The stock market had a mixed performance on Wednesday, as S&P 500 and NASDAQ ended the day in positive territory, supported by strong bank earnings. However, ongoing concerns about U.S.-China trade talks and the government shutdown continued to weigh on investor sentiment.

The stock market had a mixed performance on Wednesday, as S&P 500 and NASDAQ ended the day in positive territory, supported by strong bank earnings. However, ongoing concerns about U.S.-China trade talks and the government shutdown continued to weigh on investor sentiment.

Overall, S&P 500 edged up 0.4% to 6,671, while NASDAQ gained 0.7% to 22,670.

Chart of the Day

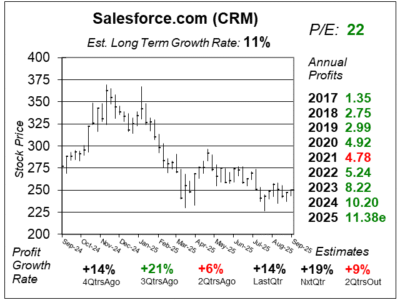

Here is the one-year chart of Salesforce (CRM) as of September 22, 2025, when the stock was at $250.

Here is the one-year chart of Salesforce (CRM) as of September 22, 2025, when the stock was at $250.

Last quarter, this former 20%-plus profit grower delivered 14% profit growth on just 10% revenue growth. Management stated more than 40% of its data cloud and Agentforce bookings this quarter came from existing customers expanding their investments, yet revenue contribution still makes up a small part of Salesforce’s $40 billion a year business.

The company is also laying off its own workers and is depending on AI to pick up the slack. It recently laid off 4,000 workers, noting 50% of the company’s work is now handled by AI. However, 50% may be a stretch. Salesforce’s customers are not happy with the company’s move to AI as Agentforce does not always give them reliable results.

CRM is part of our Growth Portfolio. The CRM industry is slowing, as most organizations have already signed up. Now, what is left is higher revenue from upgrades like Agentforce. However, that is not enough to get revenue growth of above 10%.

This stock is a value with a P/E of 22, but there is not a catalyst to have revenue growth accelerate back past 10% to get the P/E to move higher.