Stocks closed higher for a second straight session on Tuesday as corporate earnings reports had a solid start, despite the hawkish footing of the Federal Reserve.

Stocks closed higher for a second straight session on Tuesday as corporate earnings reports had a solid start, despite the hawkish footing of the Federal Reserve.

Overall, S&P 500 was up 1.1% to 3,720, while NASDAQ grew 0.9% to 10,772.

Tweet of the Day

Cantor Fitzgerald's Eric Johnston makes his case for why he thinks inflation is "firmly falling" based on home price data: pic.twitter.com/6qXgstoCr6

— CNBCOvertime (@CNBCOvertime) October 17, 2022

Chart of the Day

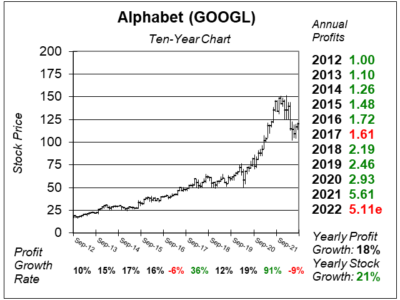

Our chart of the day is the ten-year chart of Google (GOOG) from 2012 Q4.

Our chart of the day is the ten-year chart of Google (GOOG) from 2012 Q4.

David Sharek sold the stock around November 6, 2012 from the Growth Portfolio.

Note that, in this chart, the company was expected to deliver 10% profit growth that year. Not shown is profit growth was -7% in the latest qtr.

He bought GOOG back around February 10, 2014 at around $29. After splits, he sold at approximately $17 a share (only to buy back later). Now with the stock at $101, it is obvious he should have held.

GOOG is part of the Growth Portfolio, Conservative Growth Portfolio and Aggressive Growth Portfolio.

David Sharek’s Fair Value P/E remains at 28. The stock is super cheap with a 23 P/E.