The stock market moved back into positive territory on Wednesday, snapping its recent losing streak as investors shifted their focus to NVIDIA’s (NVDA) highly anticipated earnings report.

The stock market moved back into positive territory on Wednesday, snapping its recent losing streak as investors shifted their focus to NVIDIA’s (NVDA) highly anticipated earnings report.

Overall, S&p 500 climbed 0.4% to 6,642, while NASDAQ grew 0.6% to 22,564.

Tweet of the Day

Broadcom $AVGO helps big companies make their own personalized AI computing chips.

Broadcom refers to AI accelerators as XPUs instead of NVIDIA’s GPUs.

Aspects of an XPU include:

– compute (optimizing flow)

– memory (the correct size, cooling, testing)

– input/output… https://t.co/6ulLhxTkwG— David Sharek (@GrowthStockGuy) November 15, 2025

Chart of the Day

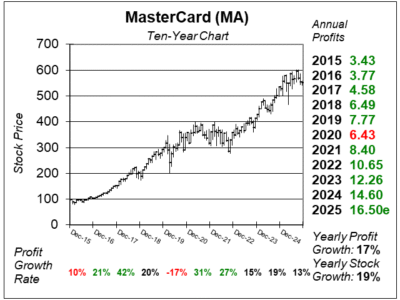

Here is the ten-year chart of Mastercard (MA) as of November 10, 2025, when the stock was at $550.

Here is the ten-year chart of Mastercard (MA) as of November 10, 2025, when the stock was at $550.

Agentic commerce is the next step for MasterCard. This is when advanced AI systems called agents act autonomously and make transactions on behalf of people or businesses. On MasterCard’s end, AI agents are marking purchases over its payment network without humans being involved.

MasterCard has also made its way into cryptocurrency transactions. On the crypto side, the company has around 130 crypto co-brand programs in the market. Crypto volumes and transactions are growing at a healthy rate.

Last quarter, MasterCard posted 13% profit growth on net revenue growth of 17%. Management said that consumer and business spending remains healthy, with balanced unemployment rates and wages continuing to rise faster than inflation. Even with some ongoing geopolitical and economic uncertainty, management said the company remains well positioned for the opportunities ahead, driven by its resilient and diversified business model.

MasterCard is at one of its lowest valuations in years. The P/E is 29 based on 2026 EPS estimates. The last time the P/E was this low was in 2023 Q4. There is “plump” upside for the stock in 2026 and 2027.

MA is part of our Conservative Portfolio and Growth Portfolio.