Stocks were flat today amid an up and down session, as the Federal Reserve decided to be aggressive on its latest interest rate hike. It raised the fed funds rate 0.75% last month, which was larger than expected, as inflation forecast had declined.

Stocks were flat today amid an up and down session, as the Federal Reserve decided to be aggressive on its latest interest rate hike. It raised the fed funds rate 0.75% last month, which was larger than expected, as inflation forecast had declined.

As David Sharek, the founder of The School of Hard Stocks, said:

It’s really the Fed Chairman, Jerome Powell who’s been talking as if he will continue to raise rates until inflation gets under control. Even if he risks a recession.

That’s helped bring commodity prices down more than anything.

Commodity prices have been declining this month, July, and that should lead to lower CPI.

But June might be another high of inflation.

Both S&P 500 and NASDAQ closed down 0.4% at 3845 and 11362, respectively.

Tweet of the Day

Wow. “The construction of new manufacturing facilities in the US has soared 116% over the past year, dwarfing the 10% gain on all building projects combined.” https://t.co/cT328MPSkp

— Sarah Miller (@sarahmillerdc) July 5, 2022

That means more manufacturing here would help the economy.

Chart of the Day

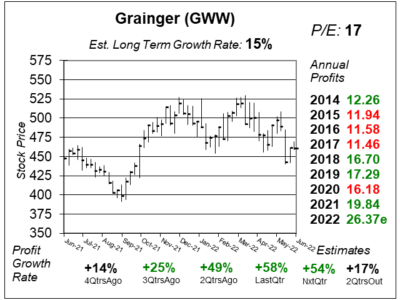

Our chart of the day is the one-year chart of Grainger (GWW):

GWW is the leading supplier of maintenance supplies in North America, Japan and the United Kingdom. The company stocks more than 1.5 million products from more than 4,500 suppliers. Its customers include manufacturing plants, retail distribution centers, hospitals and governments.

This stock is holding up well considering the stock market has been awful this past month. The Estimated Long-Term Growth Rate (Est. LTG) is 15%. That’s an excellent growth rate for a stock that’s delivered increased dividends for 51 years.

Qtrly profit growth has been excellent the prior three qtrs, as America opened back up for construction work. Some of the good growth numbers are because COVID-19 was hindering results the prior two years.

My Fair Value on this stock is a P/E of 20, which suggests the stock is 14% undervalued.

GWW was part of the Conservative Growth Portfolio in the past. I will repurchase the stock for the same portfolio, albeit at a higher price. The P/E of 17 makes the stock solid value, and the company is really clicking on all cylinders right now. In addition, more manufacturing would also help GWW.