Stock (Symbol) |

Arista Networks (ANET) |

Stock Price |

$141 |

Sector |

| Technology |

Data is as of |

| May 24, 2023 |

Expected to Report |

| July 31 |

Company Description |

Arista Networks is a supplier of cloud networking solutions that use software to address the needs of Internet companies, cloud service providers and enterprises. Arista Networks is a supplier of cloud networking solutions that use software to address the needs of Internet companies, cloud service providers and enterprises.

The Company cloud networking solutions consist of its Extensible Operating System (EOS), a set of network applications and its Gigabit Ethernet switching and routing platforms. Its cognitive single-tier Spline campus network extends EOS across the campus workspace and the data center. CloudVision, its network-wide approach for workload orchestration and automation, leverages EOS and Cognitive WiFi features, to deliver a workflow orchestration and automation solution for cloud networking to its enterprise customers. It sells its products through both its direct sales force and its channel partners. The Company’s end customers span a range of industries and include large Internet companies, service providers, financial services organizations, government agencies, media and entertainment companies and others. Source: Refinitiv |

Sharek’s Take |

Arista Networks (ANET) could be ready to become the next big stock market winner in the AI space. During the past month, AI stocks have been on fire, lead by NVIDIA and SuperMicro Computers. NVIDIA makes the brains, then SuperMicro and Arista make the gear (such as servers) and software to run NVIDIA’s GPUs. I believe ANET stock is being held back by a so-so quarter the company just reported. Profits were just slightly higher than 2QtrsAgo, and ANET only beat the street by 9 cents a share, versus 20 cents 2QtrsAgo. More on this in the Earnings Table section below. Cloud titans was Arista’s largest vertical last qtr, followed by enterprise, specialty cloud providers, financials, then service providers. Meta is now contributing 26% of company revenue, with Microsoft at 16%. Managment expects AI networking to become meaningful throughout the decade ahead. But in the earnings call I didn’t get the impression that demand was super strong. Arista Networks (ANET) could be ready to become the next big stock market winner in the AI space. During the past month, AI stocks have been on fire, lead by NVIDIA and SuperMicro Computers. NVIDIA makes the brains, then SuperMicro and Arista make the gear (such as servers) and software to run NVIDIA’s GPUs. I believe ANET stock is being held back by a so-so quarter the company just reported. Profits were just slightly higher than 2QtrsAgo, and ANET only beat the street by 9 cents a share, versus 20 cents 2QtrsAgo. More on this in the Earnings Table section below. Cloud titans was Arista’s largest vertical last qtr, followed by enterprise, specialty cloud providers, financials, then service providers. Meta is now contributing 26% of company revenue, with Microsoft at 16%. Managment expects AI networking to become meaningful throughout the decade ahead. But in the earnings call I didn’t get the impression that demand was super strong.

Arista Networks makes network switches that help computer servers communicate in datacenters. ANET provides Gigabit Ethernet to many companies that run high volume servers that require a lot of bandwidth. Gigabit Ethernet switches are the hardware that connects computer and servers in local networks. The faster the Ethernet switch, the faster data is transmitted between the computers and the local networks. Management sees its total addressable market for Cloud Networking growing from $23 billion in 2021 to $35 billion in 2025. Competitors include Cisco Systems and Juniper Networks. Since 2016, ANET has outsold Cisco when it comes to small and large internet firms upgrading to 100-gigabit Ethernet switches. In terms of 2022 product lines, Arista has three categories:

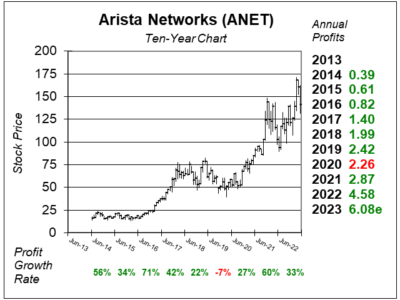

Arista has been performing magnificently for a while now. Still, the stock isn’t keeping up with its profit growth. ANET has an Estimated Long-Term Rate of 10% but this figure was 25% last quarter and I believe this is more of a 30-35% grower. The stock’s P/E is just 23, and I feel P/E of 35 seems reasonable for this stock. One little detail that impressed me this qtr is shares outstanding were 316 million versus 320 million a year-ago. Many (most?) tech stocks issue a bunch of stock options to employees, which increases shares outstanding. Arista management not only buys back stock, but also reduces share could. I admire that. ANET is my of the largest positions in the Growth Stock Portfolio and Aggressive Growth Portfolio. I think last quarter was seasonally weak, and believe the stock might go on a run higher after the company reports next quarter. |

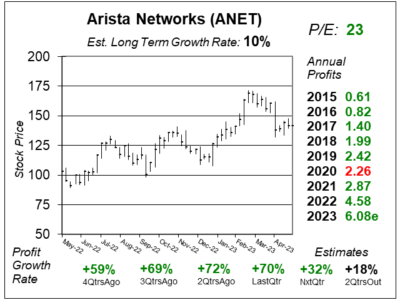

One Year Chart |

Note these charts and tables were done on 5/24 with the stock at $141. Today is 5/31 and ANET has since shot up to $167. AI stocks are hot. ANET tried to break out this week, and has since pulled back. Note these charts and tables were done on 5/24 with the stock at $141. Today is 5/31 and ANET has since shot up to $167. AI stocks are hot. ANET tried to break out this week, and has since pulled back.

One thing I wish to point out is qtrly profit growth slowed slightly last qtr. The company had been on a string of accelerating revenue growth and profit growth. Revenue growth also slowed from 55% 2QtrsAgo to 54% last qtr. The Est. LTG of 10% is modest. This figure was 25% last qtr. ten percent is way to low, this must be an error. The P/E of 23 is really good. I think the stock should have a P/E of 35. |

Earnings Table |

Last qtr, Arista recorded 70% profit growth and beat expectations of 60% growth. Revenue grew 54%, year-over-year. Product revenue (87% of total revenue) grew 62%. Service revenue (13% of total revenue) grew 18%. Gross margin declined to 59.5% from 63.1% a year-ago due to higher supply chain costs, increased headcount, and new product costs. Last qtr, Arista recorded 70% profit growth and beat expectations of 60% growth. Revenue grew 54%, year-over-year. Product revenue (87% of total revenue) grew 62%. Service revenue (13% of total revenue) grew 18%. Gross margin declined to 59.5% from 63.1% a year-ago due to higher supply chain costs, increased headcount, and new product costs.

Notice the company earned $1.43 in EPS last qtr, up slightly from $1.41 2QtrsAgo. Prior to this, profits had been jumping on a sequential basis. But note the same thing happend last year, earned $0.84 five qtrs ago, up slightly from $0.82 six qtrs ago. And prior to that, profits had been jumping. Robust revenue growth last qtr was supported by outsized growth in the US, which was led by Cloud Titan customers like Meta and Microsoft, and improvements in component supply lead times. Annual Profit Estimates grew again this qtr. For 2023, management expects revenue to grow 26%. With supply chain issues easing, customers might not need to make purchases so far in advance, which might hamper future sales. Qtrly profit Estimates are for 32%, 18%, 8%, and 5% growth the next four qtrs. For next qtr, management predicts demand growth from Cloud Titans to moderate due to strong demand from last year. However, growth from enterprise customers will remain steady. Analysts think that Arista revenue will grow 31% next qtr. |

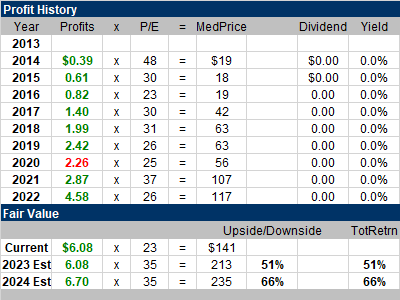

Fair Value |

My Fair Value is stays at 35 P/E, which gives the stock nice upside. Note the 51% upside was when the stock was $141. So with the stock at $167 now, some of the upside has already been achieved. My Fair Value is stays at 35 P/E, which gives the stock nice upside. Note the 51% upside was when the stock was $141. So with the stock at $167 now, some of the upside has already been achieved. |

Bottom Line |

Arista Networks (ANET) really seems to have the best computer networking equipment in the market. Management says its a best of breed company. I owned this stock in the past, and sold it at a low point in the 2019 decline. Looking back, I sold ~$48 after the company lowered guidance. That tells me I shouldn’t bail on the stock if things aren’t going well. Arista Networks (ANET) really seems to have the best computer networking equipment in the market. Management says its a best of breed company. I owned this stock in the past, and sold it at a low point in the 2019 decline. Looking back, I sold ~$48 after the company lowered guidance. That tells me I shouldn’t bail on the stock if things aren’t going well.

ANET has lost a bit of luster compared to previous quarters, but I think that’s a seasonal thing. I feel the stock is deserving of a 35 P/E, which is $213 a share. ANET ranks 1st in the Growth Stock Portfolio Power Rankings. The stock stays at 2nd in the Aggressive Growth Portfolio Power Rankings as Supermicro Computers has greater upside due to its low P/E. |

Power Rankings |

Growth Stock Portfolio

1 of 27Aggressive Growth Portfolio 2 of 19Conservative Stock Portfolio N/A |