The stock market slid on Wednesday as latest labor data showed jobs and wage growth slowed more than expected in November. Meanwhile, oil prices hit a five-month low due to weak demand.

The stock market slid on Wednesday as latest labor data showed jobs and wage growth slowed more than expected in November. Meanwhile, oil prices hit a five-month low due to weak demand.

Overall, S&P 500 declined 0.4% to 4,549, while NASDAQ fell 0.6% to 14,147.

Tweet of the Day

https://twitter.com/GeneInvesting/status/1732212410587705652

Chart of the Day

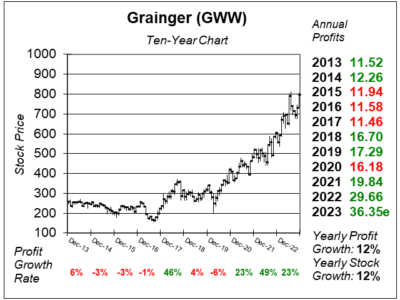

Here is the ten-year chart of Grainger (GWW) as of November 15, 2023, when the stock was at $795.

Here is the ten-year chart of Grainger (GWW) as of November 15, 2023, when the stock was at $795.

Grainger reported another solid quarter with 14% profit growth on 7% revenue growth. In the earnings call, management stated that “demand stayed reasonably steady” as sales grew 9% on a daily constant currency basis. Growth was driven by positive performance across both the its big customers (High-Touch Solutions) and small customers (Endless Assortment). Grainger increased Operating Margin to 15.9% versus 15.3% last year. This improvement was largely attributed to enhanced freight and supply chain efficiencies, as well as a favorable product mix.

GWW is part the Conservative Growth Portfolio.