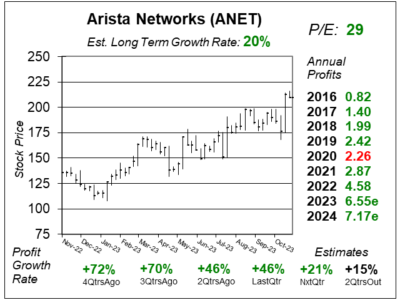

Arista Networks (ANET) |

Stock Price |

$210 |

Sector |

| Technology |

Data is as of |

| November 8, 2023 |

Expected to Report |

| February 15 |

Company Description |

Arista Networks is a supplier of cloud networking solutions that use software to address the needs of Internet companies, cloud service providers and enterprises. Arista Networks is a supplier of cloud networking solutions that use software to address the needs of Internet companies, cloud service providers and enterprises.

The Company cloud networking solutions consist of its Extensible Operating System (EOS), a set of network applications and its Gigabit Ethernet switching and routing platforms. Its cognitive single-tier Spline campus network extends EOS across the campus workspace and the data center. CloudVision, its network-wide approach for workload orchestration and automation, leverages EOS and Cognitive WiFi features, to deliver a workflow orchestration and automation solution for cloud networking to its enterprise customers. It sells its products through both its direct sales force and its channel partners. The Company’s end customers span a range of industries and include large Internet companies, service providers, financial services organizations, government agencies, media and entertainment companies and others. Source: Refinitiv |

Sharek’s Take |

Arista Networks (ANET) posted excellent results last qtr, beating analyst estimates and driving the stock to break out once more. Profit grew 46% during the quarter and beat estimates of 26%. But what I really liked was Meta n their own earnings release stating some positives on networking spend. Meta is perhaps Meta’s biggest customer. Here’s some takes in Meta’s earnings release: Arista Networks (ANET) posted excellent results last qtr, beating analyst estimates and driving the stock to break out once more. Profit grew 46% during the quarter and beat estimates of 26%. But what I really liked was Meta n their own earnings release stating some positives on networking spend. Meta is perhaps Meta’s biggest customer. Here’s some takes in Meta’s earnings release:

Arista Networks makes network switches that help computer servers communicate in data centers. ANET provides Gigabit Ethernet to many companies that run high volume servers that require a lot of bandwidth. Gigabit Ethernet switches are the hardware that connects computers and servers in local networks. The faster the Ethernet switch, the faster data is transmitted between the computers and the local networks. Arista provides equipment for the back-end of a network (like AI) and the front-end (infrastructure). Customers are now doubling-down in back end spending (AI). In the future they see more investments in the front-end s well. Competitors include Cisco Systems and Juniper Networks. Since 2016, ANET has outsold Cisco when it comes to small and large internet firms upgrading to 100-gigabit Ethernet switches. In terms of 2022 product lines, Arista had three categories:

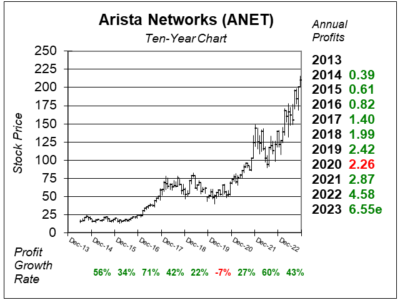

Arista has been performing magnificently for a while now. ANET has an Estimated Long-Term Rate of 20% but I believe this is more of a 30-35% grower. The stock’s P/E is just 29, and I feel P/E of 35 seems reasonable for this stock. ANET is one of my largest positions in the Growth Stock Portfolio and Aggressive Growth Portfolio. This stock is a true market leader at this time. |

One Year Chart |

The stoke broke out to $185 2QtrsAgo and now it broke to $200 after the company released its latest earnings. The stock broke out into $200 the day after its earnings call and continued to rise to $211 2 days later. The stock has been around this price since. The stoke broke out to $185 2QtrsAgo and now it broke to $200 after the company released its latest earnings. The stock broke out into $200 the day after its earnings call and continued to rise to $211 2 days later. The stock has been around this price since.

The Est. LTG of 20% isn’t high enough in my opinion. Management said the company is growing at 30% now. I think 35%. The P/E is 29, same with last qtr. But this qtr I’m looking ahead to 2024 profit estimates to calculate this figure, as we are now in ANET’s fiscal Q4. Note qtrly profit Estimates show growth could slow, but ANET has been beating the street so I think these Estimates are too low. |

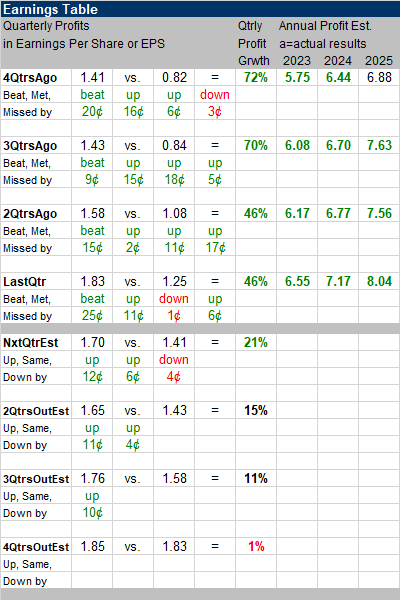

Earnings Table |

Last qtr, Arista recorded 46% profit growth and beat expectations of 26% growth. Revenue grew 28%, year-over-year versus estimates of 25%. Last qtr, Arista recorded 46% profit growth and beat expectations of 26% growth. Revenue grew 28%, year-over-year versus estimates of 25%.

Annual Profit Estimates increased again this qtr. For 2023, management raised their outlook to a revenue growth of 30%, up from 26% previously. Management raised its outlook due to improving lead time. Qtrly profit Estimates are for 21%, 15%, 11%, and 1% growth the next four qtrs. Analysts predict revenue will climb 20% next quarter. |

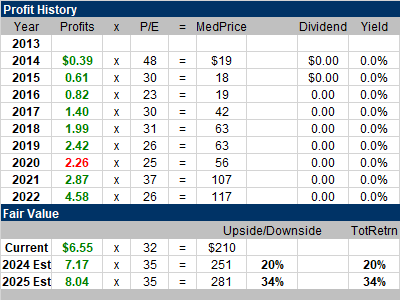

Fair Value |

My Fair Value is a P/E of 35. My Fair Value is a P/E of 35.

This stock seems to have 20% upside for 2024. And remember ANET has been upping estimates. |

Bottom Line |

Arista Networks (ANET) really seems to have the best computer networking equipment in the market. Management says its a best of breed company. I owned this stock in the past, and sold it at a low point in the 2019 decline. Looking back, I sold ~$48 after the company lowered guidance. That tells me I shouldn’t bail on the stock if things aren’t going well. Arista Networks (ANET) really seems to have the best computer networking equipment in the market. Management says its a best of breed company. I owned this stock in the past, and sold it at a low point in the 2019 decline. Looking back, I sold ~$48 after the company lowered guidance. That tells me I shouldn’t bail on the stock if things aren’t going well.

Last qtr I said Arista’s business is strong right now, but there’s uncertainty with one Cloud Titan (perhaps Meta?) and its ordering size. Now that Meta increased its infrastructure espenses for 2024, I feel more confident with Arista being a top holding. ANET stays at 2nd in the Growth Stock Portfolio Power Rankings and Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

2 of 29Aggressive Growth Portfolio 2 of 17Conservative Stock Portfolio N/A |